Australian Dollar reaches 19-month high boosted by Chinese economic stimulus and weaker US Dollar

The AUD/USD pair climbed to 0.6922 on Monday, marking its highest point since February 2023. This surge was primarily triggered by China’s announcement of economic stimulus measures, which is significant given China’s status as Australia’s largest trading partner. Such support for the Chinese economy will likely increase demand for commodities and bolster major currencies tied to trade with China.

Additionally, the Australian dollar has benefited from the recent weakness in the US dollar, spurred by disappointing economic data from the US. This has heightened market expectations that the Federal Reserve will persist with rapid interest rate cuts.

At its September meeting, the Reserve Bank of Australia (RBA) opted to maintain its interest rate at 4.35% per annum, suggesting that the current monetary policy might remain unchanged for some time. The RBA’s cautious approach reflects its strategy of closely monitoring inflation and employment trends without immediate concern about aligning its pace with other global central banks.

This week is set to be significant for the Australian dollar. Australia is scheduled to release data on retail sales, construction, and various trade indicators, which could influence the currency’s trajectory.

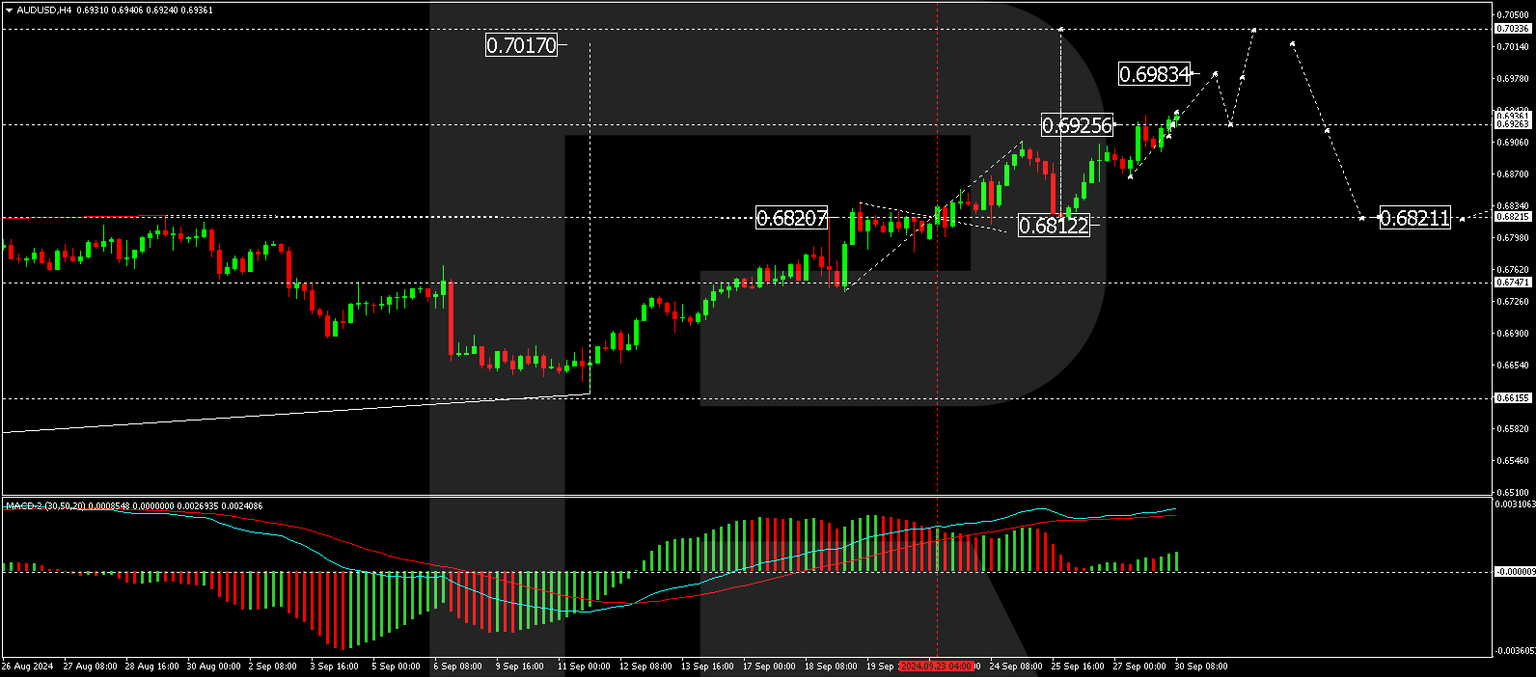

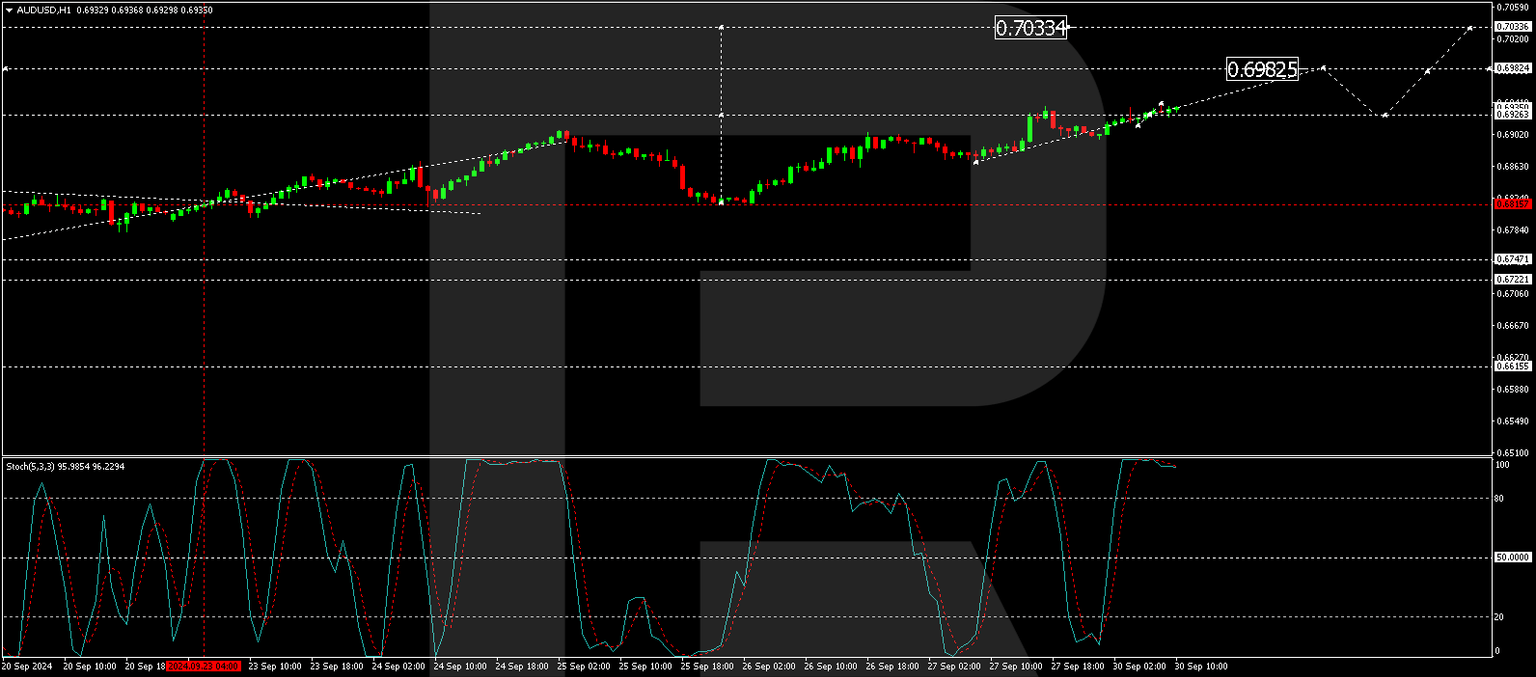

Technical analysis of AUD/USD

The AUD/USD market is extending the fifth wave of growth, with a consolidation range forming around the 0.6925 level. There is potential for an upward break targeting 0.6983. After reaching this level, a corrective movement to retest 0.6925 may occur. If the bullish momentum continues, the next wave could reach 0.7033. The MACD indicator supports this bullish scenario, with its signal line well above zero and upwards.

On the hourly chart, the AUD/USD has achieved a growth wave up to 0.6926 and is now consolidating just below this level. If the pair exits this range downward, a correction to 0.6877 could be expected. Conversely, a breakout above could extend the uptrend towards 0.6982, potentially reaching 0.7033. The Stochastic oscillator, currently above 80 and trending downward, suggests a short-term pullback might occur before further advances.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.