Australian Employment Preview: No surprises on solid job creation

Australia is expected to have added 25K new jobs in July.

The sour market’s sentiment favors a bearish run on a dismal report.

AUD/USD is technically bearish and could extend its decline towards the 0.6850 price zone.

Australia will report July employment data on Thursday, August 18. The country is expected to have added roughly 25K new jobs after gaining 88.4K in the previous month, while the Unemployment Rate is foreseen steady at 3.5%. Additionally, the Participation Rate is also seen as stable, at 66.8%.

Wages remain well below inflation

Ahead of the release, the aussie got hit by a key employment-related report, the Q2 Wage Price Index. The Australian Bureau of Statistics reported wages were up 0.7% in the three months to June, while the annual rate growth was 2.6%, slightly below the 2.7% expected. Still, it is the highest annual rate of growth since Q3 2014.

Raising labor demand maintains unemployment at healthy lows, yet wage gains are still lagging behind inflation, which means that real wages are still going backwards. According to the latest official data, the Consumer Price Index stands at 6.1% YoY, more than doubling salaries’ gains.

Poor wage growth undermined demand for the Australian dollar, which was further hit by a dismal market mood that boosted demand for the greenback.

AUD/USD possible scenarios

A solid Australian employment report would be cheered by market players but also have limited positive effects on the aussie, particularly if the market sentiment remains on the back foot. A dismal report, on the other hand, should exacerbate the dominant trend and push the AUD further down across the FX board.

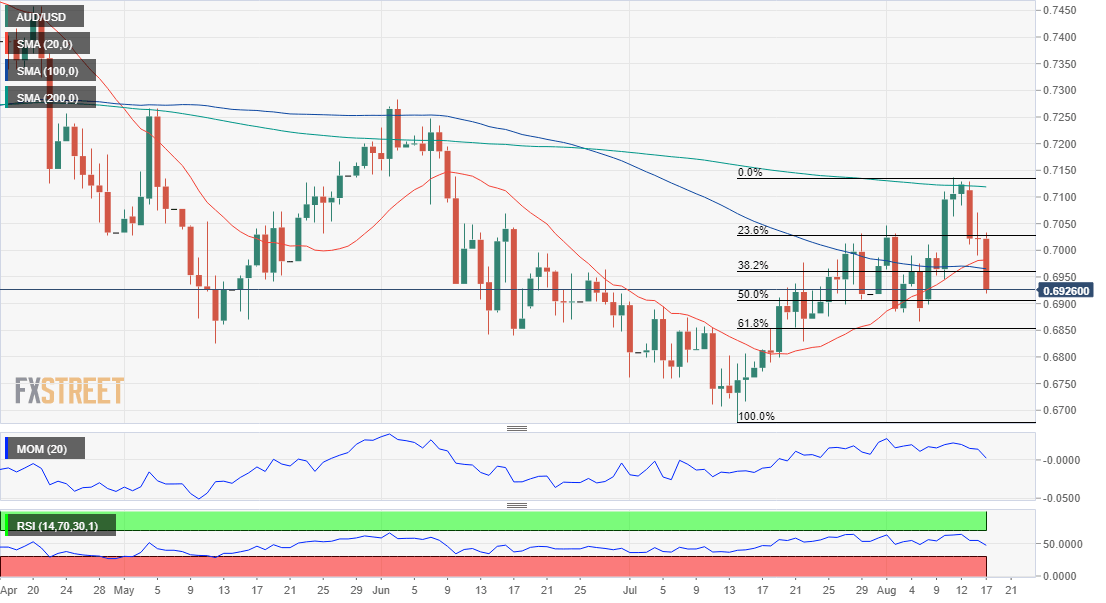

Technically, AUD/USD is bearish. The daily chart shows that the pair has broken below the 38.2% retracement of its latest bullish run between 0.6680 and 0.7136 at 0.6960. The pair has also slid below a now flat 20 SMA while technical indicators head firmly south below their midlines.

The immediate Fibonacci support is the 50% retracement of the aforementioned rally at 0.6907, followed by the 0.6850 price zone. Sellers may reappear if the pair manages to recover up to the 0.7020 price zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.