- The Bank of England is set to leave its policy unchanged and potentially hint at tapering bond buys.

- Weak inflation may hold the BOE from acting quickly.

- A bright outlook for the economy is mostly priced into the pound.

- Uncertainty about local and regional elections may prevent any sterling upswing.

A shot in the arm from vaccines and a second one from the Bank of England? That is what sterling bulls may have in mind ahead of "Super Thursday" – when the BOE publishes its quarterly report in addition to announcing its rate decision.

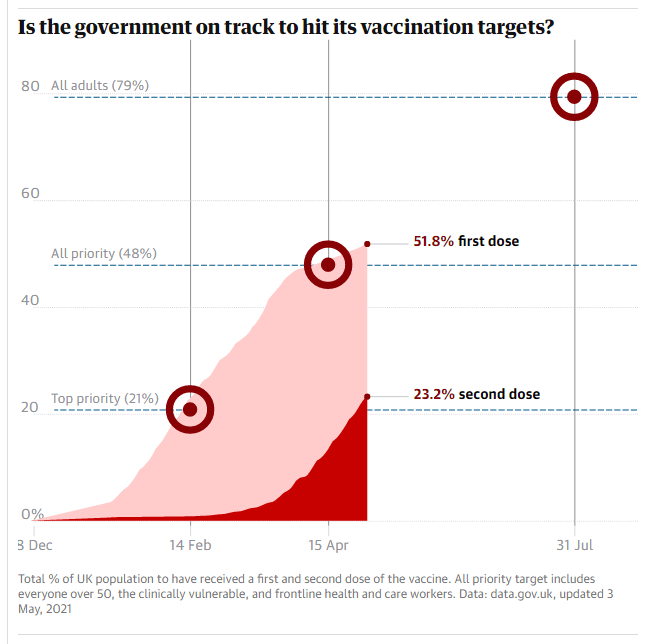

Since the bank last released its Monetary Policy Report in February, the outlook has significantly improved. Most importantly, the UK's vaccination scheme has been at full speed, surpassing half of the population. It has already pushed COVID-19 cases, hospitalizations and deaths considerably lower – and also allowed the government to ease its restrictions.

Source: The Guardian

Moreover, Gross Domestic Product figures for January and February beat estimates, showing that the economy withstood the harshest months of the full lockdown. In March, the US Congress approved a $1.9 trillion covid relief package – above the BOE's estimates of $1 trillion – that boosted the economy. US President Joe Biden aims for $4 trillion more in spending.

All that is pointing to some tightening from "The Old Lady" as the BOE is also known. The bank would probably signal an unwinding of its bond-buying scheme before considering raising rates. The Asset Purchase Facility (APF) ballooned to a total of £895 billion after the crisis, more than double the £435 billion it had been at prior to March 2020.

Any signal that the London-based institution is on course to embark on the long and winding road to squeeze its balance sheet could boost the pound. Fewer pounds printed and more confidence conveyed is good news for the current and for the British economy. Will any member of the BOE vote in May to begin the process? That would serve as a signal that tapering is coming in June.

On the other hand, there are three reasons to expect sterling to fall.

1) Inflation is weak

The Bank of Canada was the first out of the gate to announce it will buy fewer bonds – a fast vaccination campaign and strong demand from the US prompted Ottawa to act. However, the Federal Reserve continues characterizing rising inflation as transitory and only due to base effects and bottlenecks. The Fed will not taper despite rising prices.

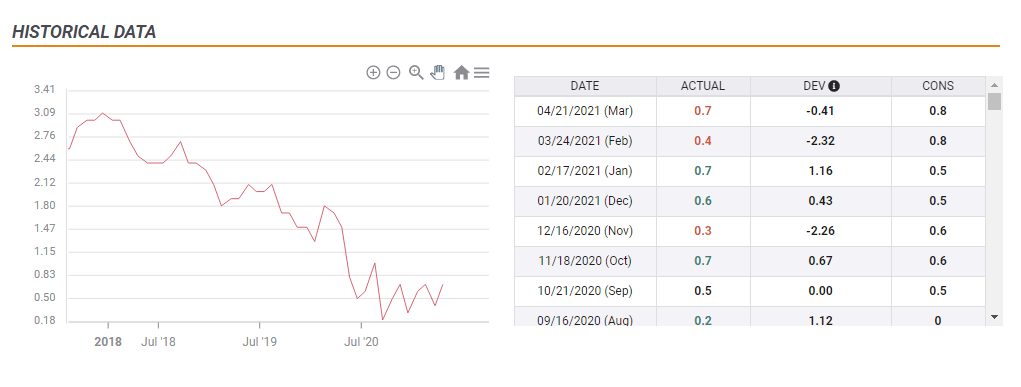

In the UK, inflation is far off the BOE's 2% target – and even out of its wider 1-3% band. The latest figures for March came out at 0.7% yearly – compared to 2.6% in the US. Why should the bank run to slow the recovery when prices are far from moving?

Source: FXStreet

2) Good news is priced in

Sterling stood out earlier in the spring when Britain's vaccination campaign was the quickest among large countries. However, the US and also European countries are catching up quickly with immunization, eroding the UK's health and economic advantage. The British economy is set to shine – but that is not so special and is mostly in the price.

The BOE's upgraded growth forecasts would merely catch up with what market participants and economists already know – giving no additional advantage to the pound against the dollar nor the euro.

3) Timing is everything

While the BOE announces its decision in midday on Thursday in London, polls are open in local and regional elections across the country. Several mayoral races serve as a barometer for the popularity of Prime Minister Boris Johnson, who has recently been embroiled in scandal.

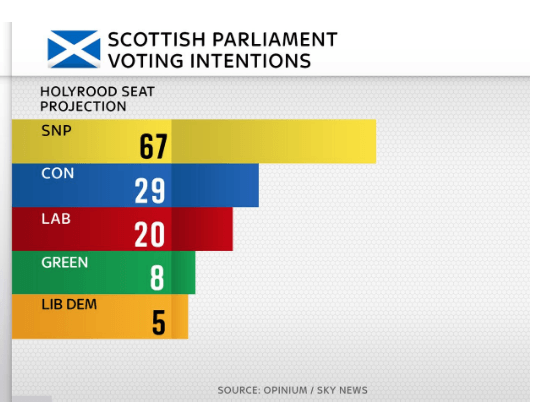

More importantly, elections in Scotland could reopen independence strive, especially if the Scottish National Party wins an absolute majority as polls show. Certainty about a vaccine-led recovery will, thus, be overshadowed by uncertainty over election results. That could keep sterling in check.

Source: Sky News

A survey by Opinium shows the SNP winning 67 seats, more than half the 129-strong chamber: Results will be known only early on Friday.

Conclusion

While the BOE is set to paint a rosier picture of the British economy, the pound is poorly positioned and may fall in the aftermath.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades deep in red below 1.0300 after strong US jobs report

EUR/USD stays under bearish pressure and trades below 1.0300 in the American session on Friday. The US Dollar benefits from the upbeat jobs report, which showed an increase of 256,000 in Nonfarm Payrolls, and forces the pair to stay on the back foot heading into the weekend.

GBP/USD drops toward 1.2200 on broad USD demand

GBP/USD extends its weekly slide and trades at its weakest level since November 2023 below 1.2250. The data from the US showed that Nonfarm Payrolls rose by 256,000 in December, fuelling a US Dollar rally and weighing on the pair.

Gold ignores upbeat US data, approaches $2,700

Following a drop toward $2,660 with the immediate reaction to strong US employment data for December, Gold regained its traction and climbed towards $2,700. The risk-averse market atmosphere seems to be supporting XAU/USD despite renewed USD strength.

Sui bulls eyes for a new all-time high of $6.35

Sui price recovers most of its weekly losses and trades around $5.06 at the time of writing on Friday. On-chain metrics hint at a rally ahead as SUI’s long-to-short ratio reaches the highest level in over a month, and open interest is also rising.

Think ahead: Mixed inflation data

Core CPI data from the US next week could ease concerns about prolonged elevated inflation while in Central and Eastern Europe, inflation readings look set to remain high.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.