- AUD/USD puts the 0.6600 barrier to the test on Monday.

- Markets remained sidelined ahead of key releases on the US docket.

- The Australian labour market report will be the salient event this week.

AUD/USD resumed its uptrend and rapidly left behind Friday’s knee-jerk, returning albeit briefly beyond 0.6600 the figure in quite an auspicious start to the new trading week.

Meanwhile, the Aussie dollar's key focus remains on the critical 200-day SMA, currently at 0.6595, as a decisive break above this level is crucial to reinstating a more positive outlook for the pair.

Monday’s significant rebound in the pair coincided with a broad-based recovery in the commodity sector, marked by a decent increase in copper prices, while iron ore prices attempted a mild bounce as well.

Investor sentiment towards the Australian currency was further bolstered by the Reserve Bank of Australia's (RBA) recent decision to maintain its current policy stance. The RBA emphasized its cautious approach, indicating that it is not in a rush to ease policy with expectations that domestic inflation will be more persistent. Both trimmed-mean and headline CPI inflation are now projected to approach the mid-point of the 2-3% range by late 2026, rather than the previous estimate of June 2026.

During her press conference, RBA Governor Michele Bullock mentioned that the Board considered a rate hike and highlighted that rate cuts are not on the horizon. She also pointed out that expectations for rate cuts are premature.

Further comments by Bullock later in that week reiterated that the central bank would not hesitate to raise interest rates if needed to control inflation, underscoring a hawkish stance as underlying inflation remains elevated. She highlighted that the bank's board remains vigilant about the risks of rising inflation, following the decision to keep interest rates unchanged earlier in the week. Core inflation, which was 3.9% last quarter, is expected to decrease to the target range of 2% to 3% by late 2025.

Overall, the RBA is likely to be the last among the G10 central banks to begin cutting interest rates. Potential easing by the Federal Reserve (Fed) in the medium term, contrasted with the RBA's expected prolonged restrictive stance, could support AUD/USD in the coming months.

However, the sluggish momentum in the Chinese economy could hinder a sustained recovery of the Australian dollar. China continues to face post-pandemic challenges, deflation, and inadequate stimulus for a robust recovery. Concerns about demand from China, the world's second-largest economy, also surfaced following the Politburo meeting, where, despite promises to support the economy, no specific new stimulus measures were introduced.

Of note, Chinese inflation figures saw a mild uptick in July, both in the monthly and yearly CPI, while Producer Prices also came in a tad above estimates.

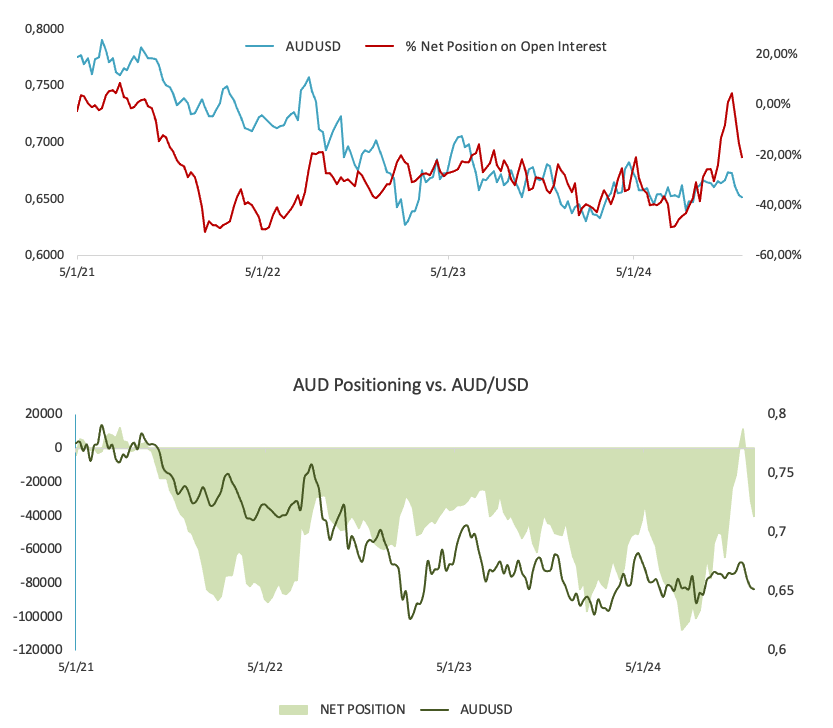

Meanwhile, non-commercial traders (speculators) remain largely net-short on the AUD, according to CFTC data, mostly in response to the utter absence of signs of life from China. Banning the two-week hiccup in positioning seen in mid-July, net shorts have prevailed since Q2 2021.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further rises should cause the AUD/USD to challenge the significant 200-day SMA of 0.6595, along with monthly highs just past 0.6600. Once this region is cleared, spot could move onto the transitory 55-day SMA of 0.6638, before the July top of 0.6798 (July 8) and the December peak of 0.6871.

The AUD/USD may retest the 2024 bottom of 0.6347 (August 5), ahead of the 2023 low of 0.6270 (October 26), as negative sentiment returns.

The four-hour chart shows some consolidative move in the short-term horizon. That said, the initial support is at the 55-SMA of 0.6534, followed by 0.6347, and then 0.6338. On the upside, the initial resistance level is at 0.6605, which comes before 0.6610 and the 200-SMA of 0.6639. The RSI eased to around 57.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.