- Economists expect Australia to report a modest gain of 15,000 job gains in July.

- Australia's labor figures tend to provide bitter disappointments after two consecutive beats.

- A potentially weak employment report worries about China and fears of the Fed downing AUD/USD.

Two steps forward, one step back – and a big one in the wrong direction. That has been the pattern in recent Australian jobs reports. If recent history repeats itself, there is room for a substantial slide in AUD/USD, which has already been under pressure from various factors.

Here is a preview of Australia's Employment Change release for July, due out on August 17 at 1:30 GMT.

Australian jobs data follows a pattern for a year

The land down under has been benefiting from the post-pandemic recovery and the steaming hot global job market. The Unemployment Rate stood at 3.5% in June, a remarkable achievement, according to the Australian Bureau of Statistics.

A bustling labor market and rising inflation have pushed the Reserve Bank of Australia (RBA) to raise interest rates to 4.10%, but it has been hesitating recently. Apart from tamer price rises, the RBA also watches the labor market – and so do markets. Investors react to new information, not to the overall rosy situation.

Four out of six labor market reports so far in 2023 have outperformed early estimates, yet there is a clear pattern emerging since July 2022 – and patterns mean opportunities for traders.

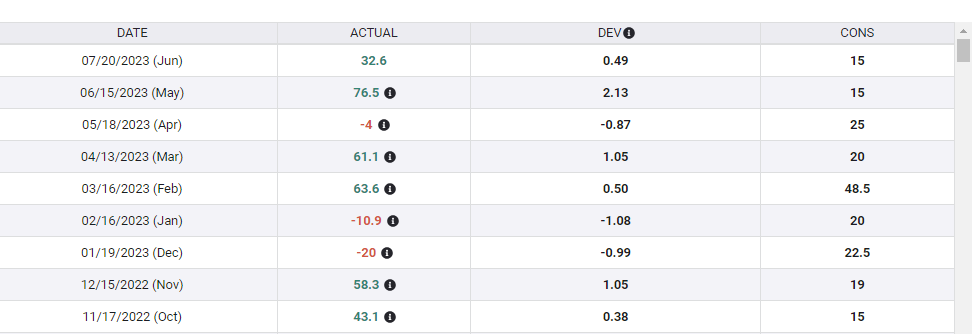

Australian Employment Change. Source: FXStreet

Contrary to America's Nonfarm Payrolls (NFP), Australian jobs numbers tend to jump around. However, after two consecutive beats, there is a bitter disappointment.

Australia reported two consecutive gains of over 60,000 jobs in February and March, only to shed workers in April. The nation averaged 50,000 jobs gained in October and November 2022, before reporting a loss of 20,000 in December. Back in May and June of last year, labor gains were impressive, before July saw a plunge of 40,900 positions.

Will the data for July 2023 repeat this pattern? The Australian labor market expanded by 76,500 in May and 32,600 in June, exceeding modest estimates. For the upcoming report, the economic calendar points to an increase of 15,000 positions.

Potential AUD/USD reaction to Australia's labor figures

If the pattern repeats itself and Australia reports downbeat data, AUD/USD has substantial room to fall. Why?

The Australian Dollar has been under pressure due to ongoing signs of weakness from China, the nation's largest trading partner. Property developers in the Asian giant are struggling to hold up – and that means reduced demand for Australian metal exports.

The Aussie has also suffered from the central bank's reluctance to raise rates, as mentioned earlier. Worries about Australia's housing market and stock market struggles have weighed on the currency. The A$ is a risk currency, which tends to follow the global mood.

On the other side of the Pacific, the US Dollar has been having an excellent August – reversing previous falls despite signs of an economic slowdown. Investors are worried that the Federal Reserve may still raise rates again, blocking the narrow path to a soft landing. Recession fears also benefit the Greenback in its role as a safe haven.

The most recent evidence of AUD/USD's weakness came from the reaction to China's surprising rate cut – no bounce.

If the data defy the pattern and Australia reports a third consecutive beat in job gains, the Australian Dollar is set to rise. Nevertheless, current market conditions favor a decline, turning any rally into a potential selling opportunity.

Final thoughts

Australia's monthly jobs report is a critical mover for the currency and may trigger high volatility. There is a greater chance of a fall than of a rise, given data patterns and market trends.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.