- The BOE is set to leave rates unchanged and continue dismissing negative borrowing costs.

- Acknowledging the improving virus situation will likely support sterling.

- Silence on rising UK bond yields may further push them and the pound higher.

Fireworks – that is in the Federal Reserve's gift, but the Bank of England may provide a more certain path for currency traders than its American counterpart. There is a wide consensus that the BOE will leave rates unchanged, but its updated view on the economy and hints at future policy may rock markets.

Here are three ways the "Old Lady" may stir sterling to the upside.

1) No negative rates

The most significant way that the BOE hit the pound was by opening the door to negative rates. While sub-zero borrowing costs have had little success in reviving growth in Japan and the eurozone, they undoubtedly weighed on respective currencies. Punishing investors and commercial banks for parking funds send money out.

However, after discussing the options more than once, the London-based institution cooled down market concerns. Andrew Bailey, Governor of the Bank of England, has reiterated that while technical preparations are in place, slashing rates below zero is off the cards.

If the BOE repeats this stance, it would further alleviate fears and allow sterling to shine.

2) Encouraging virus developments

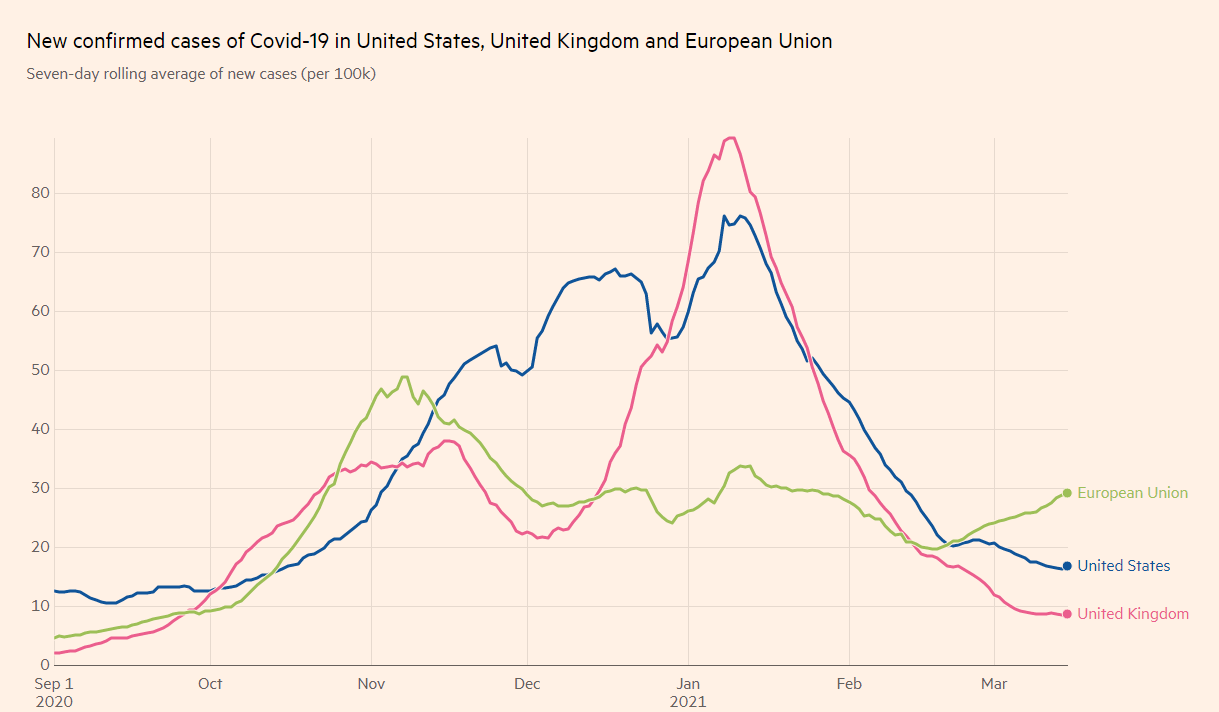

At the time of writing, the UK has already inoculated COVID-19 vaccines to over 37% of its population – the world leader among large countries. The immunization scheme and the lockdown are bearing fruit. UK cases have fallen sharply from the highs in January.

Source: FT

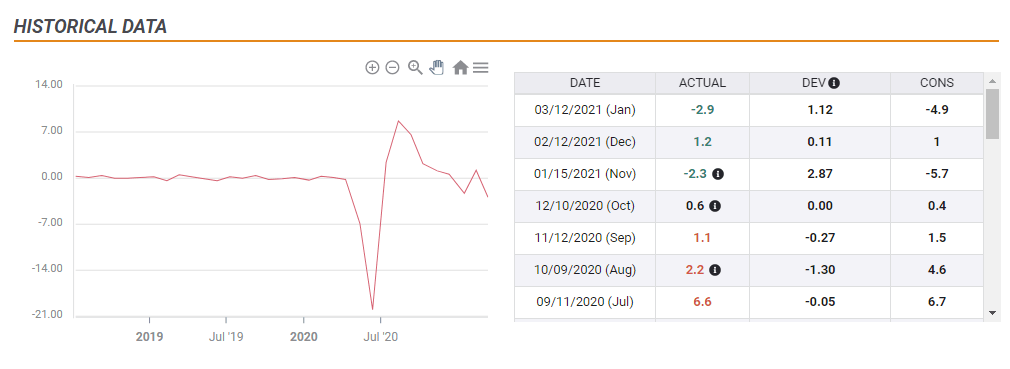

During those difficult days, the economy still outperformed estimated, shrinking by 2.9% in the first month of the year. And since then, the government kicked off the reopening and is set to bring the country to near-normal conditions in mid-June.

Monthly Gross Domestic Product has surprised to the upside in the past three releases, which refer to times of strict shutterings:

Source: FXStreet

All in all, the near future looks promising for the UK

3) Loud silence on yields

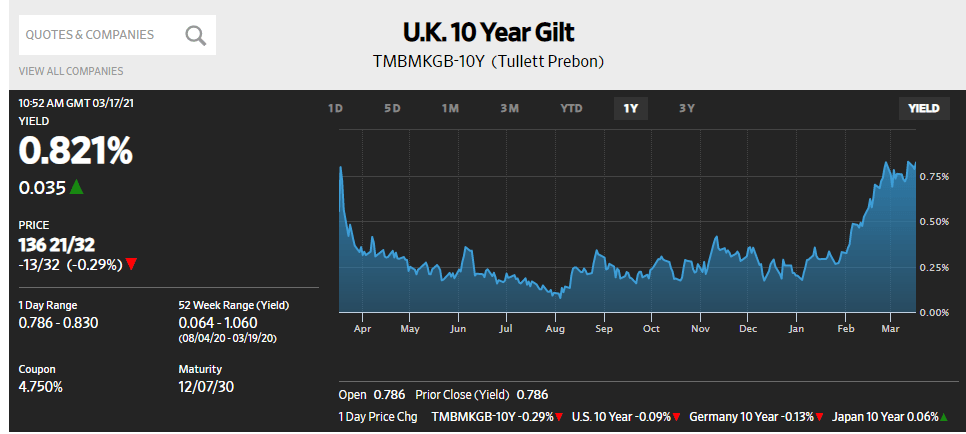

Several major central banks are worried about rising bond yields and some have even acted to bring them down. The US Fed is happy to see better returns on US debt and is only concerned about the pace of change. What about the BOE?

Returns on ten-year UK Gilts have returned to pre-pandemic levels:

Source: WSJ

So far, the BOE has been reluctant to discuss the topic – and may refrain from talking about yields in its statement nor in its accompanying meeting minutes. Moreover, at this March meeting, the bank does not hold a press conference, giving reporters no chance to discuss the topic.

This "sound of silence" is powerful and would allow the returns to continue higher – carrying sterling higher with them.

Bonus and Conclusion

An extra boost to the BOE's forecasts comes from across the pond – America's recently approved stimulus funds are also set to propagate around the world, indirectly boosting demand for British goods.

The BOE's decision is set to pale in comparison to the Fed's but may provide pound bulls ammunition to push higher – for all the good reasons.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains depressed near 1.1350

The US Dollar now grabs momentum and motivates EUR/USD to return to the 1.1350 zone on Thursday, as investors continue to digest the ECB’s decision to lower its policy rates by 25 basis points, as widely estimated. It is worth noting that most markets will be closed on April 18, Good Friday.

GBP/USD maintains the consolidation around 1.3260

The upside momentum in the British pound remains well and sound on Thursday, underpinning the eighth consecutive daily advance in GBP/USD, which now trades in a consolidative fashion near 1.326. Cable’s strong performance comes despite the marked rebound in the US Dollar.

Gold bounces off daily lows, back near $3,320

The prevailing risk-on mood among traders challenges the metal’s recent gains and prompts a modest knee-jerk in its prices on Thursday. After bottoming out near the $3,280 zone per troy ounce, Gold prices are now reclaiming the $3,320 area in spite of the stronger Greenback.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.