AUD/USD Price Forecast: Next on the upside comes 0.6400

- AUD/USD reversed multi-week lows and refocused on 0.6300.

- The US Dollar traded in an inconclusive fashion amid declining yields.

- The RBA left rates unchanged and delivered a hawkish message.

The Australian Dollar (AUD) managed to regain some balance, leaving behind two daily pullbacks in a row vs. the US Dollar (USD), including a pessimistic start to the week.

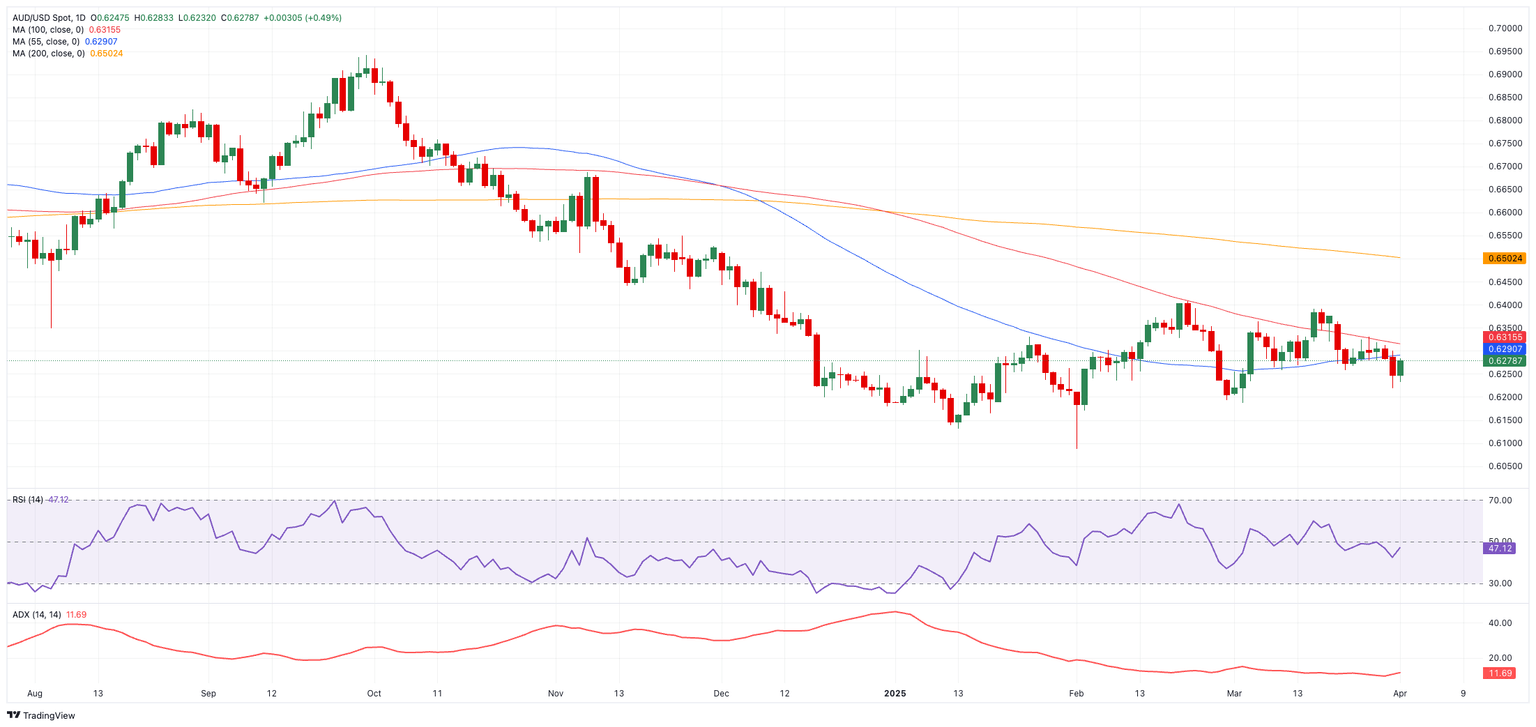

That said, Tuesday’s respite sent AUD/USD back to the 0.6280-0.6285 band, a region coincident with the transitory 55-day SMA, despite intense concerns surrounding the US trade policy, particularly ahead of the so-called “liberation day” on April 2.

Tariff tensions cloud the outlook

Despite periodic flashes of optimism, the spectre of additional US trade measures continues to cloud market outlooks, as the White House is expected to announce reciprocal tariffs on April 2. Against that, fresh tariffs threaten to trigger retaliatory moves from major US trading partners, further souring investor sentiment and weighing on risk assets.

The Aussie, which is closely linked to both global risk appetite and Chinese demand for commodities, is particularly vulnerable. Any signal of slower growth in China can ripple through the Australian economy, potentially dragging down GDP and putting pressure on the currency.

Still around China, an unexpected improvement in the Caixin Manufacturing PMI in March (51.2) also lent some oxygen to the Aussie Dollar, further bolstering the uptick in spot.

Fed's balancing act amid trade uncertainty

The Federal Reserve (Fed) is grappling with a delicate balancing act. On one hand, ongoing trade tensions could fan inflation, potentially justifying prolonged higher interest rates. On the other, early indicators of a cooling US economy suggest caution—despite a still-robust labour market.

On March 19, the Fed left its benchmark rate steady at 4.25–4.50% and reiterated a “wait-and-see” approach. Fed Chair Jerome Powell stressed the need for patience, even though the central bank’s forecasts signal slower growth and slightly higher inflation ahead—some of which could stem from tariff pressures.

RBA's cautious stance on rate moves

Meanwhile, the Reserve Bank of Australia (RBA) left its Official Cash Rate (OCR) at 4.10%, as widely anticipated, early on Tuesday.

However, the central bank made it clear that it’s in no rush to resume easing. In a notable departure from its February stance, the central bank removed the sentence that stated, “the Board remains cautious on prospects for further policy easing.” Instead, officials emphasised that while the steady decline in underlying inflation is encouraging, persistent risks on both sides mean the outlook remains uncertain.

At the press conference, RBA Governor Michele Bullock admitted that the Board does not have “100% confidence” that inflation is moving sustainably toward the 2–3% target range. Bullock confirmed that the decision to hold rates was reached by consensus, with no explicit discussion of a rate cut.

Following the RBA gathering, odds of a 25 basis points cut at the May 20 meeting fell to 70% from 80% prior to the announcement.

Growing bearish bets on the Aussie

Bearish bets on the Aussie are mounting. The latest CFTC report shows net short positions at nearly 80K contracts (as of March 25), a multi-week high that’s been building since mid-December, fuelled by escalating tariff worries.

Key levels and momentum for AUD/USD

A clean break above the 2025 high at 0.6408 (February 21) could open the door for a test of the 200-day SMA at 0.6505. Beyond that, the November 2024 peak of 0.6687 stands as the next key resistance.

On the other hand, if sellers regain the initiative, the March low at 0.6186 (March 4) serves as the first support. A decisive move below this level paves the way for a potential retest of the 2025 trough at 0.6087, with the psychologically important 0.6000 mark on deck.

The RSI regains some impulse and flirts with the 47 level, signalling that some upside momentum appears to be shaping up. However, a muted ADX reading near 11 suggests the overall trend remains somewhat weak in conviction.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.