AUD/USD Weekly Forecast: Could the rally continue in a risk-averse world?

- Central banks’ imbalances had no material effect on AUD/USD.

- Persistent tensions in Eastern Europe could finally take their toll on the aussie.

- AUD/USD is technically bullish in the longer-term perspective, 0.7440 is key.

The AUD/USD pair managed to post a substantial comeback from a weekly low of 0.7164, currently trading around 0.7400. The aussie started the week on the back foot, pressured by concerns related to the Russia-Ukraine crisis.

Patient RBA vs aggressive Fed

The Australian dollar was also pressured by the “patient” stance of the Reserve Bank of Australia, as the central bank has released the Minutes of its latest monetary policy meeting, which brought little new to speculative interest.

The pair recovered some ground post-US Federal Reserve’s announcement, as the central bank came with an ace under its sleeve. Policymakers surprised investors with some planned hawkish action in almost every meeting this year, as the dot plot included six rate hikes. Also, policymakers see the Fed Funds rate at a median of 2.8% at the end of 2024, while chief Jerome Powell said that their plans on reducing the massive $9 trillion balance sheet would likely be completed by the time of their May meeting.

A substantial recovery in gold prices provided additional support to the aussie, as the bright metal recovered towards $1,950 a troy ounce after bottoming for the week at $1,895 in the Fed’s aftermath.

Data overshadowed the market’s sentiment

Meanwhile, the sentiment seesawed alongside headlines coming from Eastern Europe. The week comes to an end with no clear solution to the conflict, but on the contrary, with increased fears of a possible nuclear attack and concerns about the effect of the war on global growth and inflation.

The commodity-linked currency had one more reason to strengthen. Australian employment data resulted much better than anticipated. The country managed to add 121.9K full-time jobs, and while the number of part-time positions was down by 44.5K, the final total was 77.4K – more than doubling the 37K expected. The Unemployment Rate contracted to 4%, while the Participation Rate rose to 66.4%.

The US did not publish relevant data, but it is worth noting that Retail Sales were up a modest 0.3% in February, missing the market’s expectations.

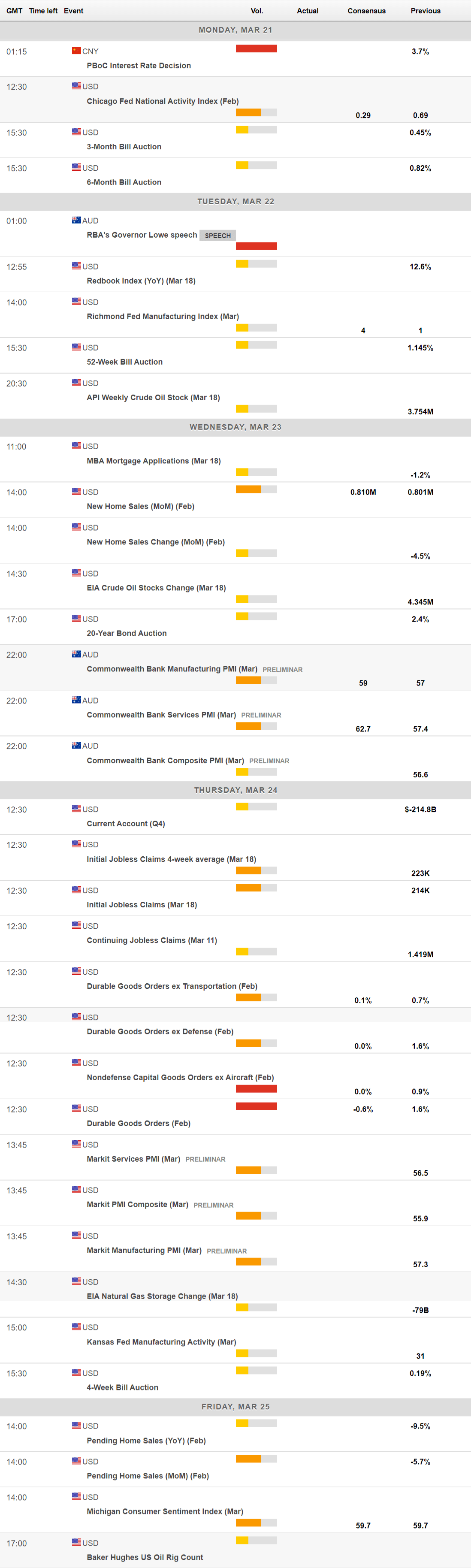

During the upcoming week, the focus will be on business growth, as Australia will release the preliminary estimates of the March Commonwealth Bank PMIs, while Markit will release the US Manufacturing PMI for the same period.

AUD/USD technical outlook

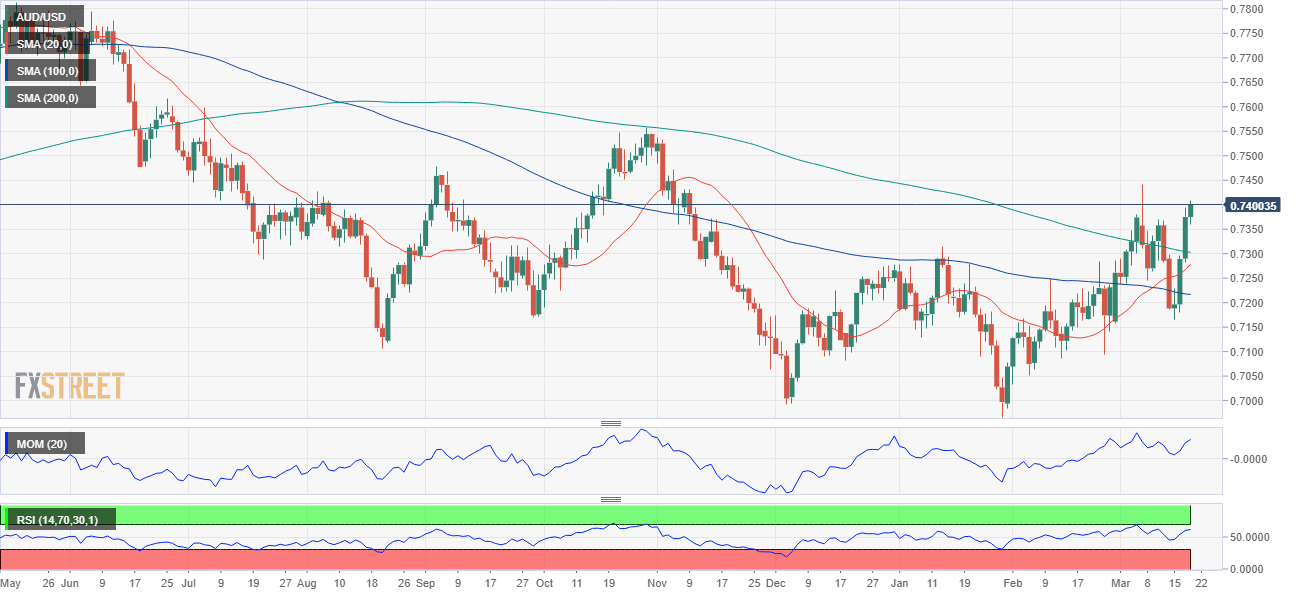

The weekly chart for the AUD/USD pair shows that risk remains skewed to the upside, although with a notorious lack of momentum. The pair finished the week above all of its moving averages, which anyway are confined to a tight range. Only the 100 SMA offers a mildly bullish slope, not enough to confirm a long-term bullish continuation. Meanwhile, technical indicators hold within positive levels, although lack directional strength.

The daily chart offers a more encouraging bullish perspective. The pair is also developing above its moving averages, although the 20 SMA maintains a firmly bullish slope after crossing above the 100 SMA and is heading towards surpassing the 200 SMA. Technical indicators have lost their previous strength but are consolidating well above their midlines.

The pair peaked early in March at 0.7440 the immediate resistance level. Once above it, the rally can continue towards 0.7555, the October monthly high. On the downside, relevant support comes in at around the 0.7300 figure, followed by the 0.7240 price zone.

AUD/USD sentiment poll

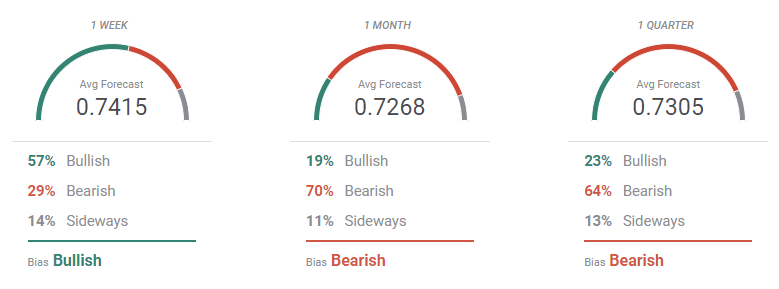

According to the FXStreet Forecast Poll, AUD/USD rally could be short-lived. The pair is seen rising next week to an average of 0.7415, but the sentiment turns bearish afterwards. Bears account for 70% of the polled experts in the monthly view, and 64% in the quarterly perspective, with the pair seen down to 0.7268 and 0.7305 respectively.

The Overview chart shows that the three moving averages under study keep heading north, in line with a continued advance. Still, the spread of possible targets has widened in the monthly view, with the pair now seen between 0.70 and 0.76.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.