- Economists expect the BoE to raise rates by 75 bps to fight high inflation.

- Political calm and recent dovish comments from bank members open the door to a 50 bps hike.

- Even a 75 bps hike could prove bearish for the pound if new forecasts point to a deep recession.

The warm autumn is set to end – at least for sterling, which is looking like it will get a cold shower from the Bank of England. The BoE's Super Thursday is set to result in gloomy forecasts and perhaps a lower-than-expected rate hike.

As I explain below not everything is gloomy, but here are more reasons to expect sterling to sink rather than shine.

Big rate hike in doubt

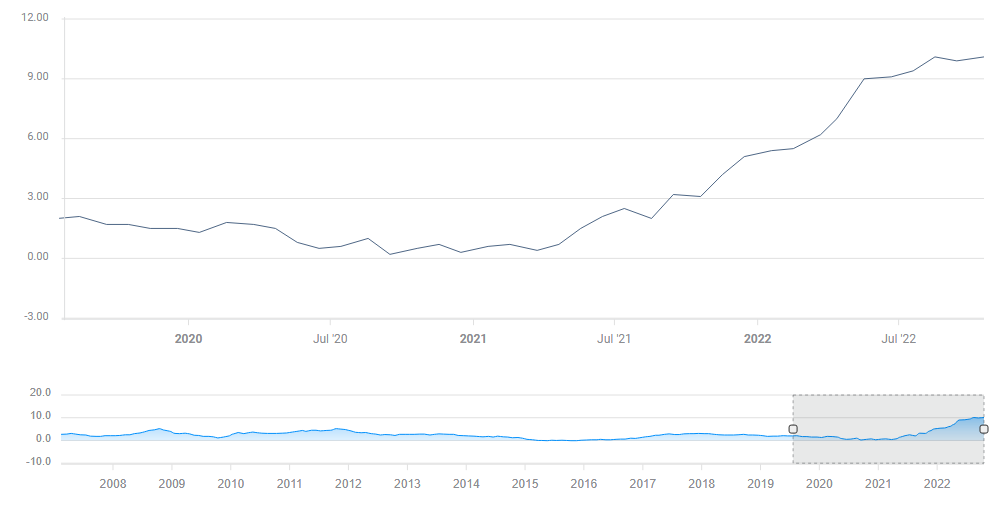

Starting with the biggest market mover – the interest rate. Economists expect a 75 bps hike to fight rising inflation, which stubbornly sticks to double-digit levels.

Source: FXStreet

However, there are several reasons to expect a lower hike.

1) The political crisis is over: At least for now, UK PM Rishi Sunak's swift ascent and his choice of Jeremy Hunt as Chancellor of the Exchequer helped calm investors. UK bond yields have dropped and the pound has risen. The BoE no longer needs to raise rates to shore up the pound.

2) Pushback from officials: Ben Broadbent, the bank's deputy governor, said that raising rates to 5% would take a significant toll on the economy. He seemed to be aware of what markets were pricing. Another member, Catherine Mann, suggested market pricing was "too aggressive."

3) Global pivot: The Bank of Canada, the Reserve Bank of Australia and, most importantly, the European Central Bank have either slowed down the pace of rate hikes or signaled they are ready to do so. The US Federal Reserve has been sending mixed messages but still pushed back against the notion of reaching a high "peak" rate. That differs from the Fed's previous effort to talk up expected rates in 2023.

Will the BoE stand out with a surprising acceleration in rate hikes? I want to stress that the "Old Lady" in London has only hiked by a maximum increment of 50 bps. A 75 bps would be not only an acceleration but also a precedent.

4) Weak data: High inflation is taking its toll on growth. The past two monthly Gross Domestic Product (GDP) figures disappointed. The UK may already be in a recession.

Source: FXStreet

Super Thursday

Apart from the rate decision, the bank publishes the Meeting Minutes, which unveil how the nine members of the Monetary Policy Committee voted. Back in September, Swati Dhingra opted for a 25 bps hike while three others wanted 75 bps and the Governor was only backed by four other members in supporting a 50 bps hike.

Even if the BoE goes big and raises rates by 75 bps, a significant minority voting against such a decision and preferring 25 or 50 bps would limit any enthusiasm.

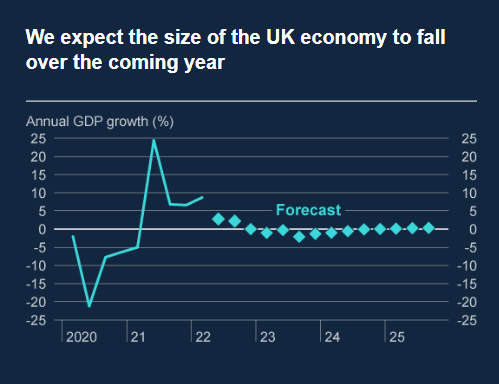

What makes this event super is that the BoE also releases its quarterly Monetary Policy Report. Updated forecasts for inflation and growth grab attention. In the past, the bank foresaw a recession beginning in the fourth quarter of 2022 and lasting through 2023.

A forecast to be frowned upon:

Source: BoE

Will Bailey stick to such doom and gloom? His honesty about darkening skies – not literally, it is still surprisingly sunny in London – has earned him respect. It has also weighed on the pound.

If the BoE leaves its gloomy outlook unchanged or even downgrades it, the pound could further suffer.

A downbeat outlook would also require the government to tighten its spending in the upcoming Autumn Statement due on November 17, further eroding growth prospects and weighing on the pound.

Final thoughts

I find it hard to expect anything but frowns from BoE Governor Bailey – and for good reasons. A 50 bps hike would hit the pound instantly, while a 75 bps move would probably create a selling opportunity in sterling. It would take an upgrade of forecast and a big hike to buoy the pound.

In any case, trading GBP/USD might be problematic. The BoE announces its decision less than 24 hours after the US Federal Reserve announces its own. That would make selling the pound hard in case the dollar is on the back foot. Nevertheless, there are plenty of GBP crosses ready to rock.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.