- Economists expect the Bank of England to raise rates by 50 bps on "Super Thursday."

- High uncertainty about the economy may lead the BOE to downgrade its forecasts.

- Without clear commitments to further hikes, the sterling is set to sink.

Between a rock and a hard place – that is where the Bank of England is at, and any decision is set to impose hardship. The BOE is widely expected to raise interest rates by 50 bps, and it is already criticized for such an action. I think that any BOE decision will be dovish, sending the pound down.

The BOE has already raised borrowing costs five times in the current cycle, sending them to 1.25%, the highest in the post-financial crisis era. Even back then, the "Old Lady" as the bank is called, tended to refrain from double-dose increases and stuck to the standard 0.25% hikes. This time is different – inflation is high.

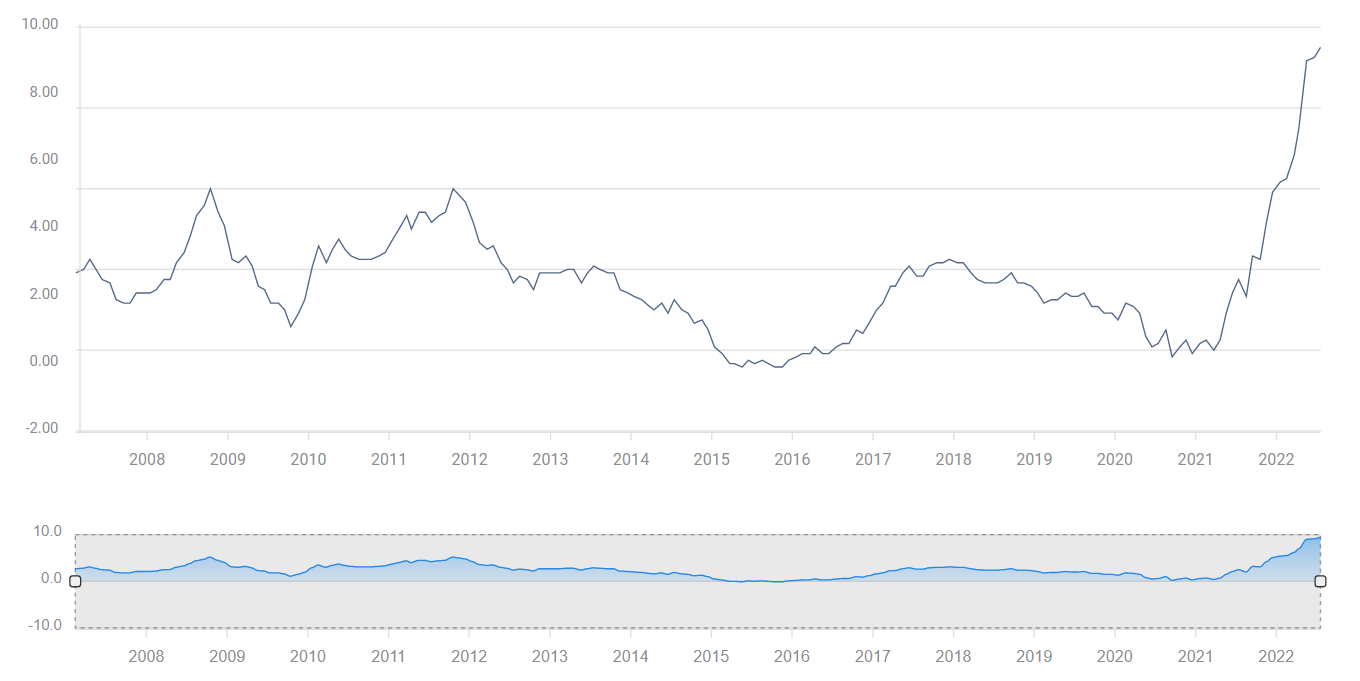

Consumer Price Index (CPI) hit 9.4% YoY in June:

Source: FXStreet

CPI is higher than the US at 9.1% and the eurozone at 8.9%, requiring interest rates to rise further to curb demand, especially as core CPI – excluding volatile food and energy prices – is at 5.8%, similar to the US. America's borrowing costs are already in a range of between 2.25 to 2.50%.

If strong demand for all types of goods and services is the issue, there is room to raise rates more substantially. Higher borrowing costs encourage saving and discourage lending. Yet that is not the fully story.

On the other hand, a substantial part of that high pace of price rises is driven by energy costs, similar to the UK's neighbors in the EU, also suffering from uncertainty about Russian oil and gas supply. The European Central Bank's deposit rate has only emerged from negative ground last week, hitting 0%.

Central banks cannot impact global energy prices. and therefore, the BOE has little wiggle room. Moreover, the bank's most recent forecasts foresee inflation jumping to 11% in October, once the government makes its bi-annual price adjustments.

Raise interest rates quickly and add unemployment to the list of Britain's issues, or increase borrowing costs only slowly, assuming high energy costs will already curb demand? That is the dilemma for Andrew Bailey, the BOE Governor.

The upcoming rate decision also comes at a time when politicians are openly talking about the bank's role in setting policy and post-Brexit regulatory powers. Liz Truss, the leading candidate, is less keen to maintain the BOE's current level of independence.

All in all, the BOE's choices are mostly bad ones, leaving more for the pound to fall.

Things to watch and GBP/USD reactions

The baseline scenario is for the BOE to raise rates by 50 bps, in response to rising inflation and to other central banks' rapid rate rises. The BOE would like to keep the pound strong, and thus lower the costs of imported goods.

GBP/USD is down some 1,000 pips since the beginning of the year:

In such an "as expected" outcome, investors would immediately react to the voting pattern. There are nine members in the Monetary Policy Committee, and some tend to dissent from the majority. If several vote in favor of a 75 bps rate hike, the pound would rise in the immediate aftermath. In case some favor a 25 bps move, sterling would fall.

After the knee-jerk response to the rate decision and the voting pattern, the focus will likely shift rapidly to the bank's quarterly Monetary Policy Report (MPR). The bank's inflation and growth forecasts will gather attention. If price rises are expected to accelerate and growth projections remain unchanged, the pound would advance.

However, if the BOE forecasts an outright recession, it is hard to see money markets pricing in bigger rate hikes, even if inflation is set to hit more than 11% currently forecast.

Bailey's press conference could also make a difference, especially if the voting pattern and forecasts send a balanced message. If the governor's tone is upbeat about Britain's prospects – based on the strong labor market for example – the pound would rise. That is far from being the base case scenario.

In recent public comments, Bailey has been gloomy, preparing the public for worse things to come. Back in February, he even asked workers to refrain from asking for a pay rise, in order to prevent stoking inflation. That did not go down well.

I think he would refrain from controversial comments, but probably paint a dark picture, perhaps trying to influence consumers to cut down on expenditure.

Circling back to the rate decision, there is always a chance of a surprise in both directions. The BOE could adhere to criticism and raise rates by only 25 bps. In that case, the pound would instantly fall and find it hard to recover.

In the less likely case of a 75 bps hike – perhaps Bailey wants to keep up with Fed Chair Jerome Powell – sterling would soar, regardless of what happens next.

Final Thoughts

The BOE is set to raise rates by 50 bps on Super Thursday, but also likely to paint a gloomy picture that would lower expectations for the path of further hikes. This complex event has several twists and turns, but more likely than not to result in sterling suffering.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637950449874114831.png)