Bank of England Preview: Action to revolve around tapering prospects

- The Bank of England is expected to maintain its current monetary policy unchanged.

- Investors will be looking for clues on tapering timing after August hawkish swift.

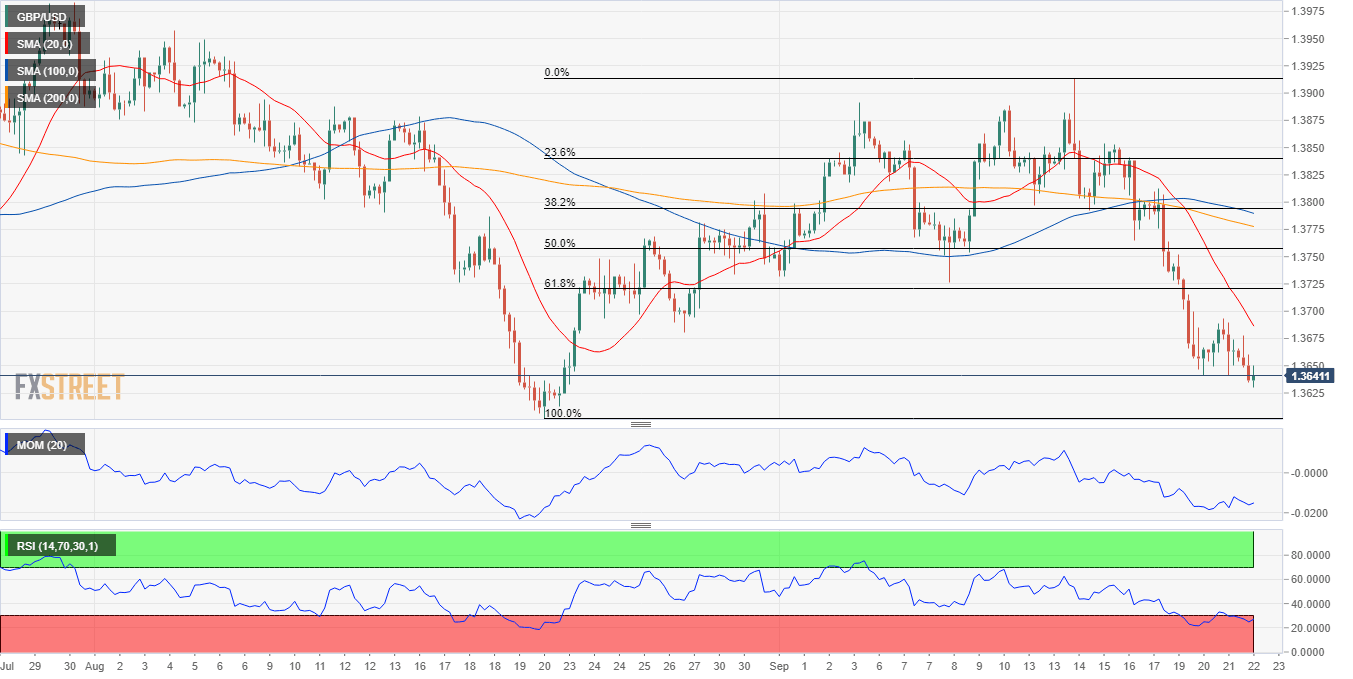

- GBP/USD is technically bearish, needs to resurge past 1.3720 to shrug off the negative stance.

The Bank of England is having a monetary policy meeting, and policymakers will announce their decision on Thursday, September 23. At this point, market participants are pricing in that the central bank will maintain its main rate unchanged at 0.1%. At the same time, the central bank has expanded its Asset Purchase Facility program to £875 billion between March and November 2020 to maintain the financial system afloat throughout the pandemic, which is also expected to remain unchanged.

Higher inflation and softer growth

The UK is experiencing the same macroeconomic situation that most major economies. The return to normal has resulted in higher inflation coupled with slow economic growth. The employment sector recovers, although at an uneven pace. According to official figures released by the Office for National Statistics, the number of payroll employees increased by 241,000 to 29.1 million in August, lifting employment in all regions of the UK to pre-pandemic levels except in London, Scotland and south-east England.

Also, in August, the Consumer Price Index jumped to 3.2% YoY, the highest in almost a decade. However, policymakers will likely stick to the “transitory” concept and instead focus on growth uncertainties. Back in July, the UK reported slower than anticipated economic expansion as the monthly Gross Domestic Product posted a modest 0.1%, down from 1% in June. The slump was blamed on shortages in the workforce and supply chain issues.

Back to the BOE, and given that no changes are expected to the current monetary policy, the big question that needs an answer is how many MPC members believe that the necessary conditions for tightening have been met. Back in August, all members voted to keep rates unchanged, while the Committee voted by a majority of 7-1 for the Bank of England to continue with its existing QE programs. While unlikely, a change in the latter stat could spur Sterling’s demand.

Nevertheless, a hawkish tilt is likely as policymakers have adopted a tightening bias in August, as they have already discussed how to reduce their massive stimulus programs. Beating on a near-term reduction seems way too optimistic at this time, but MPC won’t be able to avoid the question.

Finally, it is worth noting that Governor Andrew Bailey will not offer a speech after the release nor provide fresh economic projections this time.

Possible effects on GBP/USD

The GBP/USD pair trades near its August low at 1.3601 ahead of the event, as a dismal market’s mood fuels demand for the American currency. Ahead of the event, the US Federal Reserve will unveil its own monetary policy decision, which may spur some wild action forward of the BOE.

From a technical point of view, bears are in control of the pair, which trades well below the 61.8% retracement of the August/September rally at 1.3720. As long as GBP/USD remains below it, bears will hold the grip. A hawkish stance from UK policymakers may boost the pair toward the level, but unless there are clear indications of tapering before year-end, sellers would likely add near it. A non-expected dovish stance will probably send the pair below the 1.3600 level, with the next relevant support level and possible bearish target at 1.3520.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.