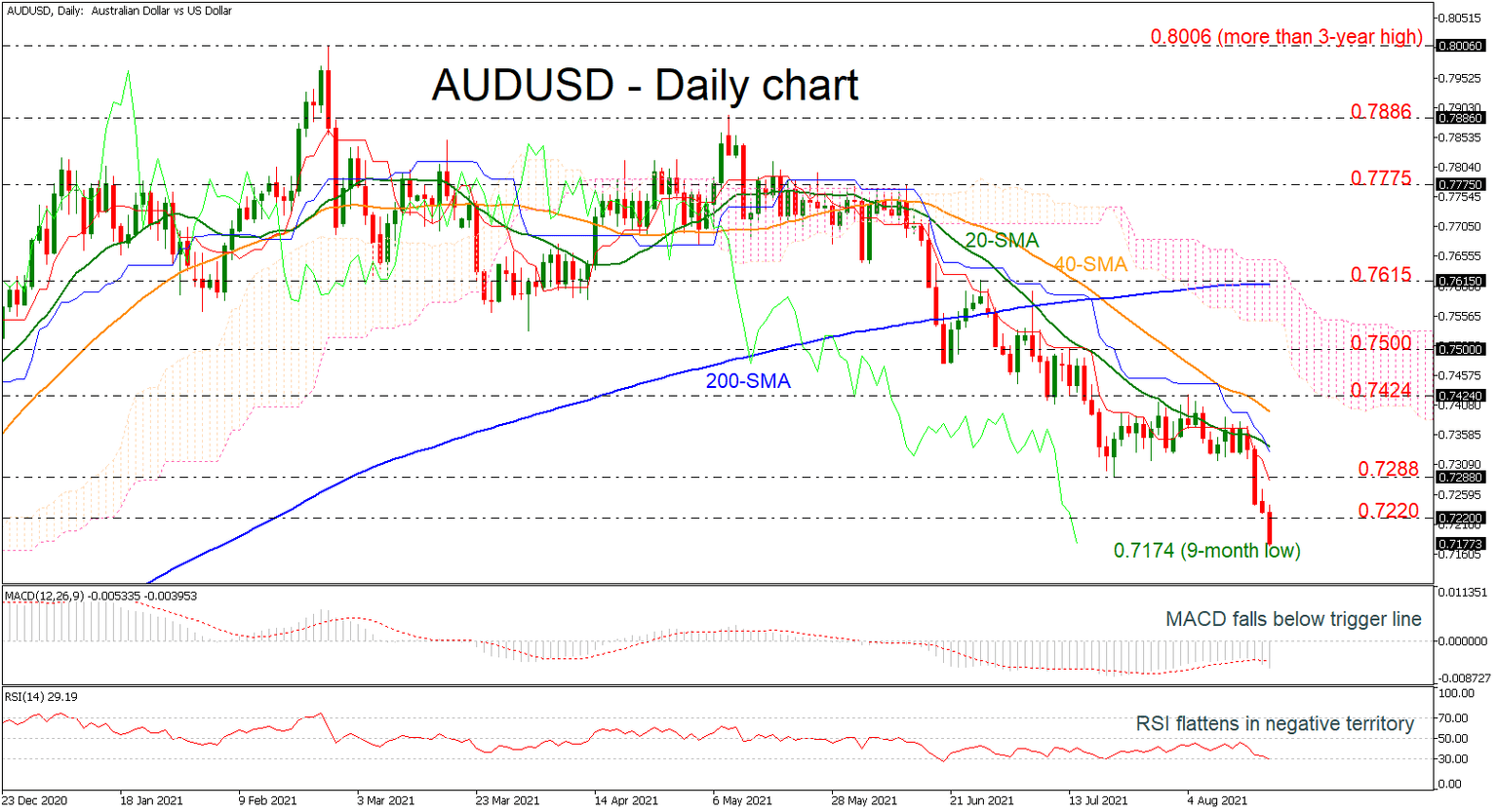

AUD/USD tumbles to new 9-month low

AUDUSD has reached a new nine-month low of 0.7174, which holds beneath the significant 200-week simple moving average (SMA). The negative structure in the price is confirmed by the technical indicators. The MACD oscillator decreased beneath its trigger line in the negative region, while the RSI is moving slightly lower near the oversold area.

If the price dips further, this could take the market towards the next strong support at 0.6990, registered in November 2020 ahead of the 0.6775 barrier, taken from the bottom in June 2020.

On the flip side, a bullish correction could drive the market towards the 0.7288 resistance ahead of the 20-day SMA at 0.7350. Above these hurdles the bulls could retest the 40-day SMA at 0.7407 and the 0.7424 resistance. The 0.7500 psychological level could halt upside movements before taking the pair until the 200-day SMA at 0.7610.

All in all, AUDUSD has been in a strong falling mode since May 10 and only a significant daily close beyond the 200-day SMA may switch this view to positive.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.