Bank of England Preview: Pound plunge with projections or surge with stimulus? Timing raises suspicions

- The BOE is set to leave its policy unchanged at an early morning rate decision.

- Expanding its bond-buying program could boost the pound

- The bank's new growth projections could be devastating, sending sterling down.

Set your alarm clocks – the Bank of England will announce its rate decision at 7:00 AM local time, 6:00 GMT. The "Old Lady" used to announce its decisions at midday for years, and the change raised eyebrows. GBP/USD volatility is set to rise, especially as it is unclear what path the BOE walks.

Timing considerations

London's stock markets open only two hours after the publication and many are asking what does the BOE plan must be released before markets open? The Office for National Statistics brought forward its publications for figures such as inflation, employment, and retail sales to the hour alongside canceling the media lockup. The data become available on the ONS website without allowing journalists early access.

Does Andrew Bailey, Governor of the Bank of England, fear that something will slip out early? Is the new boss suspicious of his colleagues?

The timing of the upcoming growth figures for the first quarter – due out on May 13, six days after the BOE decision – may also be one of the governor's considerations. The BOE will have had the data and may use it for its new forecasts.

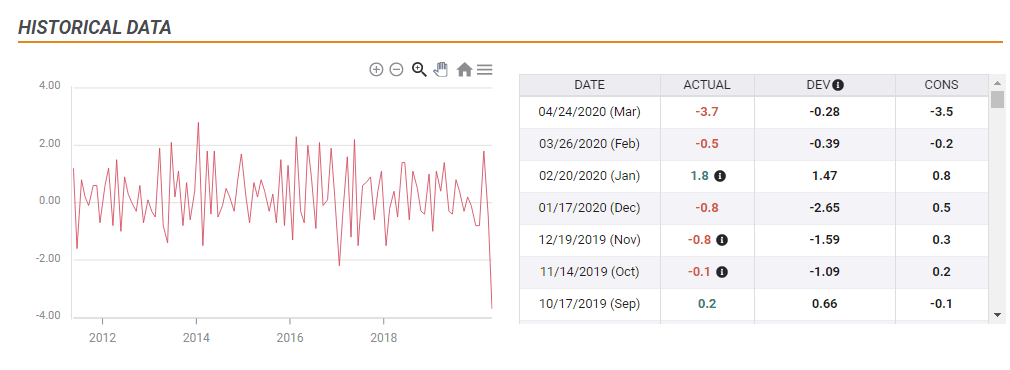

Preliminary data such as Retail Sales for March, seem to only be the tip of the iceberg:

Apart from announcing the interest rate and the size of the Quantitative Easing program, the "Old Lady" also publishes its Monetary Policy Report (MPR) The long document consists of several market-moving pieces of information, most prominently Gross Domestic Product forecasts – which could be catastrophic.

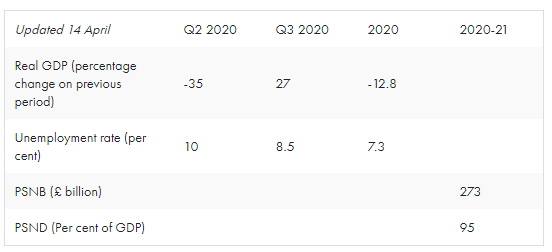

While the economy probably suffered only a relatively minor contraction in the first quarter – the lockdown was imposed on March 23 – predictions for the second one are dire. The Office for Budget Responsibility (OBR) laid down a worst-case scenario of 35% contraction in the current period and a double-digit squeeze for the whole of 2020.

Source: OBR

Since that OBR publication on April 14, the UK remained in lockdown, freezing economic activity. Moreover, Prime Minister Boris Johnson is on course to extending various limits beyond May 7 – when the recent prolongation expires and when the BOE convenes. Bailey and his colleagues will be able to incorporate new data and potentially publish even worse forecasts.

If the BOE foresees sub -35% contraction in Q2 – the pound could be pounded hard. Investors closely watch the highly-regarded BOE projection and any downfall. A more upbeat estimate would boost sterling.

Even more QE?

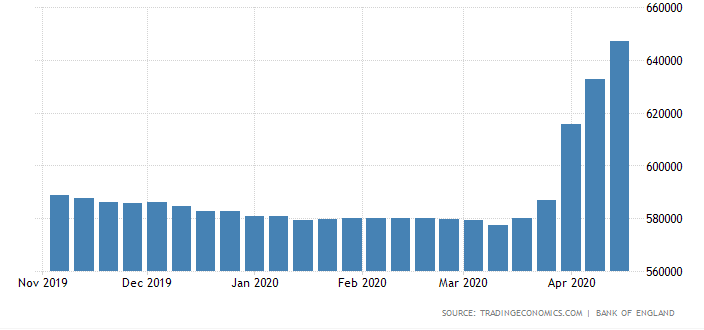

On March 19 – only on his fourth day on the job – Bailey slashed rates to 0.10% in an unscheduled decision and also expanded the Quantitative Easing program by £200 billion. The QE scheme now stands at £645 billion and that may continue rising. The BOE's pace of buying bonds is rising as the government continues supporting the economy in these troubled times. The funds go to buying medical supplies, the furlough scheme, and more.

BOE balance sheet in the past six months.

Source: Trading Economics

Moreover, the government took the exceptional step of borrowing money directly from the BOE. In QE programs, the central bank buys debt issued by the state on the markets, not directly. That step was unusual but had its precedent in the financial crisis and the government covered that overdraft shortly afterward.

While that may be the case also this time, some suspect that such direct financing – debt monetization – would become a staple of policy. Bailey is unlikely to move in that direction, but the special timing of the upcoming rate decision may suggest that the BOE could engage the QE program.

Additional bond-buying had tended to weaken the underlying currency – when there is more of something, its worth drops. However, in coronavirus times, enlarging the balance sheet allows the government to provide further relief – and then recovery – to the ailing economy. Therefore, expanding the QE program beyond £645 billion would probably push the pound higher.

Conclusion

The BOE's May 7 decision is critical due to the publication of new forecasts, speculation about the QE program, and suspicion about the timing of the decision. GBP/USD may fall with downbeat projections and rise if the bank provides more support. Overall, a highly volatile event.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.