Australian Employment Preview: Upbeat jobs data to provide tailwind to the aussie

- Australia’s jobless rate seen lower at 5.7% in March.

- RBA maintains a dovish stance, looks at rising inflation as ‘transitory.’

- AUD/USD could receive a much-needed boost on the solid jobs report.

The recovery in the Australian labor market is likely to continue in March, although it could be uneven, given that the hiring pace is seen slowing down. However, with the Reserve Bank of Australia (RBA) maintaining its dovish stance, despite concerns over rising inflation, unemployment could return to pre-pandemic levels faster than expected.

The March employment report, due to be published by the Australian Bureau of Statistics (ABS), will release at 0130GMT on Thursday. The containment of the coronavirus spread and the pace of vaccine distribution hold the key to the country’s labor market recovery.

Unemployment rate to fall further amid fewer news jobs

The OZ economy is expected to add 35K jobs in March after creating 88.7K employment opportunities in February. The participation rate is expected to hold steady at 66.1%. The Unemployment Rate is expected to reach the lowest levels since March 2020, expected at 5.7% in the third month of 2021 vs. February’s 5.8%.

RBA downplays inflation concerns, wage growth to pick up

The Australian economy is expected to make a quick turnaround from the coronavirus pandemic-induced blow, as the economic indicators have turned positive. The business and consumer confidence are rising while the wage growth acceleration has been encouraging.

According to the latest Deloitte Access Economics business outlook, released on Monday, “the wage price index would grow by just 1.2% in 2021-22, before recovering to 2.2% in 2024-25.”

“Australia’s jobs recovery, with unemployment already down to 5.8%, had been “really remarkable” and forecast it would continue to fall to 5.6% by late 2021, 5.3% by 2022 and 5.1% by 2023,” the report said.

Given the improvement in the economic outlook, the RBA maintained its monetary policy settings, citing that the “economic recovery is well underway, stronger than had been expected.”

Governor Phillip Lowe said in the statement, “Board does not expect employment, inflation goals will be met until 2024 at the earliest.”

With the inflation and employment targets still a long way, the central bank shrugged off growing inflation concerns, which could prompt them to raise rates earlier than expected.

On inflation fears, the RBA’s March meeting’s minutes revealed, “wages growth would need to be "materially higher" than it is for inflation to pick up, a major reason why "very significant" monetary support will be needed for some time yet, the minutes showed.''

Note that the rise in Australia’s inflation is likely to be transitory due to the reversal of some coronavirus-related price reductions and rising house prices.

AUD/USD probable scenarios

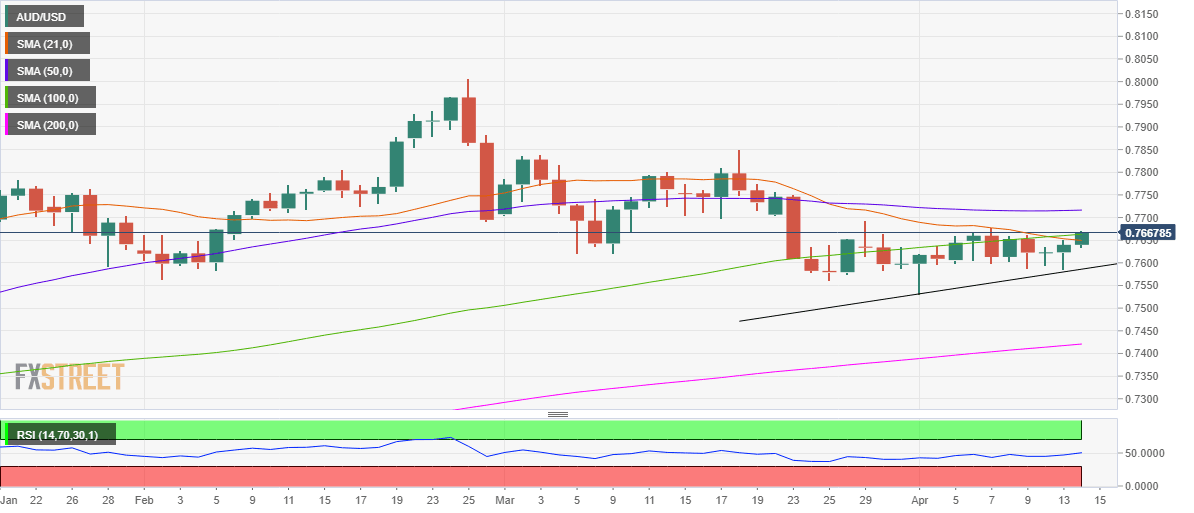

AUD/USD is looking to break higher from its side trend seen since March 24 in the run-up to Thursday’s employment report.

Therefore, upbeat jobs data could offer a much-needed boost to the aussie bulls, prompting the spot to recapture the 0.7700 threshold. If the US dollar weakness extends into Thursday after Fed Chair Powell’s speech, then the price could very well reach out to test the critical 50-daily moving average (DMA) at 0.7716. The bullish RSI favors the upside.

A downside surprise in the jobs report could negate the renewed bullish bias, calling for a test of the three-week-old ascending trendline support at 0.7586.

However, the covid vaccine developments and dynamics in the US Treasury yields would continue to remain a big catalyst behind the aussie’s price action.

Daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.