- The BOE is set to leave its policy unchanged and publish new forecasts on "Super Thursday."

- Signs of slower growth and inflation, dual covid concerns and the Fed will likely result in a cautious tone.

- GBP/USD may drop in response to the decision, but that could be temporary.

An epic battle between hawks and doves on Super Thursday? That is a dramatic way to view the Bank of England's upcoming rate decision – yet there are good reasons to expect doves to carry the day. That would send sterling down.

The BOE is set to leave its policies unchanged in its rate decision, probably show some divisions in its meeting minutes and release new forecasts in its Monetary Policy Report – a busy day for traders. Here is why the BOE could err on the side of caution.

1) Inflation peaked?

The rapid increase in prices has emboldened the hawks on the bank to call for a tapering down of the BOE's £895 billion strong bond-buying scheme. The headline Consumer Price Index has hit 2.5% YoY in June, after standing at only 0.4% in February.

Source: FXStreet

However, most of the increase is due to last year's CPI crash – a base effect that had been foreseen. Moreover, inflation is significantly stronger in the US, standing at 5.4% – and there are signs of peaking there. Business surveys in America showed an easing in shortages.

The UK is probably behind the US in both the rise and stabilization of prices. With CPI still at the BOE's 1-3% range, there is little urgency to tighten policy – especially as price stability is in the BOE's spotlight.

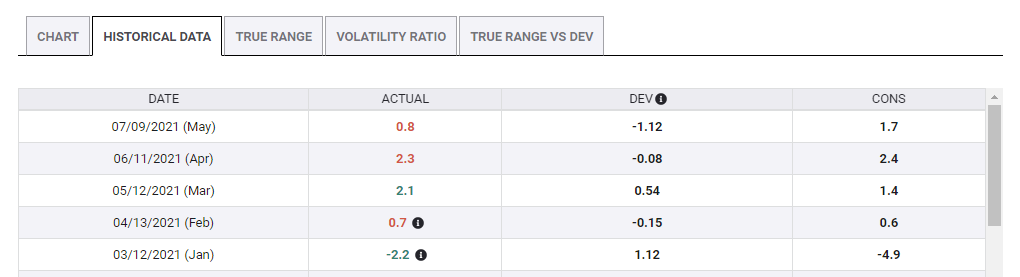

2) Growth already slowing

The increase in prices is a result of the reopening – fresh demand meets a dearth of supply in an economy suffering an induced coma. However, while that fresh expansion has been robust, it failed to meet expectations in the past two monthly releases – or in three out of five publications in 2021.

Source: FXStreet

Growth figures for the second quarter are due out only next week, but the parallel release from the US also missed estimates. The UK economy has still not fired on all cylinders, the BOE could provide more support by printing more pounds – and that is adverse for sterling.

3) Covid pingdemic in the present

COVID-19 cases are dropping in the UK, which is a positive sign for future economic growth. However, expansion is currently curtailed by the "pingdemic" – hundreds of thousands of Brits are asked to self-isolate after being exposed to someone who tested positive. That has already caused some shortages in supermarkets.

While the government is trying to alleviate these issues, it seems that also after the second quarter, the economy failed to pick up.

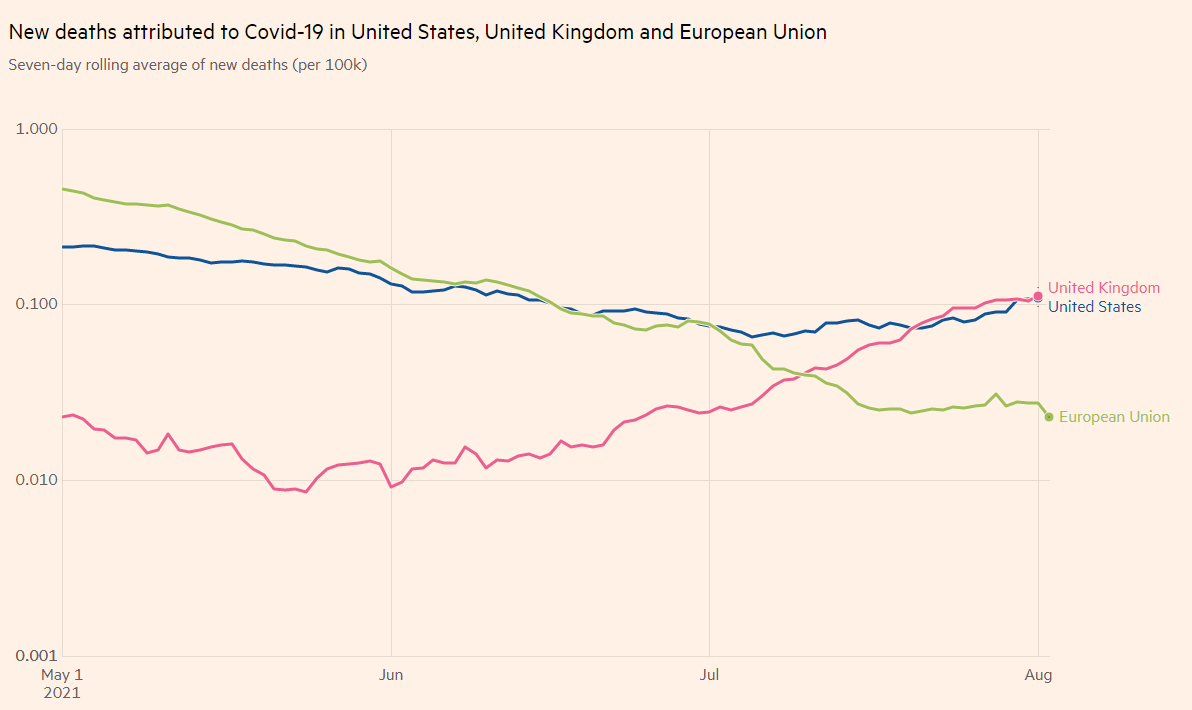

In addition, "Freedom Day" – July 19, when most covid-related restrictions were removed – did not result in a boom of activity. Brits have remained cautious as hospitalizations remain high. Deaths are still rising:

Source: FT

4) Covid uncertainty in the future

Moving from the past and the present to the near future, there is a high degree of uncertainty about the impact of autumn on the spread of the disease, the potential emergence of vaccine-resistant variants, and more.

Scientists in Britain are watching developments in Israel with unease. Despite a world-beating level of vaccinations, the Delta strain has been causing havoc in the small nation – which is now opting for booster shots for the elderly. That may be needed in the UK as well.

The BOE would not like to rush to tighten with so much uncertainty.

5) Follow the Fed

US inflation and growth have been mentioned earlier, and America's central bank is undoubtedly a factor – as it leads the world. The Federal Reserve has recently opted for a cautious approach, refraining from circling a date at which it would reduce its bond-buying scheme.

Fed Chair Jerome Powell said that the bank still sees the US economy still has ground to cover and urged patience. The BOE is set to follow from a point of caution, completing its bond-buying scheme and refraining from any tapering. Slowing purchases would signal to markets that rate hikes are coming sooner than later – an outcome it would like to avoid.

Market reaction

A dovish decision that would consist of uncertainty and pledges to support the economy is not fully priced in. Monetary Policy Committee members Dave Ramsden and Michael Saunders called on the bank to end accommodative policies, and that caused upward spikes in the pound.

However, BOE Governor Andrew Bailey and other members lean toward caution and they will likely prevail. In this scenario, sterling could stumble, paring some of its recent gains.

Will GBP/USD tumble down and remain depressed? Probably not. As mentioned, the Fed is also dovish and signs of weaker inflation in the US will likely weigh on the greenback. If stock markets continue cheering support from central banks, the resulting risk-on mood would allow cable to climb back up.

Conclusion

There are good reasons for the BOE to convey a cautious message on its August "Super Thursday." That would weigh on GBP/USD , but probably not for too long.

More Inflation, the chip shortage and Delta are peaking, what it means for markets and the dollar

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays pressured near 1.0800 on Trump's 'Liberation Day'

EUR/USD keeps the red at around 1.0800 in European trading on Wednesday as investors rush for the safe-haven US Dollar, aniticpating US President Donald Trump’s long-threatened “reciprocal” tariffs package, due to be announced at 20:00 GMT.

GBP/USD trades with caution above 1.2900, awaits Trump’s tariffs reveal

GBP/USD is trading with caution above 1.2900 in the European session on Wednesday, Traders remain wary and refrain from placing fresh bets on the major, anticopating the US 'reciprocal tariffs' announcement on "Liberation Day' at 20:00 GMT.

Gold price stabilizes ahead of Trump's tariffs announcement on “Liberation Day”

Gold price stabilizes just above $3,130 at the time of writing on Wednesday following a mean reversal move the prior day after a fresh all-time high got eked out at $3,149 before closing in negative territory. The Gold rush rally stalled ahead of Trump officially announcing the reciprocal tariff implementation later this Wednesday at the White House

ADP Employment Change projected to show US job growth gaining in March

The US labor market is poised to steal the spotlight this week as concerns over a potential slowdown in economic momentum remain on the rise — an unease fueled by recent signs of slower growth and troubling underlying data, aggravated by the ongoing uncertainty surrounding US tariffs.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.