AUD/USD Weekly Forecast: Boosted by decreasing hopes for Fed’s action

- Poor US employment-related figures sent the greenback down across the board.

- The RBA will meet this week, will probably maintain a dovish stance.

- AUD/USD is set to extend its advance in the upcoming days.

The AUD/USD pair traded as high as 0.7477 on Friday, its highest since mid-July, advancing for a second consecutive week. The pair benefited from the broad dollar’s weakness, as investors sold the greenback on speculation the US Federal Reserve will have to put tapering in the freezer for now, amid the slow recovery of the employment sector.

The US August Nonfarm Payrolls report came in mixed, but the headline figure was quite disappointing, as the country added just 235K new jobs in the month vs the 750K expected. The Unemployment Rate contracted to 5.2% as expected, while the participation rate remained unchanged at 61.7%. The poor figures fueled speculation that the US Central Bank will have to maintain its ultra-loose monetary policy for longer, to the detriment of the American dollar.

Australia doing a bit better

Meanwhile, Australian figures released in the last few days were more encouraging than anticipated. In the second quarter of the year, Company Gross Operating Profits improved to 7.1%, while Q2 Gross Domestic Product printed at 0.7%, better than the 0.5% expected. The July Trade Balance posted a surplus of 12,117 million, while the August Commonwealth Bank Manufacturing PMI printed at 52. However, the official AIG index came in at 51.6, well below the previous 60.8, while the Commonwealth Services PMI shrank to 42.9, a result of the latest restrictive measures in the country.

Australia will publish the August TD Securities Inflation on Monday, foreseen at 0.5% MoM, and the AIG Performance of Services Index, previously at 51.7. The Reserve Bank of Australia will meet on September 7, with investors largely anticipating a dovish stance. The RBA will likely stick to massive fiscal stimulus amid the ongoing coronavirus crisis.

The US will not release first-tier data and has quite a light macro-week. The focus will be on employment-related data in the form of weekly unemployment claims and inflation figures, as the country will release the August Producer Price Index, expected to decline to 7.3% YoY.

AUD/USD technical outlook

The weekly chart for the AUD/USD pair shows that the pair has extended its recovery above its 100 and 200 SMAs, although the 20 SMA maintains its bearish slope, providing dynamic resistance at around 0.7530. Meanwhile, technical indicators have recovered further from oversold readings, heading firmly higher within negative levels.

The daily chart suggests that the pair may continue advancing in the upcoming sessions. The pair has moved well above a still flat 20 SMA, while technical indicators head firmly higher within positive levels. The 100 SMA heads south below the 200 SMA, currently at 0.7545, providing dynamic resistance.

If the pair manages to break above 0.7480, then 0.7545 comes at sight, ahead of the 0.7600 figure. The pair could turn south on a break below 0.7400, with the next support level at 07330.

AUD/USD sentiment poll

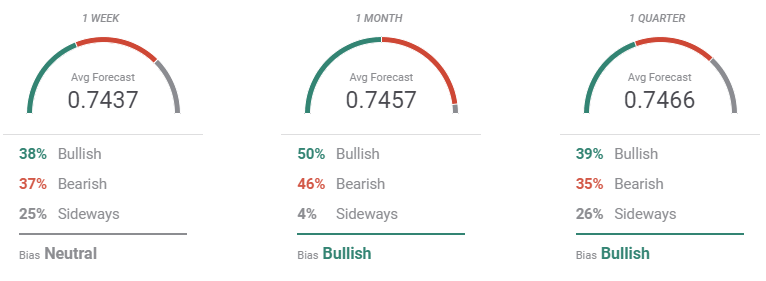

According to the FXStreet Forecast Poll, the AUD/USD pair could extend its gains in the upcoming months. The sentiment is neutral in the near term as bulls and bears are pretty much the same, with an average target of 0.7435. In the monthly view, bulls take the lead, which they maintain on the quarterly perspective. However, those betting for a decline to sub-0.7300 are quite enough to put at doubt the expected rally.

Finally, the Overview chart shows that the moving averages in the three time-frame under study have turned higher, although losing strength as time goes by. In all cases, most targets accumulate between 0.74 and 0.76, supporting a bullish continuation at least in the near term.

Related Forecasts:

USD/CAD Weekly Forecast: Third week of falls? BOC and Canadian jobs hold the keys

GBP/USD Weekly Forecast: Torn between mixed forces, data to determine next moves

EUR/USD Weekly Forecast: Bulls cheer tepid US employment data, more gains in the docket

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.