AUD/USD Weekly Forecast: Long-term bearish case persists

- Australia will publish next week RBA Minutes and critical employment-related data.

- The US Senate passed a $1 trillion bipartisan infrastructure bill, limiting greenback’s gains.

- AUD/USD needs to break below 0.7288 to confirm a medium-term bearish continuation.

The AUD/USD pair closed a third consecutive week little changed, now trading at around 0.7370, consolidating July losses. For the last month, the pair has been confined to a tight range between the year low at 0.7288 and 0.7426, with attempts to break above the 0.7400 figure being quickly reverted.

Nothing to cheer in Australia

The aussie has been unable to attract investors despite soaring equities, as Wall Street keeps rallying to record highs. It seems that stocks’ traders are no longer concerned about whether or not the US Federal Reserve will maintain its ultra-loose monetary policy. And they have a good reason to do so. After months of back and forth, the US Senate has finally passed a $1 trillion bipartisan infrastructure bill to rebuild the US economy. Even further, Congressmen prepared a framework to approve a $3.5 trillion Democratic budget. Fresh flows into US markets are enough to prevent an AUD/USD collapse.

On the other hand, Australia has little to cheer for. The country’s economy stays beyond its major rivals due to the excessive confidence the government put in closing borders last year. When authorities finally realized the measure could not hold forever, it was too late to join the vaccines’ train. Regional lockdowns have been once again extended, and macroeconomic data has continued to reflect the poor performance of the economy. There’s hope, however, as the country plays catch up. Up to today, roughly 20% of the Australian population has been fully vaccinated.

Funds flooding Wall Street

Across the Pacific, the US reported the final readings of its July inflation, which temporarily cooled expectations of soon to come tightening. The Consumer Price Index was confirmed at 5.4% YoY, while the core reading was downwardly revised to 4.3% as expected. Also, the country reported the Producer Price Index for the same period, which unexpectedly surged to 7.8%. The dollar suffered a setback on Friday, as the US Michigan Consumer Sentiment Index plunged to an almost 10 years low of 70.2 in August, according to preliminary estimates. The Federal Reserve is now expected to begin winding down facilities in the last quarter of the year.

Australian data was extremely disappointing, as NAB’s Business Confidence plummeted to -8 in July from 11 in the previous month, while August Westpac Consumer Confidence printed at -4.4%, down from 1.5% in July. Finally, Consumer Inflation Expectations contracted to 3.3% in August, while New Home Sales plunged 20.5% MoM in July, according to HIA.

Week ahead

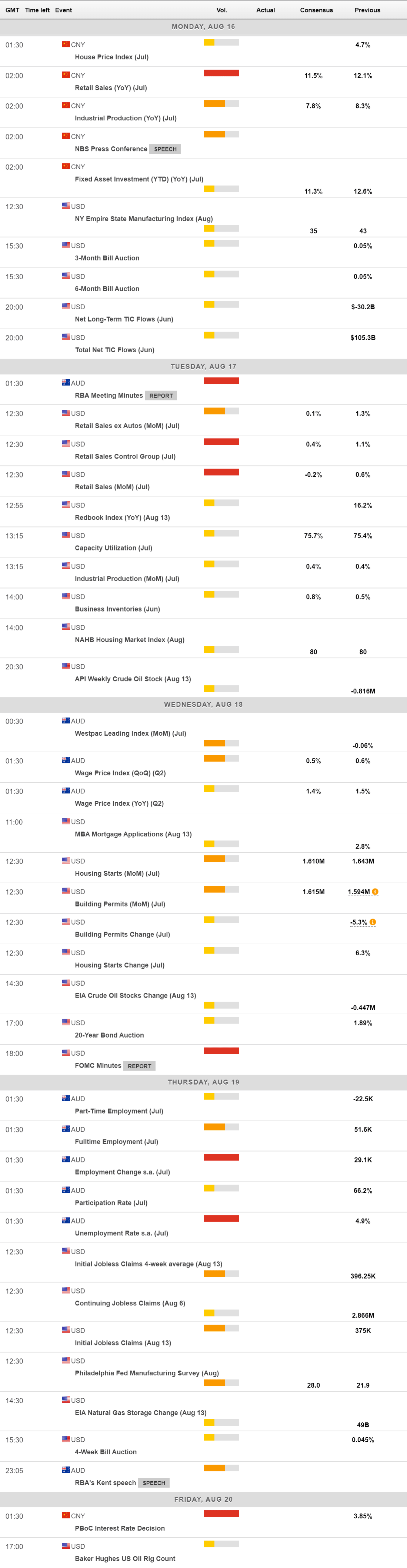

The macroeconomic calendar includes a few first-tier events next week. On Tuesday, the US will release July Retail Sales, the latter seen declining 0.2% MoM. On Wednesday, the US Federal Reserve will publish the Minutes of its latest meeting. The Reserve Bank of Australia will release the Minutes of its latest meeting, while the country will publish the Q2 Wage Price Index and July employment figures. The economy is expected to have lost 45,000 job positions in the month.

AUD/USD technical outlook

The modest weekly recovery fell short of changing the long-term bearish stance for AUD/USD. In the weekly chart, the pair is developing below a bearish 20 SMA, while above directionless longer ones. Technical indicators remain near weekly lows within negative levels, with the Momentum heading south and the RSI stable around 39.

The daily chart shows that the pair is neutral-to-bearish. AUD/USD is currently hovering around a bearish 20 SMA, while the 100 SMA is crossing below the 200 SMA in the 0.7600 area. Technical indicators have recovered modestly, with the Momentum stuck around its midline and the RSI ranging around 46.

The immediate support level is 0.7288, the year low, with a break below it, opening the door for an extension toward the 0.7220 price zone. Once below the latter, the pair has room to extend its slide toward the 0.7100 figure. Bears will retain control as long as the pair trades below 0.7440, although an extension beyond the latter would favour a continuation toward 0.7500.

AUD/USD sentiment poll

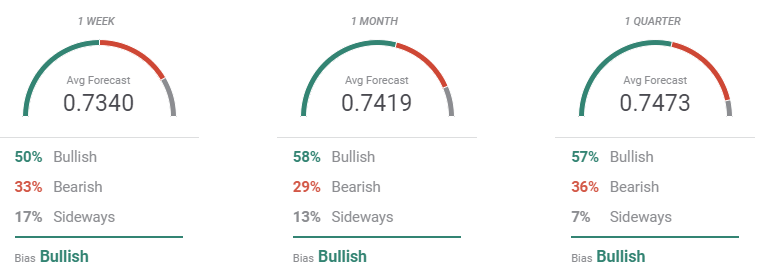

According to the FXStreet Forecast Poll, the AUD/USD pair could correct higher in the upcoming weeks, as bulls led the three time-frame under study, although on average, the pair is seen below the 0.7500 level. Those betting for a decline increase to 36% in the quarterly perspective, although bulls represent 57%.

The Overview chart shows that the moving averages are losing bearish steam. In fact, the weekly and monthly ones have turned modestly higher from multi-month lows. The quarterly media is flat, as the spread of possible targets is quite ample, indicating uncertainty about the long-term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.