AUD/USD Price Forecast: There is still room for further gains

- AUD/USD’s recovery faltered just ahead of the key 0.6400 barrier.

- The US Dollar added to the ongoing bearish trend ahead of the Fed.

- Markets’ attention remains on upcoming central banks’ meetings.

The Australian Dollar (AUD) retested the area of weekly highs on Tuesday, although AUD/USD seems to have run out of steam just ahead of the key 0.6400 barrier despite the modest retracement in the US Dollar (USD).

On the latter, ongoing weakness dragged the US Dollar Index (DXY) to the area of multi-month lows near 103.30 amid mixed yields, persistent tariff concerns and renewed geopolitical tensions in the Middle East.

Trade tensions in the spotlight

Washington’s unpredictable trade policies continue to unsettle markets, with investors bracing for possible retaliation from the United States' (US) trading partners. The risk of an escalating trade war remains a major headwind, threatening to keep risk-sensitive assets under pressure.

Australia—heavily reliant on commodity exports to China—has been particularly wary of US tariffs on Chinese imports. Any slowdown in China, Australia’s top trade partner, could swiftly drag the Aussie Dollar lower.

Central banks and inflation: The evolving narrative

Fears that trade-driven inflation might push the Federal Reserve (Fed) into extended tightening are colliding with mounting worries over a US economic slowdown. On this, investors are expecting the central bank to shed further light at its upcoming Wednesday’s meeting, where interest rates are expected to remain unchanged.

In the meantime, weaker-than-expected US Consumer Price Index (CPI) figures for February have reinforced expectations that the Fed may revert to an easing cycle in the near term.

Meanwhile, the Reserve Bank of Australia (RBA) lowered its benchmark rate by 25 basis points in February, bringing it to 4.10%. Governor Michele Bullock reiterated that future moves hinge on inflation data, while Deputy Governor Andrew Hauser cautioned against assuming a rapid series of rate cuts. Still, speculation persists that the RBA could implement up to 75 basis points of further easing if trade tensions escalate.

Recent Minutes from the RBA’s meeting revealed that policymakers weighed holding rates steady versus a modest cut. While they ultimately chose the latter, officials stressed that this does not guarantee a full easing cycle. They also noted that Australia’s rate peak remains relatively low by global standards, highlighting the resilience of the domestic labour market.

AUD/USD technical outlook

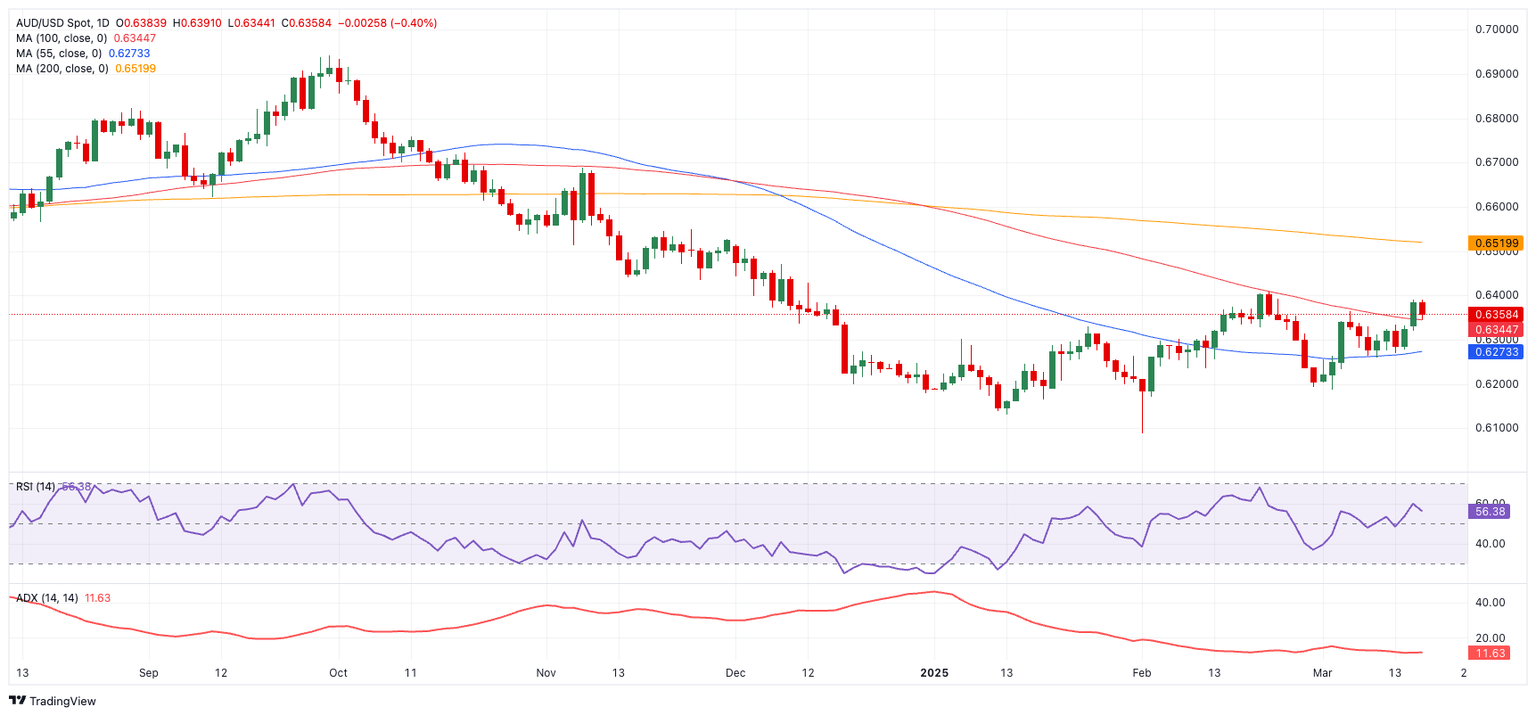

If AUD/USD breaks above the 2025 peak at 0.6408 (from February 21), it could pave the way for a test of the 200-day Simple Moving Average (SMA) at 0.6522, followed by the November 2024 high at 0.6687 (November 7).

On the downside, immediate support lies at the March low of 0.6186 (March 4). A sharper pullback could target the 2025 trough at 0.6087, with the psychologically crucial 0.6000 handle on the radar.

Momentum indicators are sending mixed signals. The Relative Strength Index (RSI) eases a tad to 56 and points to fading bullish momentum, while the Average Directional Index (ADX) near 12 suggests a generally weak trend.

AUD/USD daily chart

Key data releases ahead

Australia’s labour market report, due on Thursday, will be in the spotlight. The figures could provide crucial insight into the RBA’s next policy moves and help set the near-term direction for AUD/USD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.