AUD/USD Price Forecast: The outlook should shift to bullish above 0.6630

- AUD/USD advanced to multi-day highs past the 0.6600 barrier.

- The US Dollar faced quite a marked selling pressure ahead of the US election.

- The RBA is largely expected to keep its interest rate unchanged on Tuesday.

On Monday, the selling pressure returned to the US Dollar (USD), causing AUD/USD to quickly leave behind Friday’s retracement and embark on a further recovery north of 0.6600 the figure, or multi-day peaks.

Monday’s uptick in spot came at shouting distance from the critical 200-day Simple Moving Average (SMA) of 0.6627. A convincing breakout of this region is expected to shift the pair’s outlook to a more constructive one, paving the way for extra gains in the short-term horizon.

The resurgence of the bullish trend for the Australian Dollar (AUD) was supported by marked losses in the Greenback, amidst the lack of clear direction in US yields across the curve and steady prudence ahead of the November 5 US election.

Despite ongoing scepticism regarding the effectiveness of China’s recent stimulus measures, the Aussie Dollar managed to derive extra support from the positive performances of both copper prices and iron ore prices.

On the monetary policy front, the Reserve Bank of Australia (RBA) is largely anticipated to leave its Official Cash Rate (OCR) unchanged at 4.35% on November 5.

Recent Australian data indicated that the Monthly CPI Indicator dropped by 2.1% in September. The annual inflation rate for the third quarter eased by 2.8%, while the RBA’s Trimmed Mean CPI grew by 3.5% YoY. Although disinflationary trends are emerging, they may not yet be sufficient for the RBA to begin easing its policy cycle.

Currently, the market assigns only a 15% probability to a 25-basis-point rate cut by December and less than a 50% chance of a rate reduction in February. Overall, the RBA is likely to remain among the last G10 central banks to lower rates as both growth and inflation begin to moderate.

While potential rate cuts by the Federal Reserve later this year could support AUD/USD, ongoing uncertainty regarding China’s economic outlook may prevent the pair from embarking on a sustainable uptrend, at least in the medium term.

Still around China, the National People’s Congress Standing Committee kicked off its meeting on Monday and is set to conclude on Friday. Policymakers are anticipated to reveal the specifics of their fiscal stimulus plans once the meeting wraps up.

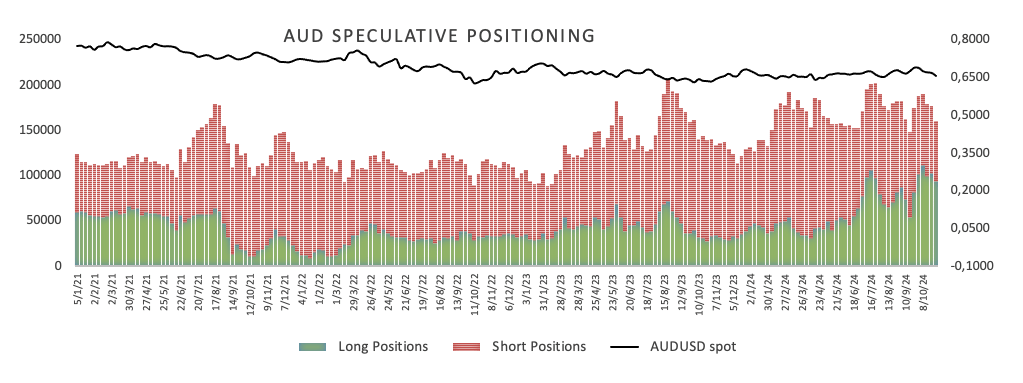

A glance at the latest CFTC Positioning Report shows that speculators (non-commercial players) remained net buyers of AUD in the week to October 29, although open interest retreated for the third consecutive week.

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might send the AUD/USD to its October low of 0.6536 (October 30), ahead of the 2024 bottom of 0.6347 (August 5).

On the upside, intermediate resistance is at the 200-day SMA of 0.6627, followed by the interim 100-day and 55-day SMAs of 0.6691 and 0.6733, respectively, before reaching the 2024 peak of 0.6942 (September 30).

The four-hour chart shows that a mild uptrend could be in the offing. That said, the initial resistance level is at 0.6618, followed by the 100-SMA at 0.6648 and finally 0.6723. In the meantime, there is an initial support at 0.6536, followed by 0.6347. The RSI broke below the 50 yardstick.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.