AUD/USD Weekly Forecast: AUD/USD climbs above 0.7200 despite RBA's dovish tone

- RBA's policy statement hurt AUD earlier in the week.

- Risk flows allowed AUD/USD to stage a decisive rebound.

- Labour market data from Australia will be watched closely next week.

The Reserve Bank of Australia's (RBA) dovish tone in its policy statement caused the AUD/USD pair to came under strong bearish pressure on Tuesday. However, the risk-on market environment in the remainder of the week weighed on the greenback and allowed the pair to close the second straight week in the positive territory near 0.7200.

What happened last week

Earlier in the week, the RBA announced that it left its policy rate unchanged at 0.25% as expected. In its policy statement, the Australian central bank noted that it will not increase its policy rate until convincing progress is made towards full employment and that it’s confident inflation will be sustainably within the 2–3% band. The RBA further acknowledged that it continues to consider how additional monetary easing could support jobs as the economy opens up further.

In its Financial Stability Review later in the week, the RBA warned that business failures could rise substantially. “At least 10% to 15% of small businesses in the hardest-hit industries still do not have enough cash on hand to meet their monthly expenses,” the RBA said. “These businesses are in a tenuous position and are particularly vulnerable to a further deterioration in trading conditions or the removal of support measures.”

Other data from Australia showed that economic activity in the service sector expanded at a soft pace in September. Moreover, the National Australia Bank reported that Business Confidence and Business Conditions improved modestly in September. Finally, the Australia Bureau of Statistics said on Friday that Home Loans and Investment Lending for Homes in August rose by 13.6% and 9.3%, respectively.

On the other hand, the ISM and the IHS Markit both reported that the US service sector continued to gather strength in September. Additionally, the US Department of Labor’s weekly data showed that Initial Jobless Claims declined by 9,000 to 840,000 in the week ending October 3rd. Meanwhile, in the minutes of its September meeting, the FOMC noted that the economic recovery was faster than initially expected and reiterated the need for more fiscal support.

On Tuesday, US President Donald Trump announced, via Twitter, that he instructed his representatives to stop negotiations on the coronavirus relief bill until after the election. Although the initial market reaction caused safe-haven flows to take control of financial markets and provided a boost to the USD, the greenback struggled to preserve its bullish momentum. Trump quickly clarified that they will continue to work on standalone bills on payroll protection and stimulus check to families, as well as aid for airlines.

With risk flows dominating the financial markets and allowing Wall Street’s main indexes to rise sharply, the US Dollar Index spent the second half of the week under pressure and closed in the negative territory for the second straight week.

Next week

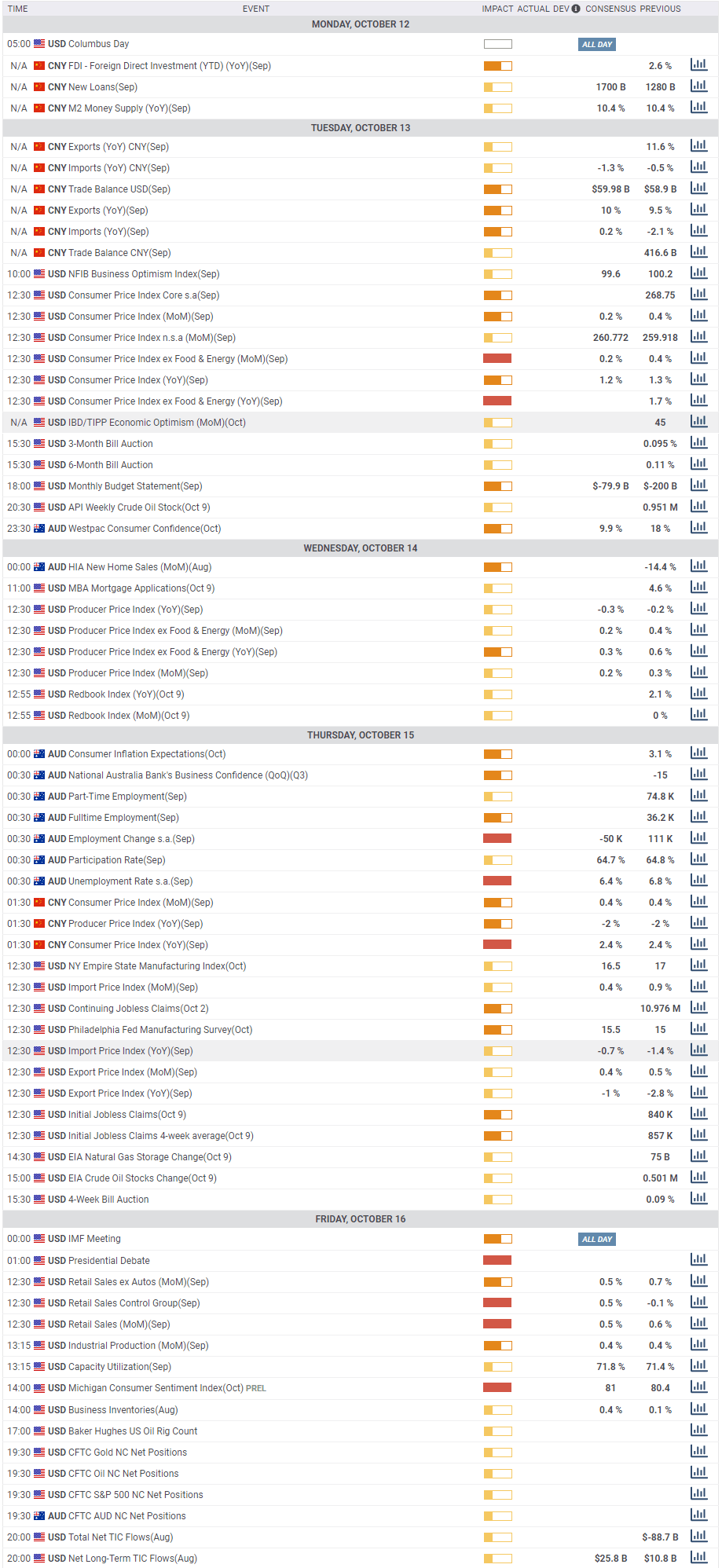

The Westpac Consumer Confidence Index and New Home Sales data will be released from Australia on Wednesday. More importantly, the Australian Bureau of Statistics will publish the October Consumer Inflation Expectations and September Employment Change data on Thursday. Markets expect the Unemployment Rate to decline to 6.4% in September from 6.8% in August. A worse-than-expected jobs report could cause investors to start pricing a dovish shift in the RBA’s outlook and weigh on the AUD.

The US economic docket will feature the Consumer Price Index (CPI) report on Wednesday ahead of Friday's Industrial Production and the University of Michigan Consumer Sentiment Index data.

AUD/USD technical outlook

With Friday's upsurge, AUD/USD closed above the 20-day and the 50-day SMAs for the first time since mid-September, suggesting that buyers are dominating the pair's action. Additionally, the RSI indicator on the same chart rose above 50, confirming the near-term bullish outlook.

On the upside, the initial resistance aligns at 0.7300 (psychological level), ahead of 0.7350 (static level) and 0.7415 (two-year high set in late-August).

The initial support is located at 0.7170 (20-day SMA) ahead of 0.7075 (100-day SMA). However, only a daily close below 0.7000 (psychological level/Fibonacci 23.6% retracement of April-September rally) could cause AUD/USD's near-term outlook to turn bearish.

AUD/USD sentiment poll

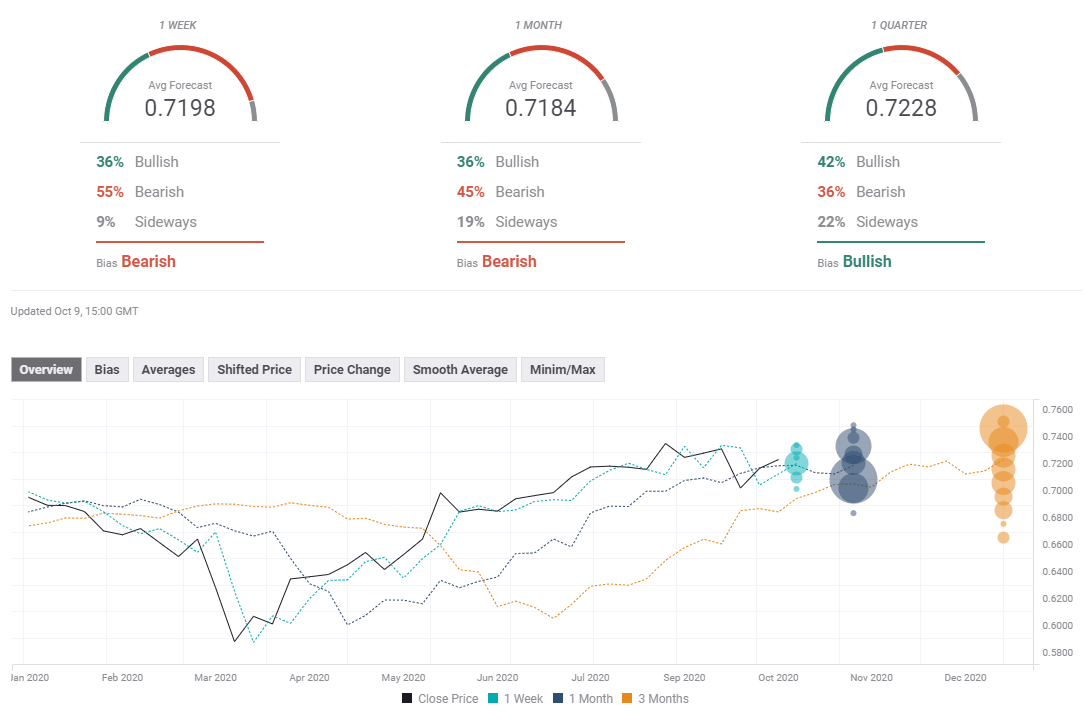

Despite the near-term technical bullish outlook, the FXStreet Forecast Poll reveals that AUD/USD could struggle to push higher above 0.7200. The weekly and the monthly outlooks both show that experts don't see AUD/USD holding above 0.7200. Although the quarterly outlook points out that 42% of experts adopt a bullish view, the average price target of 0.7228 suggests that gains are not expected to be substantial.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.