Back to better breadth

S&P 500 closed the bullish MU earnings driven gap – clients knew I wasn‘t bearish, and the resulting good data (no negative surprise) were in line with expectations. Yet, equities sold off in what I consider just a technically driven move to shake off weak hands, offering a fake Russell 2000 breakdown earlier today – only to take equities back close to where they declined from.

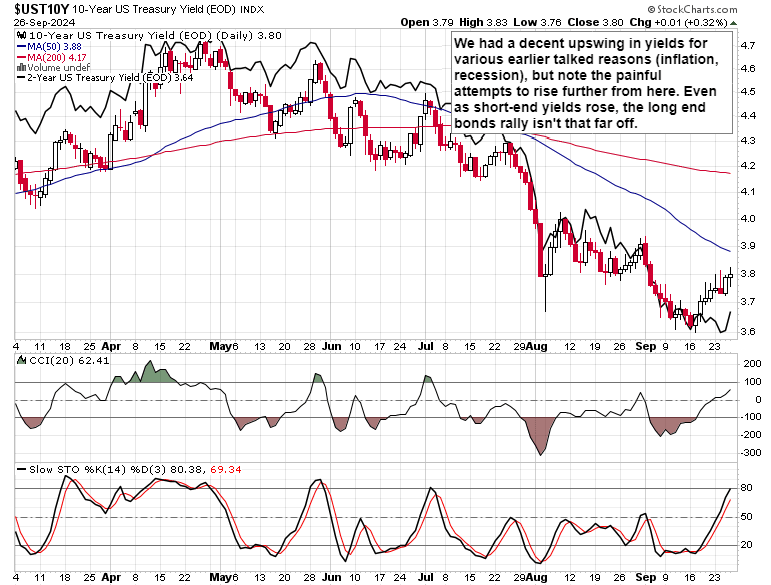

Bond auction (the 7y one) went well, and rate cut odds haven‘t changed much on a day to day basis. Today, I expect an in-line core PCE figure – and that will result in no deer in the hearlights moment for equities bulls. A bit more is though required for return into 5,8020s, and I discuss that in the premium stock market section.

Let‘s check bonds and the dollar next – you can also check the nice DAX upswing for extra clues.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.