Bank of Canada Preview: The final one, with a pause ahead?

- The Bank of Canada is set to raise rates by 25 bps, from 4.25% to 4.50%.

- The BOC could signal the end of its tightening cycle on Wednesday.

- The Canadian Dollar’s fate hinges on language in the statement, Governor Macklem.

A year ago, the Bank of Canada (BOC) took the lead in kicking off the tightening cycle amongst the major global central banks, and in 2023, the BoC is also likely to be the frontrunner in pausing rate hikes.

Economists expect the Canadian central bank to deliver 25 basis points (bps) hike when it concludes its January monetary policy meeting at 15:00 GMT this Wednesday, lifting the policy rate from 4.25% to 4.5% in what could be its final round of tightening.

In December, the central bank raised rates by another 50 bps rate hike to 4.25%, registering its fastest pace of rate hikes since inflation targeting began in the 1990s. However, the language in the Monetary Policy Report (MPR) was a clear departure from the hawkish tone. The Bank of Canada said, it "will be considering" whether or not the rate has to go higher in order to bring supply and demand back into balance and return inflation to target.

The December Consumer Price Index (CPI) report from Canada showed that the country’s annual inflation rate cooled by 6.3% from a year earlier, following an advance of 6.8% in November. The average of the Bank of Canada's preferred measures for underlying core inflation in December was 5.6%, down from 5.8% in the previous month. It’s worth mentioning that Canadian inflation peaked back in June.

Earlier this month, Statistics Canada showed in its labor market report that the economy added 104,000 jobs in December while the Unemployment Rate dropped to 5.0% vs. 5.1% seen in November. The average hourly wages grew by 5.1% annually, marking the seventh consecutive month of wage growth but still failed to keep pace with inflation. This means Canada’s tight labor market hasn’t been able to push wages higher, in turn, negatively impacting consumer demand.

Therefore, a pause in the BoC’s rate hike track could support the economy, especially after the Business Outlook Survey released by the central bank showed last week, “more than 70% of Canadian consumers and two-thirds of business firms think a recession is likely in the next 12 months.”

But, will it be premature to do so? Inflation still remains stubbornly high above the central bank’s target of 2.0%. In light of this, the Bank of Canada’s Monetary Policy Report, accompanied by the interest rate decision, will hold the key, as it will provide fresh economic forecasts. That combined with Governor Tiff Macklem’s press conference at 16:00 GMT will be also closely scrutinized for the bank’s future policy course.

Macklem warned in December that “if inflation sticks, much higher interest rates will be required to restore price stability”, adding that the “greater risk” is not raising interest rates enough rather than doing too much.

USD/CAD probable scenarios

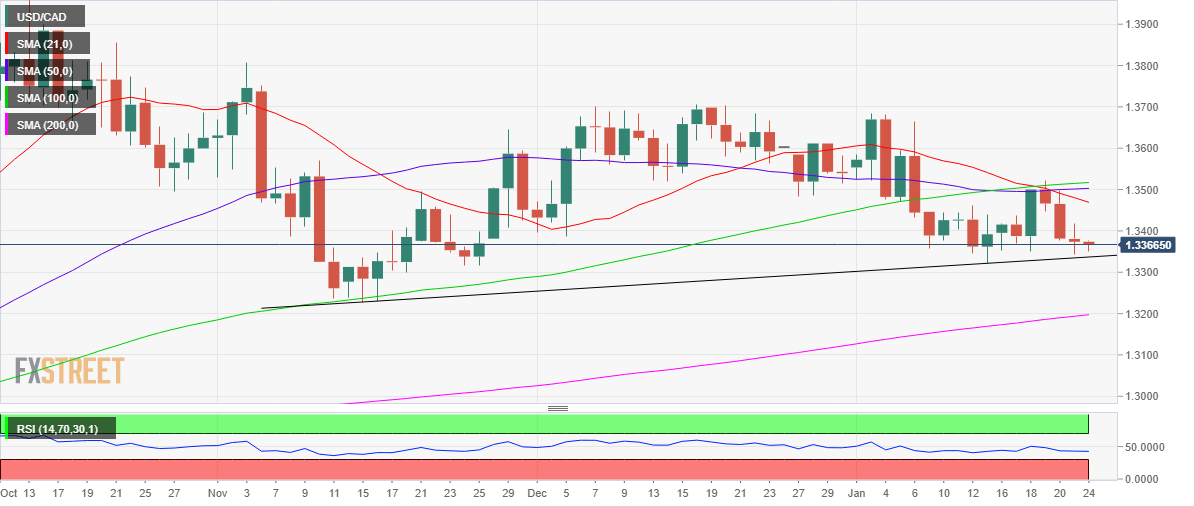

USD/CAD is trading on thin ice heading into the Bank of Canada showdown, testing the critical daily support line near 1.3335. USD/CAD could rebound firmly from that demand area on in-line with expectations BoC rate hike announcement, as the Canadian dollar could face “sell the fact” trading flows.

In case the Bank of Canada provides a clear signal on a pause in its tightening cycle, the corrective decline in the Canadian Dollar could gather strength, driving USD/CAD back toward the bearish 21-Daily Moving Average (DMA) at 1.3470.

If the language in the MPR and Macklem’s comments leaves doors open for further rate hikes, the USD/CAD pair could crack the critical support, with a fresh downtrend opening up toward the 200 DMA, aligned at 1.3197.

Note that the Bank of Canada has a tendency to surprise markets, and therefore, investors will trade the USD/CAD pair with caution while any knee-jerk reaction to the policy announcements could be soon reversed on Macklem’s words.

Swaps that bet on the bank's future policy moves imply the market is pricing one more small rate hike of 25 bps in the new year before the bank changes direction and has to cut its rate at least once in 2023.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.