AUD/USD stabilises as traders await economic signals

The AUD/USD pair is navigating the week starting with a steady tone, trading around 0.6590. After a significant drop last Friday, triggered by disappointment over China's economic stimulus measures, the pair finds a momentary respite as it consolidates recent movements.

China's announcement of a significant debt reduction and support for local governments and economic growth fell short of full transparency, leaving investors wanting more details. Given China's crucial role as Australia's top trading partner, any economic shifts there have a pronounced impact on the AUD's performance.

The ongoing uncertainties surrounding the implications of Donald Trump's U.S. presidential win also continue to influence market sentiment, particularly regarding U.S.-China relations.

This week is pivotal for Australian data with the release of Q3 payroll statistics and overall employment data, which are essential for assessing the Reserve Bank of Australia's (RBA) future monetary policy decisions. Additionally, RBA Governor Michele Bullock's participation in a regulatory panel might offer fresh insights into the central bank's views on inflation and economic demand.

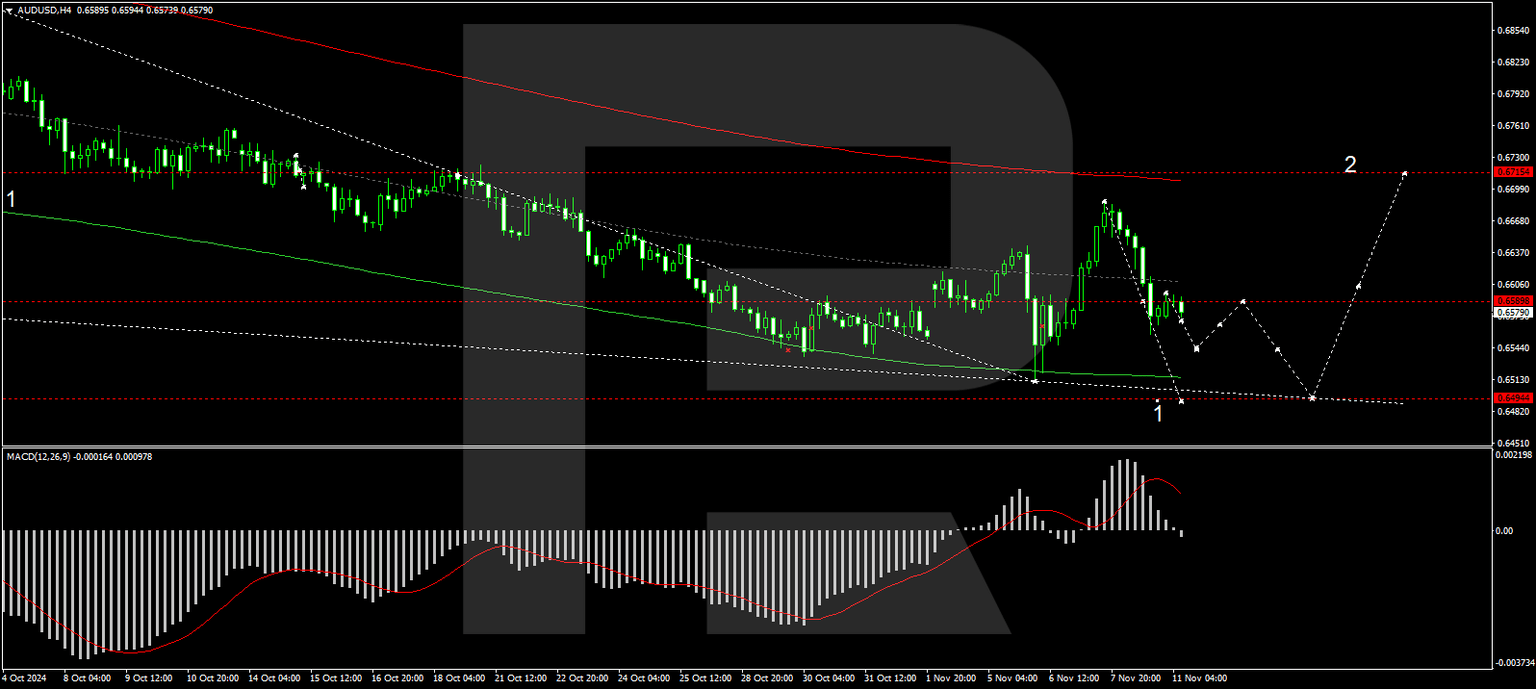

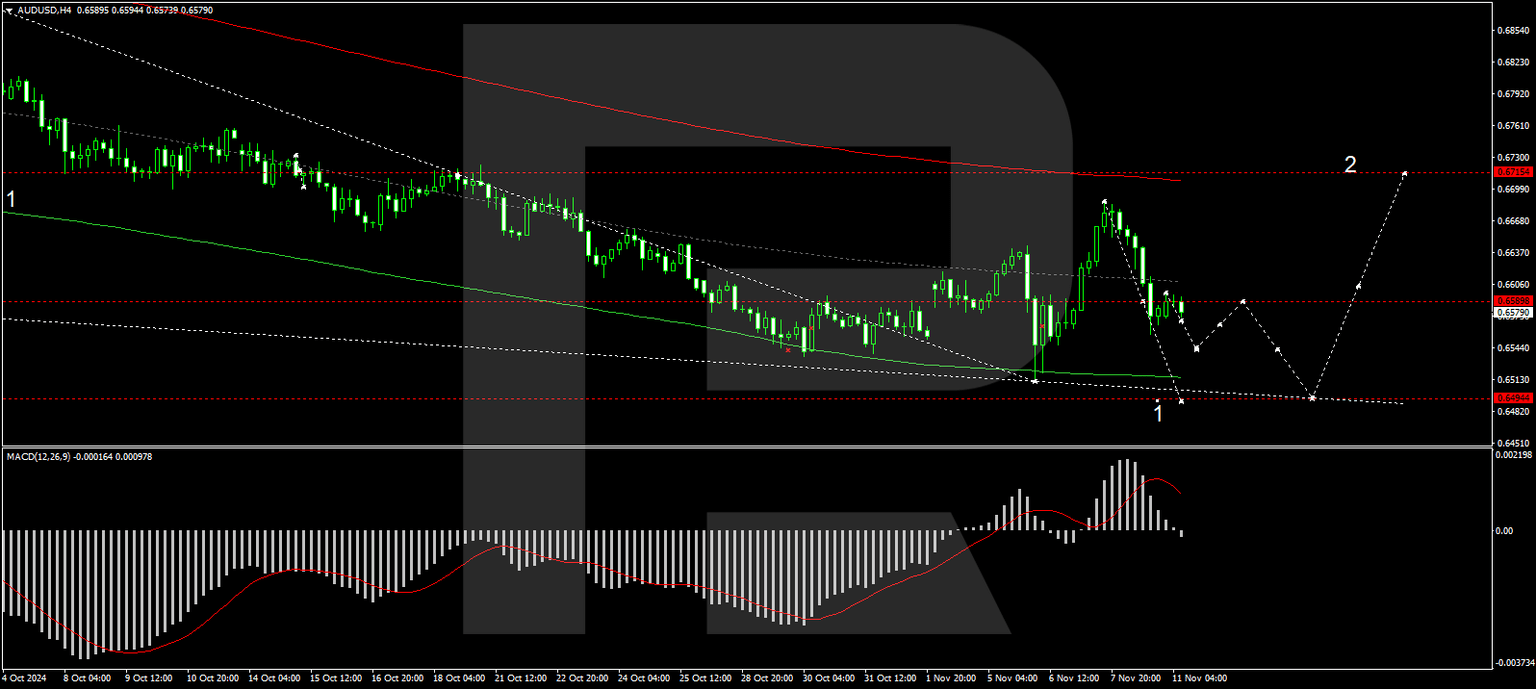

AUD/USD technical analysis

On the hourly chart, after completing a decline to 0.6557 and a subsequent correction to 0.6600, expectations are for a further dip to 0.6544. Success in reaching this level may prompt a rebound to 0.6600, testing from below before possibly resuming the downward trend towards 0.6494. The stochastic oscillator, currently below the 50 mark, underscores the potential for further declines.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.