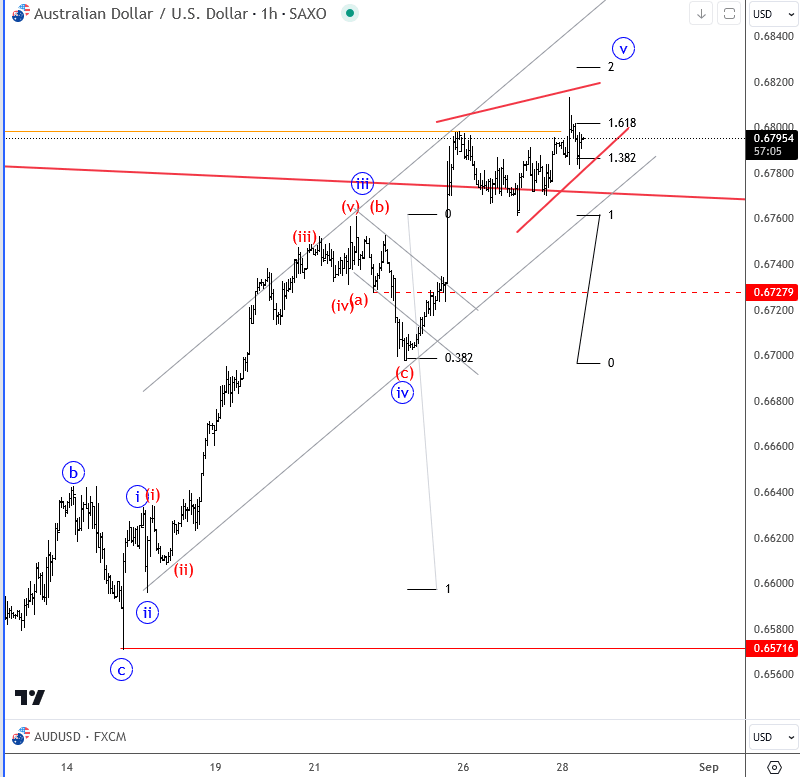

Elliott Wave analysis: Aussie testing resistance after AUD CPI data

The Aussie jumped to a new high versus the US dollar during the session after the Australian CPI came in at 3.5%, down from 3.8%. However, this was worse than expected, as expectations were at 3.4%. This discrepancy caused a spike to the upside in the Aussie, but it's important to note that inflation is still cooling down, which is the most important, and this cooling trend could suggest that the RBA might consider another rate cut in the coming months if inflation continues heading towards 3%. This expectation might limit the upside then in the near term.

Looking at the wave count, we can see five waves up, which could be in their late stages as we approach the 0.6820 level.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.