AUD/USD Price Forecast: Further upside should see 0.7000 retested

- AUD/USD advanced further and surpassed the 0.6800 barrier.

- The Dollar remained on the defensive as investors digested the Fed’s cut.

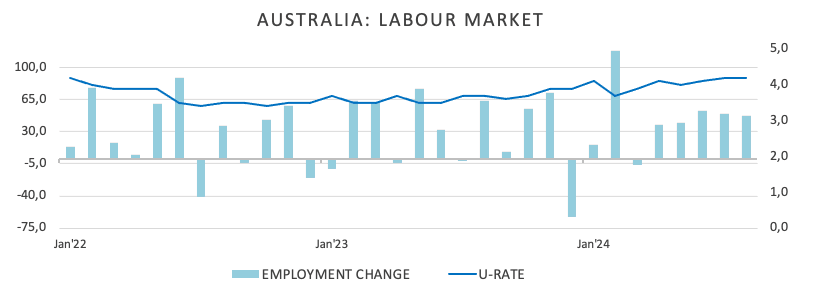

- Australian jobless rate held steady at 4.2% in August.

On Thursday, increased post-Fed selling interest in the US dollar (USD) provided additional support for risk-related assets, allowing AUD/USD to continue its bullish momentum for the fourth consecutive day and hit fresh 2024 peaks near 0.6840l.

In the wake of the Fed’s decision to lower its interest rates by more than widely expected, the Greenback maintained its bearishness intact, motivating the US Dollar Index (DXY) to edge lower.

The Aussie dollar's notable rise on Thursday coincided with a generalized better tone in the risk complex, while gains in copper prices and iron ore prices also collaborated with the uptick. Of note, however, is that given iron ore's strong ties to China's housing and industrial sectors, this vulnerability carries the potential to hinder AUD’s upside.

Meanwhile, the Reserve Bank of Australia's (RBA) ongoing monetary policy stance remains supportive of the Aussie dollar's upward trend. Last month, the RBA kept the Official Cash Rate (OCR) steady at 4.35%, adopting a cautious approach amid ongoing inflationary pressures. Subsequent Minutes from that meeting were particularly hawkish, indicating discussions about potential rate hikes due to persistent inflation concerns, even as the market anticipates rate cuts in late 2024.

In later comments, RBA Governor Michelle Bullock reiterated a cautious outlook, highlighting the risks of high inflation and suggesting that rate cuts are unlikely in the near future.

Nevertheless, the RBA could be among the last central banks in the G10 to start reducing rates. On this, the RBA will join the global easing cycle later this year, as underlying economic activity remains weak and suggests lower inflation pressures. Furthermore, the market is currently pricing in a high likelihood of around 70% of a 25 basis point cut by December.

Looking ahead, with the Federal Reserve's anticipated rate cuts largely priced in and the RBA expected to maintain a restrictive stance for some time, AUD/USD could experience some extra improvement later this year.

However, the slow recovery of the Chinese economy poses a significant obstacle to the above. Deflation and insufficient stimulus measures are hindering China's post-pandemic recovery and continue to weigh on future demand from the world's second-largest economy.

Additionally, the latest CFTC report, covering the week ending September 10, revealed that speculative net short positions in the Australian dollar had reached two-week highs, alongside a rise in open interest. Since Q2 2021, the AUD has largely remained in net short territory, with only a brief shift to net long positioning earlier this year.

Finally, a mixed labour market report in Australia for the month of August saw an unchanged Unemployment Rate of 4.2%, while the Employment Change increased by 47.5K individuals and the Participation Rate held steady at 67.1%.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains are expected to propel the AUD/USD to its 2024 high of 0.6839 (September 19), followed by the December 2023 top of 0.6871 (December 28), and eventually to the key 0.7000 level.

Sellers, on the other hand, may initially drag the pair to its September low of 0.6622 (September 11), which is supported by the important 200-day SMA, all before the 2024 bottom of 0.6347 (August 5).

The four-hour chart suggests a further strengthening of the optimistic sentiment. That being said, 0.6839 is the first resistance, followed by 0.6871. On the downside, preliminary support comes at the 100-SMA at 0.6732, seconded by the 55-SMA at 0.6711, and finally 0.6692. The RSI hovered around 66.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.