AUD/USD Price Forecast: The rally now looks at the RBA

- AUD/USD climbed to two-month highs near 0.6370 on Monday.

- The US Dollar traded in an inconclusive fashion in its lower range.

- The RBA’s upcoming interest rate decision remains a close call.

The US Dollar (USD) navigated the lower end of its recent range in quite an apathetic start to the new trading week, prompting the Dollar Index (DXY) to keep business in the sub-107.00 region.

Meanwhile, the Australian Dollar (AUD) took full advantage of the Greenback’s vacillating price action, encouraging AUD/USD to add to the ongoing recovery and reach fresh two-month highs in the 0.6370-0.6375 band on Monday.

Trade uncertainty and tariff turmoil

Ongoing trade tensions have shaped currency movements, with the Aussie Dollar following other risk-sensitive currencies as the US Dollar have struggled and markets remain on edge over new tariff policies from Washington.

In fact, President Trump postponed a 25% tariff on Canadian and Mexican goods for a month, briefly lifting market sentiment. However, fresh tariff threats quickly erased any optimism. The US also imposed a 10% tariff on Chinese imports, stoking fears of retaliation from Beijing.

Given China’s importance as Australia’s top export market, any countermeasures could weigh on demand for Australian commodities. Beijing has hinted at a potential WTO challenge, adding further uncertainty for resource-driven economies like Australia.

Inflation, the Fed, and the road ahead

While the Greenback has recovered some ground, concerns over a potential escalation in the trade war linger. If tensions intensify, inflation could rise further, potentially keeping the Federal Reserve (Fed) on a restrictive path for longer.

In Australia, focus shifts to the Reserve Bank of Australia (RBA) and its interest rate decision on February 18.

While market consensus seems to favour a 25 basis point rate cut, extra importance will be on the tone of the bank’s statement and its forward guidance, all amid speculation that the easing cycle by the central bank is predicted to be shallow. Deeper cuts seem unlikely, as only 75 basis points of easing is priced in for 2025.

Let’s recall the latest inflation prints in Australia: the Q4 Consumer Price Index (CPI) increased by 2.5% from a year earlier, while the Trimmed mean CPI—a key measure for the RBA—fell to a three-year low of 3.2%.

The big question: If the RBA does lower rates, how much guidance will it provide? Traders are left wondering whether this marks the start of a measured rate-cutting cycle—or a one-off move to support a cooling economy.

Commodities offer no cushion

Australia’s export prospects remain cloudy, especially if Chinese demand softens. Iron ore and copper—two of the country’s economic pillars—face downward pressure amid persistent trade tensions. A dip in both commodities on Monday also came in contrast with the stronger tone in the Aussie Dollar.

Technical picture: Key levels to watch

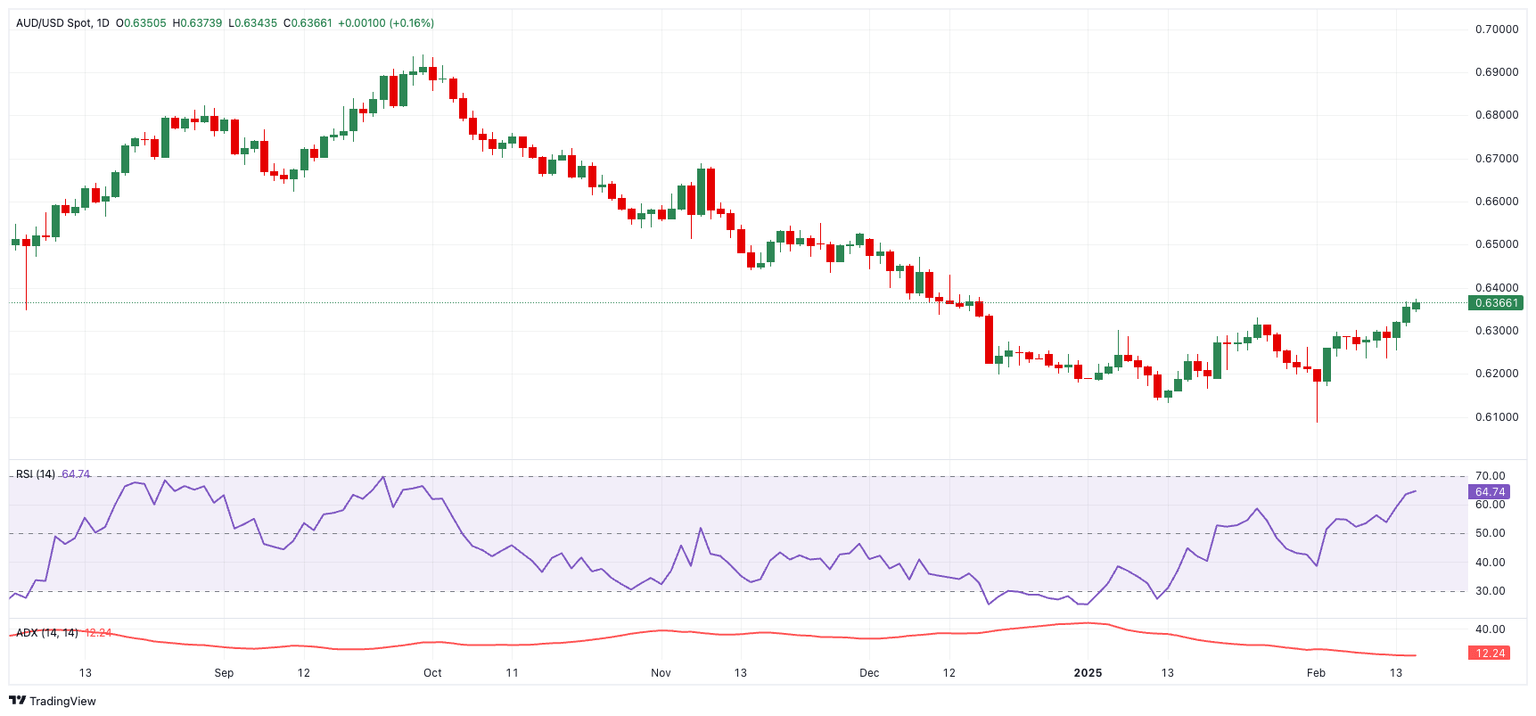

In the event of the continuation of the monthly recovery, the 100-day Simple Moving Average (SMA) at 0.6441 should offer provisional resistance, prior to the weekly high of 0.6549 (November 25), all preceding the key 200-day SMA at 0.6557.

On the other hand, there is an interim support at the 55-day SMA at 0.6283, seconded by the 2025 bottom of 0.6087, and the psychological support at 0.6000.

In addition, indicators offer mixed signals: While the Relative Strength Index (RSI) near 65 suggests increasing bullish momentum, the Average Directional Index (ADX) around 15 indicates a weak trend.

What’s Next?

All eyes are on the RBA meeting on February 18, seconded by the Q4 Wage Price Index on February 19, and the labour market report on February 20.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.