AUD/USD Price Forecast: Further advances remain on the table

- AUD/USD regained traction and surpassed the 0.6900 barrier.

- The Dollar traded in an inconclusive fashion following Wednesday’s uptick.

- China’s Politburo reinforced previous stimulus announced by the PBoC.

AUD/USD, and the risk complex in general, regained the smile and shrugged off Wednesday’s sharp pullback, reclaiming the 0.6900 barrier and beyond and flirting once again with the area of YTD peaks on Thursday.

The pair’s robust recovery came in response to news that China's Politburo has pledged to increase benefits for the poorest and provide local authorities with the necessary funds to prevent further house price declines. The move follows the PBoC’s stimulus efforts to revive the property sector and boost the stock market, as well as a focus on stabilizing the real estate market and improving the consumption framework.

In line with the move higher in the Aussie dollar, prices of copper rose to levels last traded in July near the $4.70 region per ounce, while iron ore prices extended their consolidative move below the $94 per tonne.

Extra support for the pair came from the indecisive price action around the greenback following Wednesday’s strong move higher.

On September 24, the Reserve Bank of Australia (RBA) decided to maintain interest rates at 4.35%, as anticipated. The bank kept its neutral stance, stating, “the Board is not ruling anything in or out,” while cautioning that “it will be some time yet before inflation is sustainably in the target range” and highlighting the need to remain vigilant to potential inflation risks.

However, during her post-meeting press conference, Governor Michele Bullock tempered the hawkish rhetoric, indicating that the Board “didn’t explicitly consider a rate hike this time.”

Currently, investors see about a 55% chance of a 25 basis point rate cut by the end of the year.

Recently, the RBA’s Monthly CPI Indicator reported a 2.7% increase in August, down from 3.5%. Governor Bullock noted that this release is “quite volatile” and does not encompass all items, unlike the quarterly CPI data. The RBA also reiterated its expectation that inflation will not return “sustainably” to the 2-3% target range until 2026.

Additionally, the RBA may be among the last G10 central banks to begin cutting rates. It is anticipated to join the global easing cycle later this year, given the weak underlying economic activity, which points to lower inflation pressures.

Looking forward, with the Federal Reserve's expected rate cuts largely priced in and the RBA likely to maintain a restrictive policy for some time, the AUD/USD may see further gains later this year. However, significant uncertainty remains regarding the Chinese economy and the actual implementation of the recently announced stimulus measures.

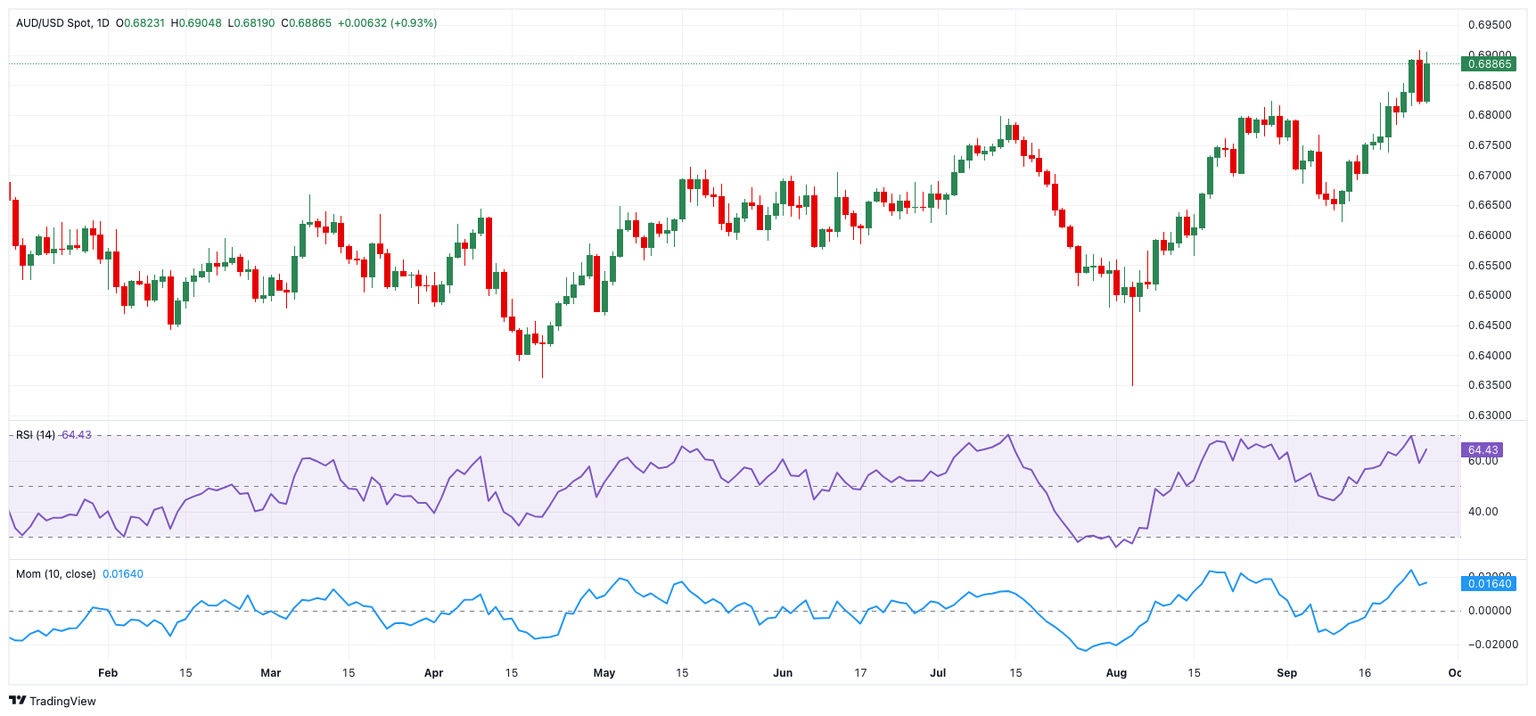

AUD/USD daily chart

AUD/USD short-term technical outlook

Further rises should motivate AUD/USD to challenge its 2024 high of 0.6908 (September 25) before reaching the important 0.7000 threshold.

Bears, on the other hand, may initially drive the pair to its September low of 0.6622 (September 11), a region supported by the important 200-day SMA, all before the 2024 low of 0.6347 (August 5).

The four-hour chart shows a pick-up of the upside momentum. Having stated that, the initial resistance is 0.6908, which comes before 0.6920 and 0.7024. On the downside, initial support is at 0.6817 ahead of the 55-SMA at 0.6804, and the 100-SMA at 0.6753. The RSI rose above the 61 level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.