Australian Employment Preview: Better figures in the docket, doubtful impact on RBA

- Australia is expected to have recovered 20,000 job positions in January.

- RBA Governor Lowe is concerned the central bank is not doing enough with interest rate hikes.

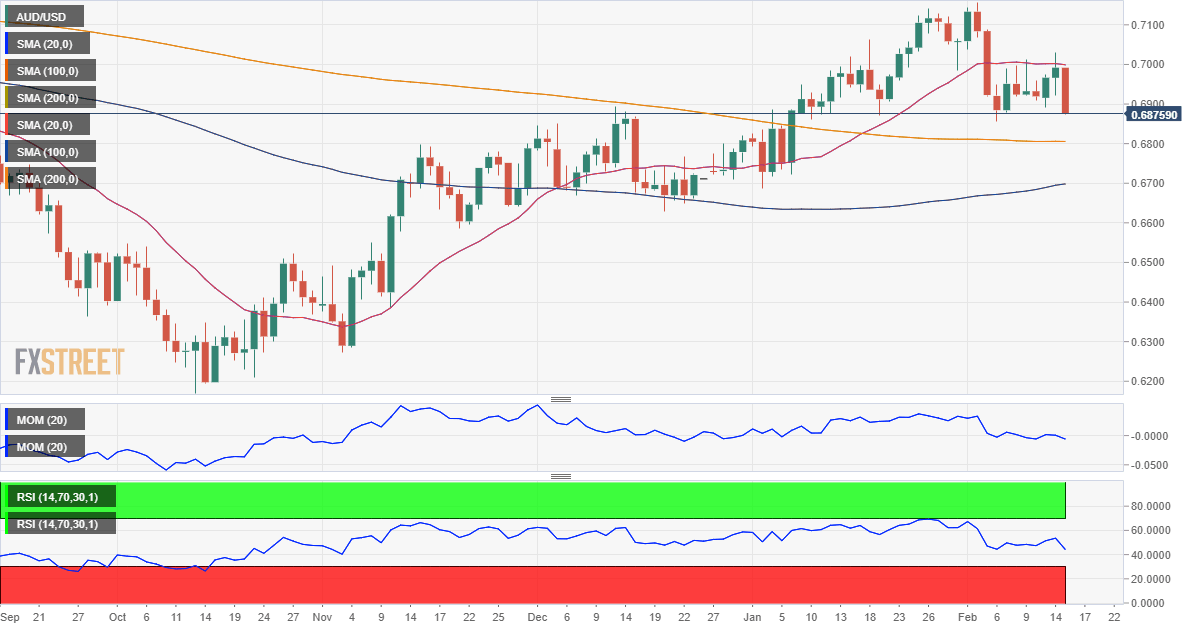

- AUD/USD is under strong selling pressure and poised to challenge February low.

Australia will report its January employment data early on Thursday, February 16 at 00:30 GMT. After losing 14,600 job positions in December, the country is expected to have added 20,000 new ones this time. The Unemployment Rate is expected to have remained steady at 3.5%, while the Participation Rate is also seen unchanged at 66.6%. Alongside monthly employment numbers, the country will publish the February Consumer Inflation Expectations, foreseen at 5.6%.

The first-tier figures will come a day after Reserve Bank of Australia (RBA) Governor Philip Lowe testified before the Senate Economics Legislation Committee. Lowe provided some interesting headlines as he said that he understands how much pain soaring interest rates have caused people, but at the same time, he noted that inflation was still too high and that there is a risk that the RBA hasn't done enough with rates. “We are trying to navigate a narrow path here,” he added.

Meanwhile, wages growth in Australia has been below average for years before the Coronavirus pandemic, and despite record-breaking wage rises in 2022, salary increases remain below inflation. Seasonally adjusted private sector wages rose 1.2% over the September quarter of 2022, the highest quarterly rate of wages growth since the September quarter of 2010. The yearly wages growth in the same quarter hit 3.4%.

Generally speaking, the employment report could have a limited impact on the Australian Dollar, as the report cannot really affect the Reserve Bank of Australia´s upcoming monetary policy decisions.

AUD/USD possible scenarios

Indeed, sharp deviations one way or the other could trigger near-term volatile moves in AUD/USD. But after the dust settles, the pair will likely return to sentiment-related trading, with the focus on the US Dollar and whatever speculative interest believes about the United States Federal Reserve.

The AUD/USD pair trades below the 0.6900 mark ahead of the event, not far above the February low at 0.6854. A break through the latter on a disappointing employment report outcome could push the pair further lower towards the 0.6800 figure. On the other hand, an upbeat report could help the pair to recover initially towards 0.6920. Further gains could see a test of the 0.6960 region, although selling interest will likely surge around it.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.