AUD/USD Price Forecast: Initial up-barrier emerges around 0.6650

- AUD/USD plummeted to three-month lows near 0.6500.

- The US Dollar rebounded sharply after Trump secured a second term.

- Next on tap will be the Fed’s interest rate decision on Thursday.

The US Dollar (USD) came roaring in the wake of the US election and rose to fresh tops on Wednesday, sentencing the Australian Dollar and the rest of the risk-linked galaxy to retreat sharply.

Against that backdrop, AUD/USD rapidly faded two consecutive daily advances in a row and collapsed to the vicinity of the 0.6500 neighbourhood for the first time since early August. Following this steep knee-jerk, spot broke below the key 200-day SMA (0.6627), at the same time shifting its near-term outlook to bearish and hence allowing for extra weakness in the short-term horizon.

Also weighing on the Aussie Dollar, China’s recent stimulus measures remain a question mark, with steady iron ore prices somewhat limiting the downside vs. a marked retracement in copper prices.

In monetary policy, the Reserve Bank of Australia (RBA) held interest rates steady at 4.35%, as expected, while maintaining a neutral stance on Tuesday. The RBA emphasised it remains vigilant on inflation risks, with inflation gradually nearing its target range. Forecasts suggest inflation will meet the midpoint of the 2-3% target by late 2026, though growth projections were slightly downgraded.

At her subsequent press conference, RBA Governor Michelle Bullock balanced her remarks, mentioning that the board hadn’t discussed immediate rate changes, suggesting current settings are appropriate. Market expectations indicate a possible rate cut in May 2025, with the RBA likely to be one of the last G10 central banks to ease policy.

Meanwhile, Australia’s September CPI slowed to 2.1%, while Q3 annual inflation came in at 2.8%, with the trimmed mean CPI at 3.5% YoY. Looking ahead, potential rate cuts from the Federal Reserve may support AUD/USD, though concerns about China’s economic outlook could limit its upward momentum.

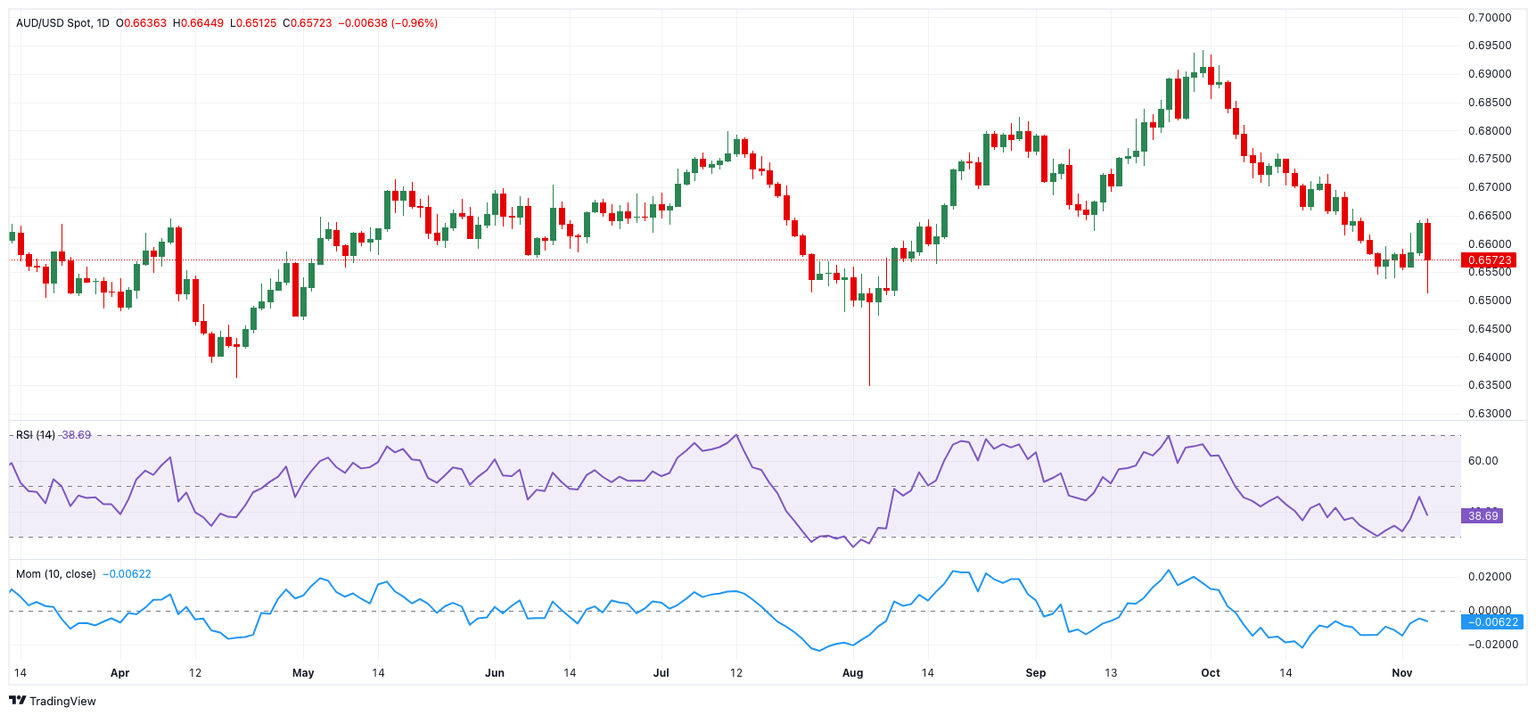

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might send the AUD/USD to its November low of 0.6511 (November 6), ahead of the 2024 bottom of 0.6347 (August 5).

On the upside, the initial obstacle is the so-far November high of 0.6641 (November 5), followed by the interim 100-day and 55-day SMAs of 0.6690 and 0.6728, respectively, before the 2024 peak of 0.6942 (September 30).

The four-hour chart shows a sudden resumption of the bearish bias. That being said, the initial resistance level is 0.6641, followed by 0.6661, and then 0.6723. Meanwhile, the initial support is around 0.6511, prior to 0.6347. The RSI receded to around 46.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.