AUD/USD Price Forecast: Further gains appear in the pipeline

- AUD/USD resumed its uptrend further north of the 0.6700 hurdle.

- The Dollar maintained its negative performance ahead of the Fed event.

- The Federal Reserve could surprise and cut rates by 50 bps.

The renewed selling pressure on the US Dollar (USD) gave a boost to risk-sensitive assets, helping the Australian Dollar gain traction and motivating AUD/USD to reclaim the 0.6700 barrier and above on Monday.

That said, the Aussie Dollar managed to recover some of Friday’s losses against the USD, always amidst the broad-based constructive outlook. Despite this positive price action, AUD faces challenges from intermittent strength in the Greenback and ongoing concerns about China’s economic performance.

In fact, Monday’s strong uptick in AUD/USD was also accompanied by further strength in copper prices, while iron ore prices experienced a slight dip. Since iron ore prices are closely tied to China’s housing and industrial sectors, their weakness could limit further gains for AUD.

Monetary policy developments have recently supported the Australian Dollar. In August, the Reserve Bank of Australia (RBA) kept the Official Cash Rate (OCR) at 4.35%, taking a cautious approach amid persistent inflationary pressures without signs of immediate easing.

The latest RBA Minutes also supported the AUD, revealing discussions among members about possibly raising the cash rate target. The minutes highlighted ongoing inflation concerns and market expectations of potential rate cuts in late 2024.

In the same direction, RBA Governor Michelle Bullock reiterated the bank’s hawkish stance in her recent comments, warning about the risks of high inflation. She indicated that, if the economy follows the expected path, the Board does not foresee needing to cut rates in the near term.

However, RBA cash rate futures still indicate a high probability (around 85%) of a 25 basis point cut by the end of the year. Overall, the RBA is anticipated to be the last among G10 central banks to begin cutting rates.

With the Federal Reserve (Fed) likely to implement rate cuts that are almost fully priced in, and the RBA expected to maintain a restrictive policy for an extended period, AUD/USD might see further gains later this year.

Still, a major headwind for extra gains in the Australian Dollar could be limited by the slow recovery of the Chinese economy. Deflation and insufficient stimulus measures are hampering China’s post-pandemic recovery, and the latest Politburo meeting, while expressing support, did not announce any significant new stimulus, raising concerns about demand from the world’s second-largest economy.

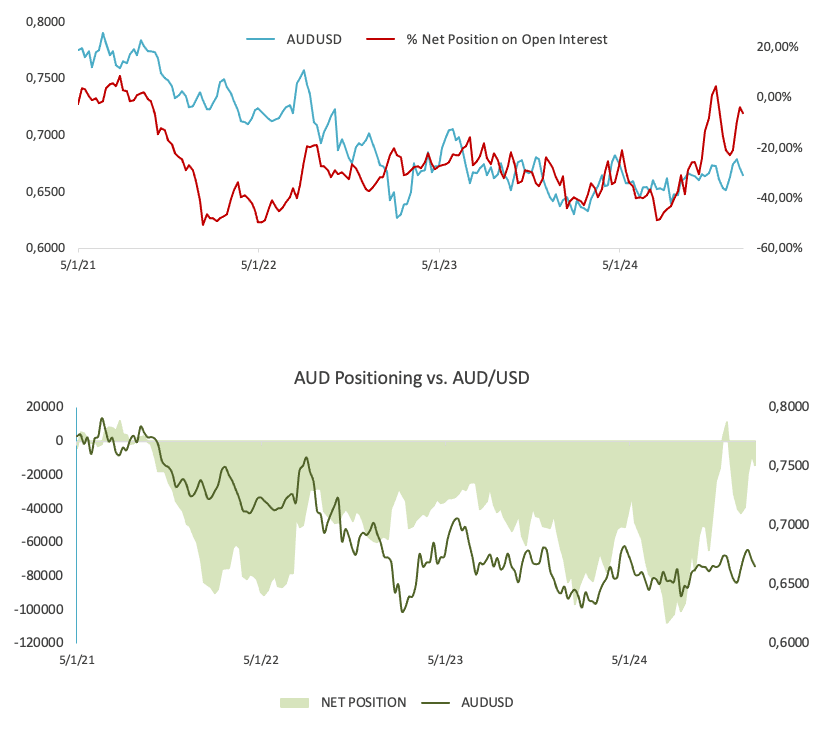

Additionally, the latest CFTC report for the week ending September 10 showed that speculative net shorts in the Australian currency rose to two-week highs amidst a decent rebound in open interest. It is worth noting that AUD has remained in net-short territory since Q2 2021, with only a brief two-week period of net-long positioning earlier this year.

In terms of data, the next release in Oz will be the Westpac Leading Index on September 18.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further increases are projected to take the AUD/USD to its August top of 0.6823 (August 29), followed by the December 2023 peak of 0.6871 (December 28), and finally to the key 0.7000 barrier.

Sellers, on the other hand, may drive the pair below its September low of 0.6622 (September 11), an area propped up by the key 200-day SMA of 0.6618. Down from here comes the 2024 bottom of 0.6347 (August 5).

The four-hour chart suggests a gradual strengthening of the bullish posture. That being said, the 0.6748 level emerges as the initial up-barrier, seconded by 0.6767, and then 0.6823. On the downside, the provisional 55-SMA is at 0.6696 prior to the 200-SMA of 0.6668, and then 0.6622. The RSI hovered around the 62 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.