AUD/USD Price Forecast: The 200-day SMA holds the downside so far

- AUD/USD abruptly deflated to two-week lows near the 0.6700 support.

- The Dollar resumed its uptrend and hurt the broader risk-related space.

- Australia’s Current Account deficit unexpectedly widened in Q2.

The US Dollar (USD) came back roaring from Monday’s Labor Day holiday, hurting the risk complex and thus sparking quite a pronounced decline in AUD/USD on Tuesday.

That said, spot retreated to the proximity of the 0.6700 region, or two-week lows, following the renewed Dollar’s upside impulse, while gloomy prospects around China and weaker commodity prices continued to weigh on the sentiment surrounding the Aussie Dollar.

Tuesday’s (very) negative price action around the Australian Dollar seems to have dented the insofar constructive outlook around the currency, which remains underpinned by the critical 200-day SMA today at 0.6614.

The daily drop in the pair was also accompanied by further weakness in both copper and iron ore prices, particularly following Chinese data released over the weekend. The sharp decline in iron ore prices is likely to cap further gains in the AUD, while it is expected to keep lingering amidst the persistently weak economic activity in the country.

Still around China, the official composite PMI registered at 50.1 in August, signalling stagnant growth. The breakdown showed a deeper contraction in the manufacturing sector (49.1) and a modest rise in non-manufacturing activity (50.3). Notably, the private Caixin manufacturing PMI improved to 50.4 in August from 49.8 in July.

Recent shifts in monetary policy have also supported the Australian dollar's upward trend over recent weeks. The Reserve Bank of Australia (RBA) recently opted to hold the Official Cash Rate (OCR) steady at 4.35%, adopting a cautious approach amid ongoing domestic inflationary pressures, with no clear indication of easing policy soon.

In a subsequent speech, Governor Michelle Bullock reaffirmed that the RBA is prepared to raise rates further if necessary to control inflation, maintaining a hawkish stance due to persistently high underlying inflation. She emphasized that the central bank remains vigilant about inflation risks even after deciding to keep rates unchanged.

Further optimism around the AUD was bolstered by the hawkish tone in the latest RBA Minutes, which revealed a debate among members about whether to raise the cash rate target. The minutes underscored persistent inflationary pressures and market expectations of possible rate cuts in late 2024.

Echoing the hawkish sentiment, RBA Deputy Governor Andrew Hauser noted that there wasn't yet enough confidence that inflation in Australia was on a sustainable path back to target, indicating that rates would need to be kept steady for now.

However, a drop in the Melbourne Institute inflation gauge to a three-year low of 2.5% year-on-year in August suggests the possibility of a lower RBA cash rate by the end of the year. Futures markets currently price in around a 66% chance of 25 basis points cut by December.

The RBA is anticipated to be the last among G10 central banks to start cutting rates.

However, with potential rate cuts from the Fed in the near future and the RBA's likely prolonged period of restrictive policy, AUD/USD seems poised for further gains in the coming months.

Nevertheless, the Australian dollar’s gains could be constrained by the slow and gradual recovery of the Chinese economy. Deflation and inadequate stimulus are stalling China’s post-pandemic recovery. The last Politburo meeting, while expressing support, failed to announce any substantial new stimulus measures, deepening concerns about demand from the world's second-largest economy.

Meanwhile, the latest CFTC report for the week ending August 27 indicated that speculators remained net short on the AUD, although their positions were halved compared to the previous week. The AUD has been in net-short territory since Q2 2021, with only a brief two-week exception earlier this year.

On the data front, in Australia, the Current Account deficit widened to $10.7B in the April-June period.

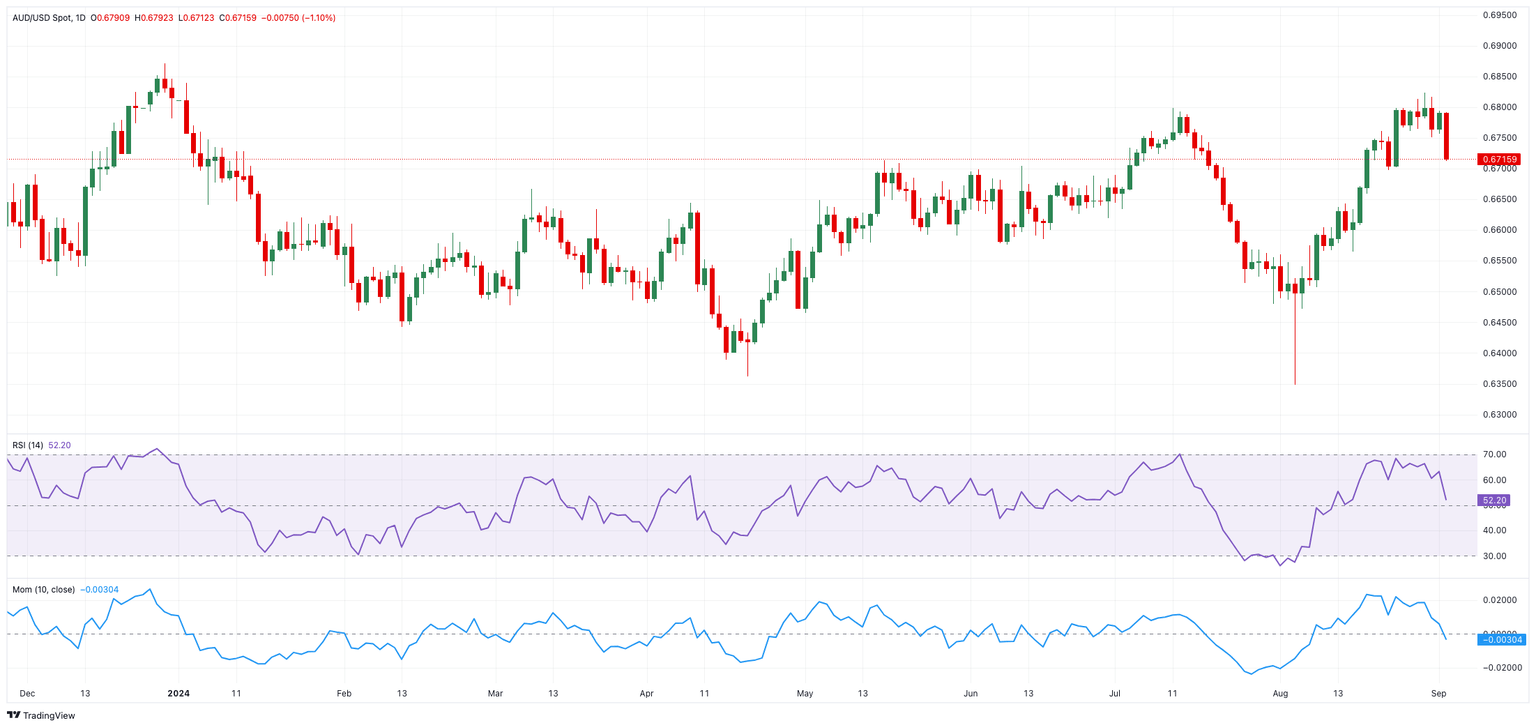

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains are projected to take the AUD/USD to its August high of 0.6823 (August 29), ahead of the December 2023 high of 0.6871 (December 28) and then the 0.7000 milestone.

Bears, on the other hand, might initially drag the pair to the temporary 55-day SMA of 0.6665, before the key 200-day SMA of 0.6614 and the 2024 bottom of 0.6347 (August 5).

The four-hour chart shows a pick-up in the downside bias. However, the immediate resistance level is 0.6823, which comes before 0.6871. On the other side, the initial support is at 0.6711, before the 200-SMA at 0.6641 and then 0.6560. The RSI plummeted to around 32.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.