AUD/USD Price Forecast: The return to the 0.6300 region

- AUD/USD advanced further and reclaimed 0.6300 and above.

- The US Dollar intensified its offered stance despite tariff concerns.

- Solid results from the Australian Q4 GDP figures lent support to AUD.

Wednesday brought more bad news for the US Dollar (USD), as lingering worries about the American economy continued to weigh it down. The US Dollar Index (DXY) dipped well below the 105.00 level for the first time since early November, while there was no end in sight for falling US yields.

Meanwhile, the Australian Dollar (AUD) added to the weekly recovery and reclaimed the area beyond the key 0.6300 barrier, also propped up by firm Q4 GDP prints in Oz.

On the latter, the GDP Growth Rate expanded 0.6% QoQ and 1.3% on a yearly basis, bolstered by both public and private spending. Looking ahead, the Reserve Bank of Australia (RBA) expects the economy to settle back into its 2% trend rate in 2025 and remains cautious—an approach that continues to lend support to the Australian dollar.

Trade tensions still dominate the headlines

Ongoing trade disputes remain the key market driver, especially for risk-sensitive currencies like the Aussie. A new 25% tariff on Canadian and Mexican imports went into effect last Tuesday, along with a 20% duty on Chinese goods—both moves that are fanning the flames of trade war fears.

Since China is Australia’s biggest trading partner, any slowdown in Chinese demand could deal a big blow to Australian commodity exports, and by extension, the AUD. Over the weekend, China’s business activity data looked upbeat, but investors still aren’t convinced it signals a major economic rebound. Earlier services prints from Caixin also lent support to the daily move in AUD.

Central banks and inflation in focus

Despite the recent volatility in the US Dollar, mounting trade tensions could stoke inflation, potentially keeping the Federal Reserve (Fed) on a path toward tighter monetary policy.

In the meantime, the RBA lowered its benchmark interest rate by 25 basis points to 4.10% in February but emphasized that this wasn’t the start of a broad rate-cutting cycle. Policymakers currently project underlying inflation around 2.7%.

Governor Michele Bullock has hinted at possible additional rate cuts if inflation continues to ease, but stressed the decision will depend heavily on upcoming data.

In addition, Deputy Governor Andrew Hauser made it clear overnight that the Board remains unconvinced by market expectations for multiple rate cuts.

Still, the market is pricing in a total of 75 basis points of easing over the next 12 months, with the next 25 bp cut anticipated in May as escalating trade tensions cloud the global economic outlook.

On the inflation side, the latest RBA Monthly CPI Indicator (Weighted Mean CPI) showed 2.5% in January, slightly below forecasts.

Lastly, and according to the RBA’s February Minutes, officials debated leaving rates unchanged or cutting them by 25 basis points, eventually choosing the cut but clarifying that it doesn’t guarantee more rate reductions. They also noted that Australia’s rates haven’t climbed as high as other economies’, and that Australia’s labour market was stronger than those countries’ when it first began easing.

Commodities offer some help to the Aussie

Australia’s heavy reliance on commodity exports makes the AUD particularly vulnerable to any hint of slowing demand from China. Copper prices jumped to multi-day peaks on Wednesday, although iron ore prices drifted lower, adding to Tuesday’s drop.

AUD/USD technical outlook

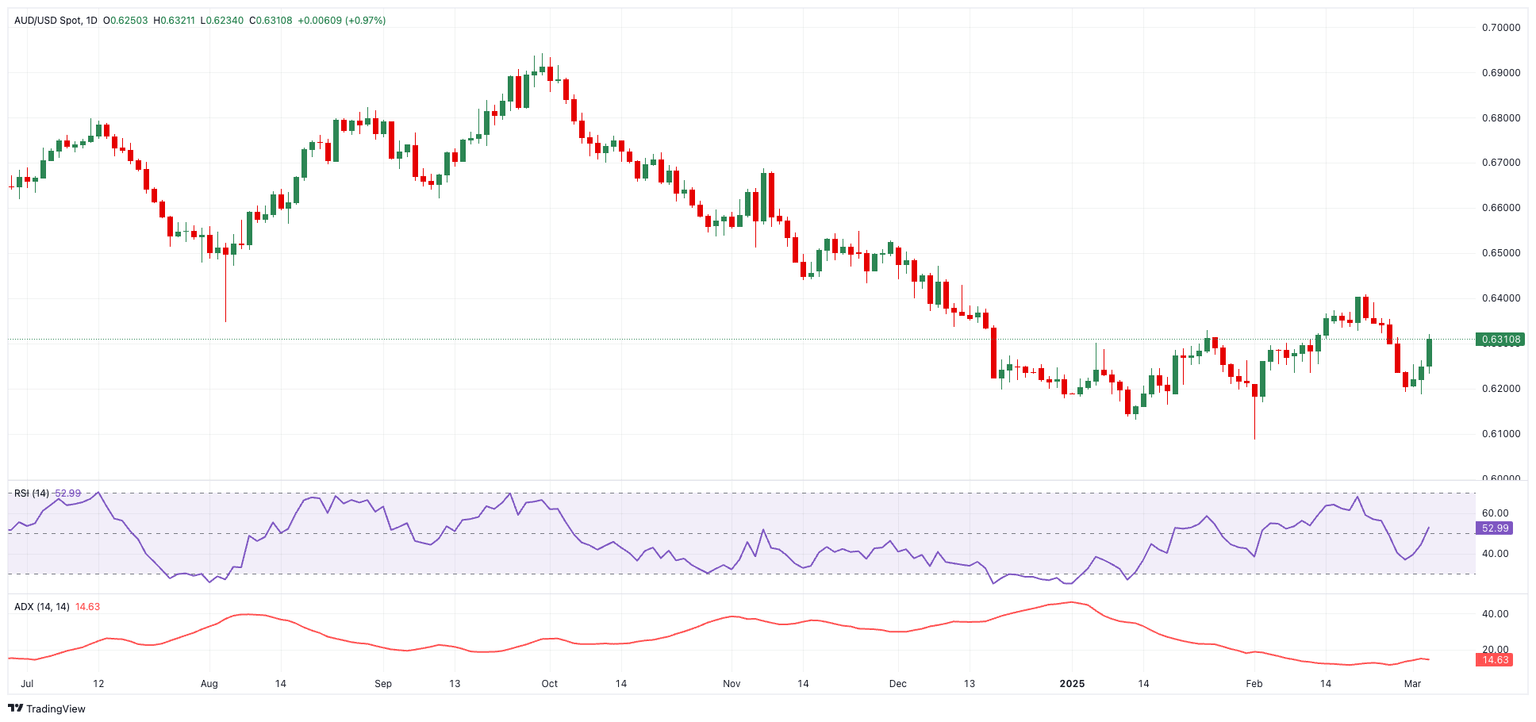

Technically, AUD/USD is eyeing a test of its 2025 peak at 0.6408 (from February 21). A break above that level could open the door to the November 25 high at 0.6549, which is also near the 200-day Simple Moving Average (SMA).

On the downside, the first support sits at the March low of 0.6186 (from March 4). A drop below that could target the 2025 bottom at 0.6087, followed by the psychologically important 0.6000 level.

Momentum indicators suggest some recovery. The Relative Strength Index (RSI) climbed past 52, while the Average Directional Index (ADX) near 15 hints that the underlying trend might still lack strength.

AUD/USD daily chart

Looking Ahead

The preliminary Building Permits and Private House Approvals will close the weekly calendar in Australia.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.