- AUD/USD tumbled down as the market mood soured on several fronts.

- Australia's jobs report, US coronavirus figures, and Chinese data are eyed.

- Mid-June's daily chart is painting a bullish picture.

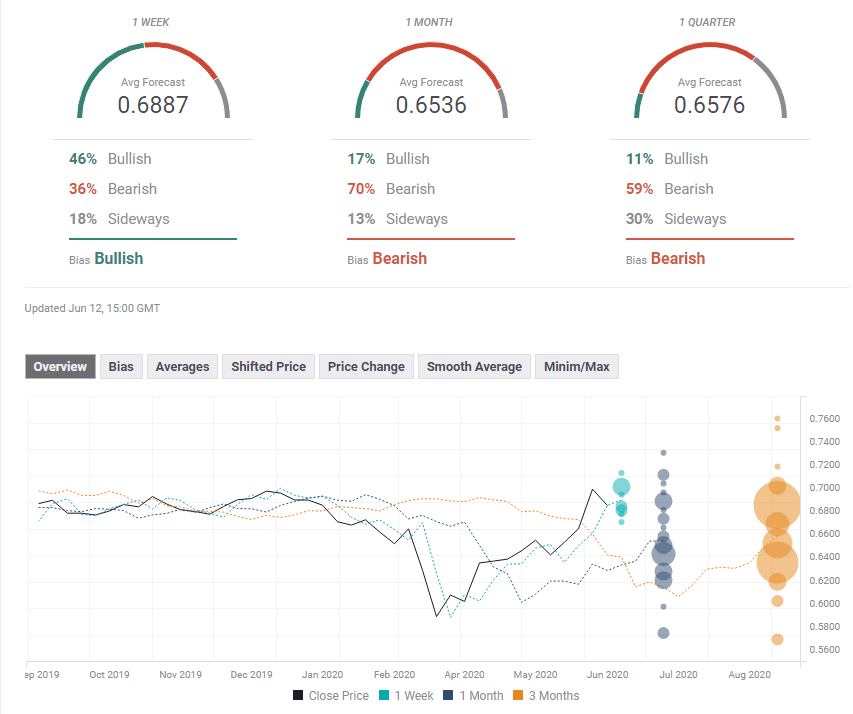

- The FX Poll is pointing to short term gains before a downfall afterward.

The tables have turned – a mix of Fed pessimism, rising US cases, and Sino-Australian tensions have sent AUD/USD down. Is it only a correction? Australia's jobs report, US disease data, US retail sales, and Chinese industrial output are all in play.

This week in AUD/USD: Strong data, upbeat markets

The Federal Reserve has been boosting stocks since March – but the latest pledge to support markets fell flat – as it came amid gloomy forecasts. The Fed foresees the economy returning to pre-crisis levels, not before 2022. While it projected single-digit unemployment by year-end, it cast doubts on the recent upbeat Non-Farm Payrolls report.

Jerome Powell's Chairman of the Federal Reserve cast a cautious tone and shares eventually stumbled, carrying down the Aussie, a risk currency. Another reason for the sell-off stemmed from rising coronavirus cases and hospitalizations.

The phenomenon has been going on for over a week, but investors took note when the situation in Houston worsened. Cases are on the rise in some 20 states. Treasury Secretary Steven Mnuchin opposes another lockdown, but the mood has clearly shifted.

Australia's COVID-19 situation remains under control as the gradual return to normal continues. It can still envy New Zealand – which reported no cases in two weeks – but Australia is also a standout in the world.

On the other hand, relations between the land down under and its China, its No. 1 trading partner, remain tense. Beijing issued a travel warning, painting a picture of racism in Australia. Beijing is angry with Canberra's demand to investigate China's handling of the disease.

AUD/USD hit new highs early in the week – continuing the previous trend – before tumbling down on the wall of worry described above.

Australian and Chinese events: More massive job

If China and Australia continue with unpleasant rhetoric but one that has no implications for trade, markets will likely learn to shrug it off. However, if Beijing threats with commerce action, the Aussie may shiver.

Sino-American tensions – which have been on the backburner – may come to the forefront and weigh on markets. Also here, investors are mostly interested in the trade deal and less on accusations related to coronavirus, Hong Kong, or human rights in Xinjiang. In case the accord is in jeopardy, the mood may worsen and the Aussie may also struggle.

A bulk of Chinese figures is due out early in the week, with industrial production expected to continue recovering while retail sales will likely remain subdued. All over the world, workers are getting back to factories faster than convincing consumers to shop.

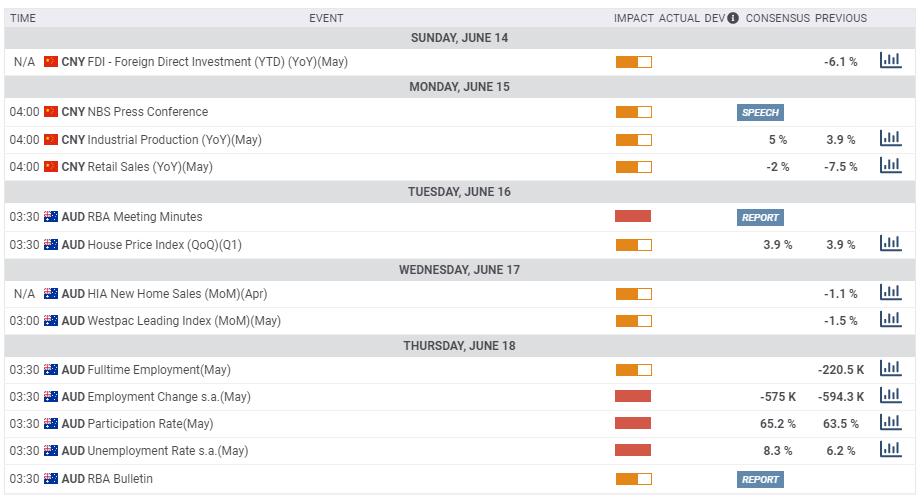

The Reserve Bank of Australia's meeting minutes may shed more light on the recent rate decision. The RBA seemed to signal it is taking a break from further easing as the economy stabilizes. Several additional economic indicators are of interest, yet the main event is left for last – the employment report.

Australia is set to announce another significant loss of jobs in May, following a decrease of nearly 600,000 in April. The Unemployment Rate is projected to leap, albeit on top of a return of the participation rate to pre-pandemic levels. AUD/USD is set to rock on any outcome, and investors will look for signs of recovery, amid the reopening.

Here are the most prominent Australian and Chinese releases on the economic calendar:

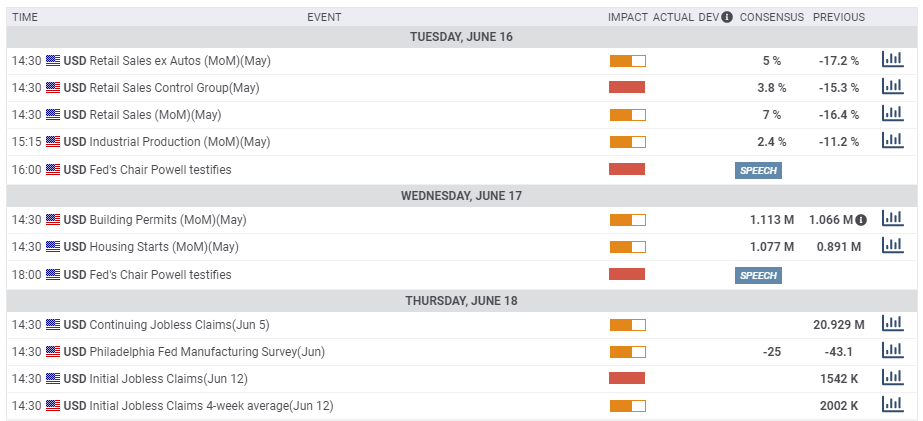

US events: Retail sales, more Powell, disease data

Protests against racial discrimination will likely resume over the weekend, potentially adding to political uncertainty. Such gatherings may also raise concerns about the spread of coronavirus. Signs of a second wave had begun emerging before the demonstrations but may be exacerbated by them.

If state governors reimpose lockdowns, the market mood may worsen and the safe'haven dollar has room to rise. If the uptrend halts, the greenback could slide.

Have US consumers returned to the shops? Retail sales stand out early in the week, with economists expecting a bounce in May after a sharp fall in April. Consumption is central to the US economy.

Jerome Powell has another opportunity to rock markets in two potentially long sessions on Capitol Hill. The Fed Chair will testify and could respond to recent data or shed more light on his views of the economy. A more rosy look may lift the mood while reiterating his cautionary tone could weigh on it.

Jobless claims – and growingly important continuing claims – stand out on Thursday. With millions on the dole and over a million of new applications every week, the US labor market is still far from recovery.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

After hitting the highest levels in nearly a year, AUD/USD entered overbought conditions – the Relative Strength Index on the daily chart surged above 70 – and then came the downfall.

So far, the charts do not indicate a change of course but only a correction. Momentum remains positive and the currency pair is holding above the 50, 100, and 200 Simple Moving Averages.

The round 0.69 level remains a battle line. It was a swing low in mid-June. Close by, 0.6940 was a high point early in the year. It if followed by 0.7015, which capped a recovery attempt in mid-June, and finally by 0.7065, the fresh peak.

Looking down, support awaits at the round 0.68 level, Friday's trough, followed by 0.6690, the pre-surge cap. 0.6620 was a stepping stone on the way up and next, we find 0.6560.

AUD/USD Sentiment

While technicals are pointing up, the correction may not be over. Fears about the US economy amid coronavirus and political unrest could send markets and the Aussie down for another week, despite a potentially upbeat Australian jobs report.

The FXStreet Forecast Poll is pointing to further losses for the Aussie in the medium and long terms. Experts are bullish only in the short term and foresee a considerable fall afterward. However, the average target for three months has been pushed higher in the past week.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

USD/JPY retreats from the 158.00 area ahead of Tokyo inflation

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Tokyo inflation stands out in the Asian session.

Gold hovers around $2,630 in thin trading

The US Dollar returns from the Christmas holidays with a soft tone, although market action seems contained. The positive tone of Asian shares weighs on the Greenback.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637275724559539835.png)