AUD/USD Price Forecast: Seems vulnerable amid the formation of a bearish flag pattern

- AUD/USD bulls remain on the sidelines amid the RBA’s dovish tilt and China’s economic woes.

- The Fed’s hawkish shift backs elevated US bond yields and helps revive demand for the USD.

- Traders now look to the Conference Board’s US Consumer Confidence Index for a fresh impetus.

The AUD/USD pair struggles to capitalize on modest gains registered over the past two days and oscillates in a narrow range through the early European session on Monday. Spot prices remain within striking distance of the lowest level since October 2022 touched last week and seem vulnerable to prolonging a near three-month-old downtrend. Against the backdrop of concerns about China's fragile economic recovery, rising bets that the Reserve Bank of Australia (RBA) might start cutting interest rates earlier next year might continue to undermine the Australian Dollar (AUD). In fact, the central bank removed its hawkish bias earlier this month and stated that the board gained some confidence that inflation was heading back towards the 2%-3% annual target.

The US Dollar (USD), on the other hand, stalls its modest pullback from a two-year peak that followed the release of the US Personal Consumption Expenditure (PCE) Price Index on Friday. In fact, the US Bureau of Economic Analysis (BEA) reported that inflation in the US, as measured by the change in the PCE Price Index, edged higher to 2.4% on a yearly basis in November from 2.3% previous. Moreover, the core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% during the reported period, matching October's print and arriving below expectations of 2.9%. The immediate market reaction, however, turned out to be short-lived amid the Federal Reserve's (Fed) hawkish shifts, which, in turn, supports the USD and contributes to capping the AUD/USD pair.

The Fed, as was anticipated, lowered its benchmark policy rate for the third time since September last week and signaled that it would slow down the pace of rate cuts next year. The outlook pushed the yield on the benchmark 10-year US government bond to its highest level in more than six months and favors the USD bulls, suggesting that the path of least resistance for the AUD/USD pair is to the downside. That said, expectations that China will roll out more fiscal stimulus in the coming year to boost growth, along with a generally positive tone around the equity markets, acts as a tailwind for the risk-sensitive Aussie at the start of a holiday-shortened week. Traders now look to the release of the Conference Board's US Consumer Confidence Index for a fresh impetus.

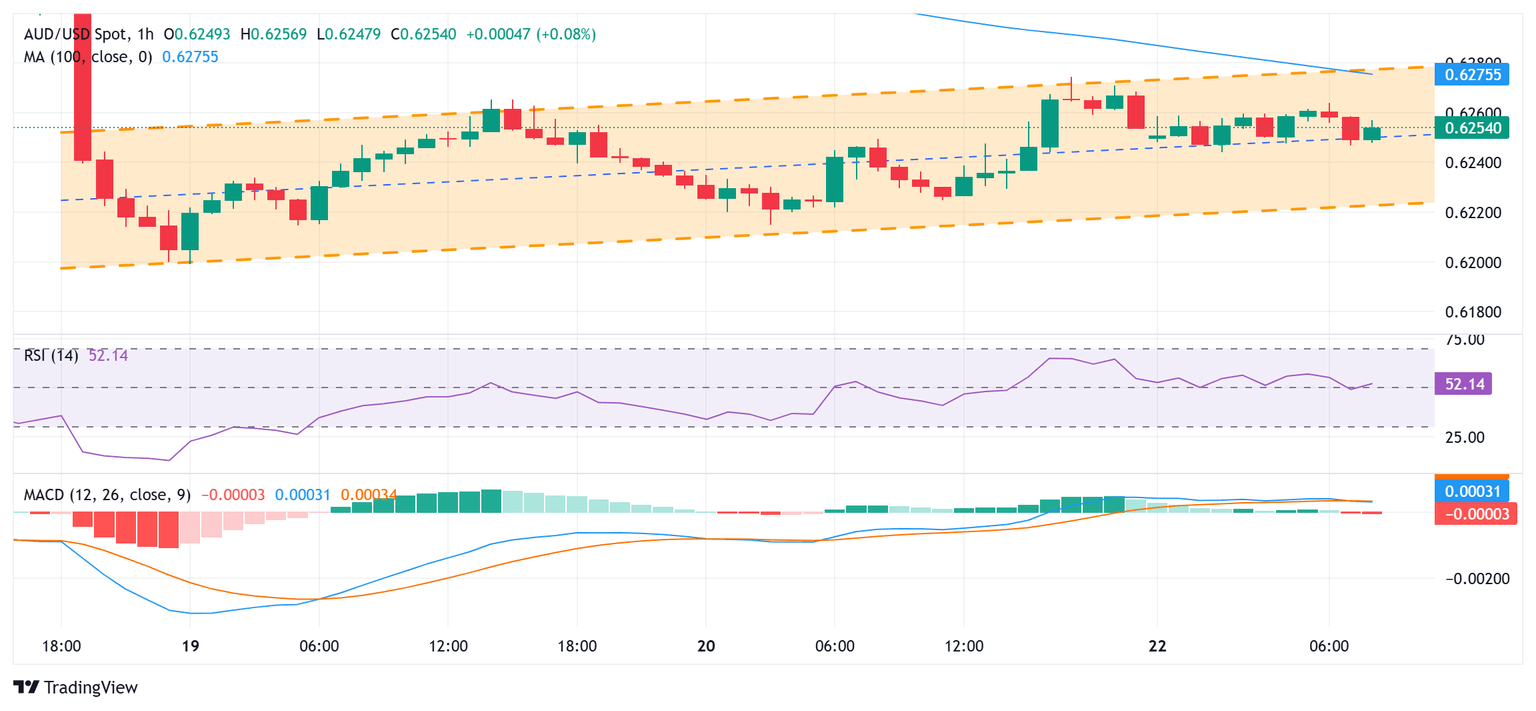

AUD/USD 1-hour chart

Technical Outlook

A modest recovery from over a two-year low could be solely attributed to a technical bounce on the back of a slightly oversold Relative Strength Index (RSI) on the daily chart. Meanwhile, the uptick has been along an upward-sloping channel. Against the backdrop of the recent downfall, the said channel constitutes the formation of a bearish flag on short-term charts. This, along with the fact that oscillators on the daily chart are holding deep in negative territory, suggests that the path of least resistance for the AUD/USD pair remains to the downside.

Hence, any further move up towards the trend-channel barrier, currently pegged just ahead of the 0.6300 mark, could be seen as a selling opportunity. A sustained strength beyond, however, might trigger a short-covering move and lift the AUD/USD pair towards the 0.6340-0.6350 horizontal support breakpoint, now turned resistance. Some follow-through buying could pave the way for additional gains, though any meaningful appreciating move still seems elusive.

On the flip side, weakness below the lower boundary of the aforementioned channel, currently pegged around the 0.6235 region, might continue to find some support near the 0.6200 mark, or the year-to-date low. A convincing break and acceptance below the latter will be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to accelerate the fall towards the 0.6130-0.6125 intermediate support en route to the 0.6100 round figure. The downward trajectory could extend further towards challenging the 0.6000 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.