Australian shrugs on mixed employment data

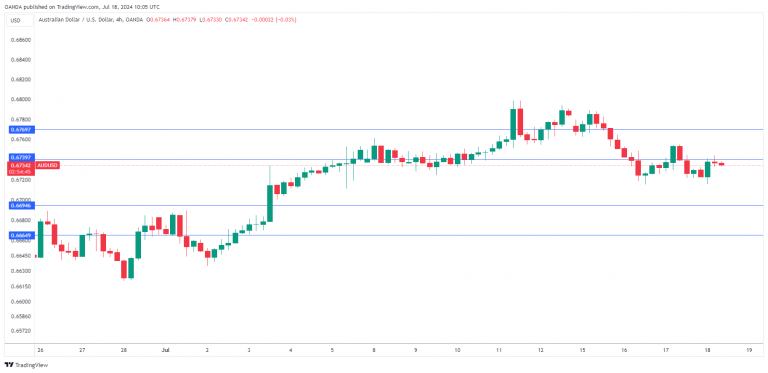

The Australian dollar is showing limited movement on Thursday. AUD/USD is trading at 0.6736 in the European session, up 0.10% on the day, up 0.1% at the time of writing.

Job growth shines but unemployment rises

Australia’s employment report for June was a mix, leaving investors scratching the heads. The Australian dollar didn’t show much reaction to the good news/bad news report.

Job growth surged to 50.2 thousand, up from a revised gain in May of 39.5 thousand and blowing past the market estimate of 20 thousand. Most of the gains were in full-time positions, pointing to a robust labor market. At the same time, the unemployment rate ticked up to 4.1%, up from the May reading of 4.0% which was also the market estimate. Unemployment has been at 4% or higher since April and the 4.1% rate matches a three-year high recorded in April and January of this year.

The Reserve Bank of Australia has stressed that its interest rate decisions will be based on key data. Inflation is the primary factor but policy makers also look at other indicators such as employment. What will the central bank do with this mixed report? On its own, the job numbers are unlikely to cause the RBA to shift policy and raise rates. We’ll have to wait for the CPI report which comes out on July 24, less than a week before the RBA decision. If inflation is higher than expected, it would support the case for a rate hike.

In the US, the markets will be keeping tabs on five FOMC members who will deliver remarks on Thursday and Friday. Investors will be hoping to get some insights on Fed rate policy, with the markets widely expecting a rate cut in September.

AUD/USD technical

-

AUD/USD is testing resistance at 0.6739. Above, there is resistance at 0.6769.

-

0.6694 and 0.6664 are the next support levels.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.