AUD/USD Weekly Forecast: Bullish run not over yet

- Upbeat Australian employment data and a dovish US Federal Reserve triggered the bullish breakout.

- Thinned markets next week could see the AUD/USD pair soaring past 0.7700.

- AUD/USD is technically bullish, overbought conditions still short of granting a correction.

The AUD/USD pair surged to 0.7639, a level that was last seen in June 2018, holding on to its gains as the week comes to an end. The pair is up for a fifth consecutive week as the greenback sell-off was the name of the game.

The American currency plunged on a risk-on mood and a dovish Fed, as speculative interest was optimistic over a Brexit deal and the US stimulus package. Both suffered delays and are still to be resolved, yet market players are confident they’ll be resolved in the upcoming days. Regarding Brexit, there are still substantial differences in fisheries, but negotiations will continue over the weekend.

Coronavirus-related aid in the US is being discussed alongside government funding. Different from UK-EU divergences, US Republicans and Democrats seem to be on the same channel.

Aussie rallied on greenback weakness

Two events pushed the pair up. A dovish US Federal Reserve maintained its current monetary policy but changed its extension to an open-ended period, to “until substantial further progress” is being made toward employment and inflation goals. The other catalyst was upbeat Australian employment data, as the country created 90K new job positions in November, while the unemployment rate shrank to 6.8%, both beating the market’s estimates.

US data, on the other hand, was soft, to say the least, as Retail Sales in the country plunged 1.1% MoM in November, while Initial Jobless Claims jumped to 885K in the week ended December 11.

About the pandemic developments, Australia is still in much better shape than the US. The latter has reported over 270K new cases in the last 24 hours. On the other hand, Australia detected a new virus cluster on Sydney's northern beaches. 28 new contagions have been reported until this Friday, and new travel bans and restrictions have been imposed within the country.

Holiday season

Winter holidays are starting in the Northern hemisphere, which means that the next two weeks will be light in terms of macroeconomic releases. The focus will remain on Brexit and US stimulus, which can trigger some wild movements in thinned markets.

Next Tuesday, Australia will publish the preliminary estimate of November Retail Sales, foreseen at -0.6% from 1.4% previously. Later in the week, the country will release the November Trade Balance figures. As for the US, the most relevant data is November Personal Spending and Personal Income. Also, the country will unveil November Durable Goods Orders, foreseen at 0.8% MoM.

AUD/USD technical outlook

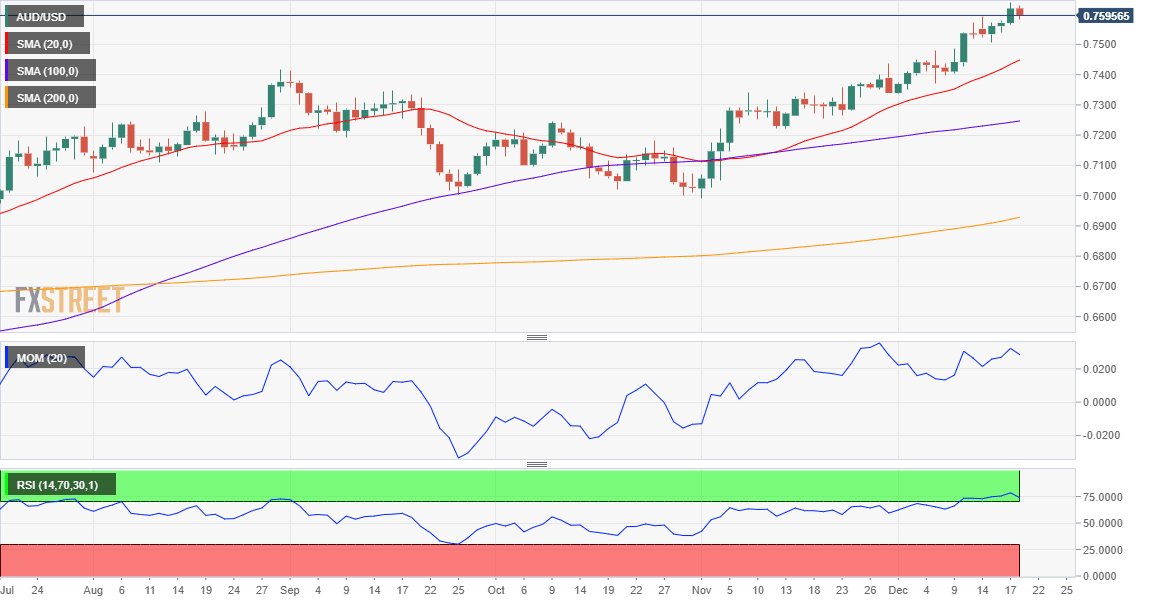

The AUD/USD pair has room to extend its advance, according to technical readings in the weekly chart. It has further advanced beyond all of its moving averages, and the 20 SMA is currently crossing through the 200 SMA, both around 0.7249. The Momentum indicator heads north within positive levels, although with limited strength. The RSI indicator, however, approaches overbought readings.

In the daily chart, the Momentum indicator maintains its bullish potential while the RSI indicator has started correcting extreme overbought readings but it is still holding above 70. The pair is trading well above its bullish moving averages, with the 20 SMA providing dynamic support at 0.7450.

If the pair breaks above 0.7640, the next possible bullish target is 0.7710, en route to 0.7770. Bulls will remain in control as long as the pair holds above 0.7500, with a break below this last, favoring a slide towards 0.7430.

AUD/USD sentiment poll

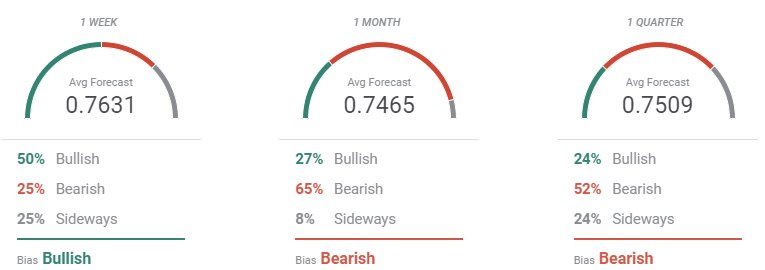

According to the FXStreet Forecast Poll, the pair will extend is positive momentum next week, but bears become a majority afterward. The pair is seen holding above the 0.7600 level in the near-term, although the range of possible targets is quite limited. A corrective decline towards the 0.7400 region could be expected, according to the monthly perspective, while the bearish pressure persists, but eases in the quarterly view.

The Overview chart shows that the bullish momentum remains strong in the weekly and monthly views, easing in the longer-term. Still, the same chart shows that the lower end of the possible price range has been lifted above the 0.7000 level, while bulls are more willing to accept an approach to the 0.80 mark.

Related Forecasts:

EUR/USD Weekly Forecast: Bullish momentum set to continue in the holidays season

GBP/USD Weekly Forecast: Fishing for a Brexit deal set to succeed, allowing for cheerful gains

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.