Back-to-back rate cuts for the ECB

As widely expected by markets and economists, the European Central Bank (ECB) reduced all three key benchmark rates by 25 basis points (bps) today amid easing inflationary pressures. This places the deposit facility rate, the main refinancing rate and the marginal lending facility rate at 3.25%, 3.40% and 3.65%, respectively. It also marks the central bank’s third rate cut this year, as well as its first back-to-back rate cut in more than a decade.

In addition to cooling inflation, weaker manufacturing and services PMI numbers (Purchasing Managers’ Index) for September and dovish commentary from ECB officials had markets fully pricing in a 25bp rate cut today. In a statement to the European Parliament last month, ECB President Christine Lagarde commented: ‘The latest developments strengthen our confidence that inflation will return to target in a timely manner’.

Rate cut based on inflation outlook

The ECB’s accompanying rate statement noted that the decision to lower rates was ‘based on its updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission’. The rate statement added: ‘The incoming information on inflation shows that the disinflationary process is well on track. The inflation outlook is also affected by recent downside surprises in indicators of economic activity. Meanwhile, financing conditions remain restrictive’.

CPI Inflation (Consumer Price Index) in the eurozone slowed to 1.7% in September (YoY), down from 2.2% in August (market consensus: 1.8%) and stepping below the ECB’s 2.0% inflation target for the first time in over three years. However, the ECB expects inflation to rise before returning to the inflation target next year. The ECB stated: ‘Domestic inflation remains high, as wages are still rising at an elevated pace. At the same time, labour cost pressures are set to continue easing gradually, with profits partially buffering their impact on inflation’. In terms of core inflation, which strips out energy, food, alcohol and tobacco prices, came in slightly lower than forecast (2.8%) at 2.7% in September (YoY), down from 2.8% in August.

What next?

Unsurprisingly, the ECB delivered rationed guidance at today’s meeting, observing that incoming data will guide the central bank’s future decisions and that it is not ‘pre-committing to a particular rate path’.

Because of the trajectory of inflation and faltering economic growth (particularly in Germany), it should not be surprising that investors are pricing further policy cuts down the road. There’s speculation that the ECB could change gears at December’s meeting and opt for a bulkier 50bp cut. Markets are currently pricing in 30bps of easing for December; if inflation cools further and growth metrics continue to signal softness, 50bp would be on the table. It is worth recalling that 50bp cuts were more common for the ECB before the financial crisis.

That said, core inflation is still uncomfortably north of 2.0% (2.7%) on a YoY basis; services inflation and wage growth also remain elevated.

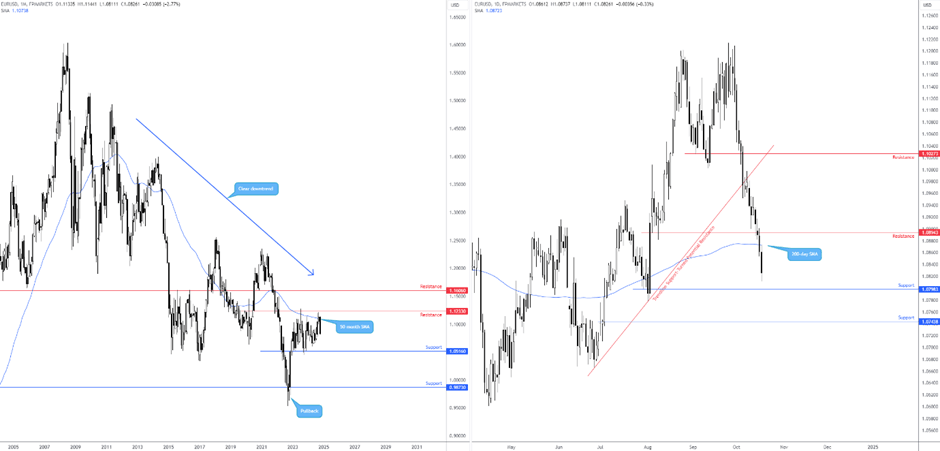

EUR/USD steamrolling lower

From a technical standpoint, a EUR/USD selloff was a strong possibility, given where the pairing was trading on the bigger picture. The 50-month simple moving average (SMA) welcomed price action in recent months (currently trading at US$1.1074), a dynamic value bolstered by key monthly resistance from US$1.1233. You will see that price sold off from the noted levels this month and is down nearly 3.0% and fast approaching April 2024 lows of US$1.0612, closely shadowed by neighbouring support at US$1.0516.

From the daily timeframe, after eclipsing bids around support at US$1.0894 (now serving as potential resistance) and the 200-day SMA at US$1.0872, another layer of support calls for attention at US$1.0798. Albeit a level that could trigger profit-taking, it is unlikely to deliver a substantial floor, according to the monthly chart. As a result, a breakout south of noted support could materialise, opening the door for further underperformance targeting support at US$1.0744.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,