AUD/USD Price Forecast: Extra weakness remains in the pipeline

- AUD/USD rebounded from multi-year troughs around 0.5930.

- The US Dollar traded with humble losses following hopes of tariff talks.

- US-China increasing trade tensions keep AUD under pressure.

The Australian Dollar (AUD) found a slight reprieve on Tuesday after its sharp plunge in the last couple of days.

Indeed, AUD/USD rose to the vicinity of the 0.6100 hurdle after bottoming out in levels last traded in March 2020 around 0.5930, up slightly for the day. The move higher in the pair came exclusively on the back of some downward bias in the US Dollar (USD), while concerns surrounding China’s retaliation are expected to keep the Australian Dollar under scrutiny for the time being.

Global trade war fears escalate

President Trump’s newly imposed tariffs—ranging from 10% to 50%—have already prompted countermeasures and raised concerns about an imminent global trade war. This escalation threatens to curb economic activity, lift consumer prices, and muddle central bank policies around the world.

Given Australia’s deep economic links with China, particularly in commodity exports, the Aussie sits squarely in the crosshairs of any slowdown in Chinese demand or broader fallout from U.S. tariffs.

The tension hit a fever pitch when China announced retaliatory tariffs last week, sending AUD/USD tumbling to more than five-year lows.

Adding to the effervescence, Trump has issued a stern warning to China: scrap its 34% counter-tariff on US imports or face an extra 50% duty. If enforced, this new charge would stack with the existing 20% tariff from March and the recent 34%, potentially ballooning the total tariff rate on Chinese goods to a staggering 104%, placing immense pressure on U.S. companies.

The Fed remains prudent amid the tariffs storm

Across the Pacific, the Federal Reserve (Fed) continues to walk a tightrope. Intensifying trade conflicts could spark higher inflation, potentially supporting more aggressive rate hikes. At the same time, signs of a moderating U.S. economy urge caution—despite a healthy labour market. In March, the Fed kept its target rate steady at 4.25–4.50%, reaffirming a “wait-and-see” stance.

On Friday, Fed Chair Jerome Powell acknowledged that tariff hikes might be bigger and more impactful than initially anticipated, possibly bringing higher inflation and weaker growth. The Fed’s next steps will likely hinge on how trade uncertainties evolve.

RBA holds steady under shadow of trade turmoil

Meanwhile, the Reserve Bank of Australia (RBA) left its Official Cash Rate (OCR) unchanged at 4.10% on Tuesday, as widely expected. Policymakers dropped previous hints of “further easing,” opting instead to underscore risks on both sides of the economic spectrum.

RBA Governor Michele Bullock acknowledged the lingering question of when inflation would return to the 2–3% target range and noted that the Board was unanimous in holding rates steady. Markets reacted by dialling back the probability of a 25-basis-point cut at the May 20 meeting to 70%, from 80% previously.

Bears circle the Aussie

Traders remain largely pessimistic on the Australian Dollar, according to recent CFTC data. Although net shorts eased slightly to around 76K contracts by April 1, they still hover near multi-month highs. These entrenched short positions reflect growing tariff worries and highlight the market’s wariness toward the Aussie.

Charting AUD/USD: Key levels

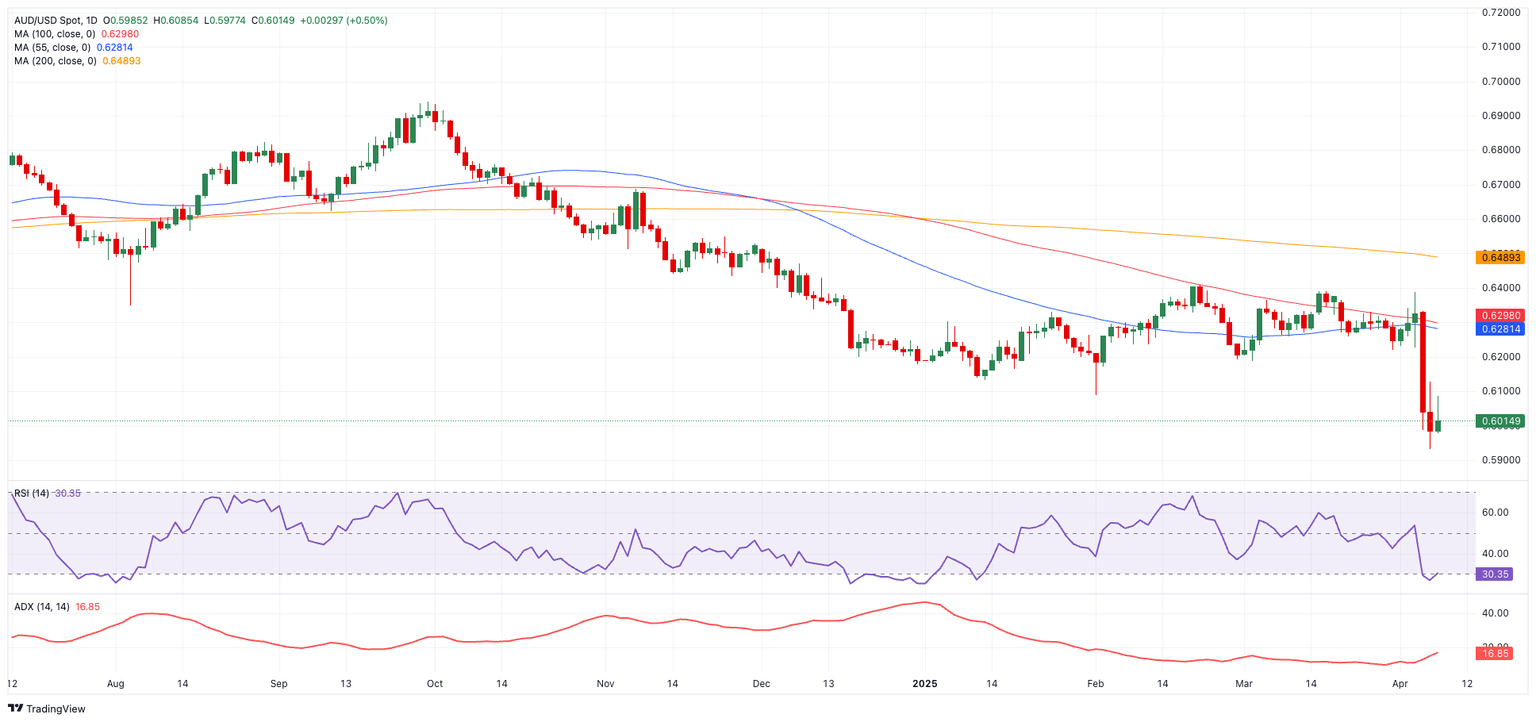

Technically, as long as AUD/USD remains below its 200-day SMA near 0.6490, the risk of further downside prevails.

Additional selling pressure could drag the pair back to its 2025 bottom at 0.5930 (April 7), ahead of the 2020 trough at 0.5506 (March 19).

On the upside, a decisive break above the 2025 high at 0.6408 (February 21) might pave the way for a run at the 200-day SMA at 0.6492, with the November 2024 top of 0.6687 looming as the next major barrier.

While the Relative Strength Index (RSI) has bounced toward 30, indicating oversold conditions, the Average Directional Index (ADX) near 16 implies the overall trend remains soft, though it has rebounded slightly from recent lows.

AUD/USD daily chart

Looking ahead

Australia’s economic calendar will feature the release of Building Permits and Private House Approvals on April 9, while the Melbourne Institute will unveil its Inflation Expectations on April 10.

Bottom Line

The Australian Dollar’s trajectory hinges on the interplay between escalating trade conflicts, China’s economic outlook, and policy decisions on both sides of the Pacific. With the stakes rising, the Aussie will be quick to react to any trade-related headlines or shifts in monetary policy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.