AUD/USD Price Forecast: Extra gains remain on the table near term

- AUD/USD resumed its uptrend and came just short of 0.6800.

- The Dollar traded in an inconclusive fashion following the US holiday.

- Chinese business activity in the manufacturing sector disappointed in August.

AUD/USD regained momentum at the beginning of the week, managing to come just pips away from the key level of 0.6800. This upward movement in the Australian dollar occurred following an inconclusive start to the week in the US Dollar (USD), following the inactivity in the US markets due to the Labor Day holiday.

Despite the ongoing consolidative theme, the pair's upward momentum remains strong, supported by the breakout of the key 200-day SMA at 0.6614, which has shifted the short-term outlook for AUD/USD to a clearly bullish stance.

The recovery of the AUD throughout last month, in the meantime, has mainly been driven by a weakening Greenback and improving conditions for risk-related assets.

Monday’s uptick, however, came despite further weakening of copper and iron ore prices, particularly following Chinese data releases over the weekend. That said, the sharp decline in iron ore prices is likely to limit the upward momentum of the AUD. Furthermore, iron ore futures dropped over 3% overnight, partly due to worsening property sales data in China, while weak economic activity in the country continued to weigh on iron ore prices.

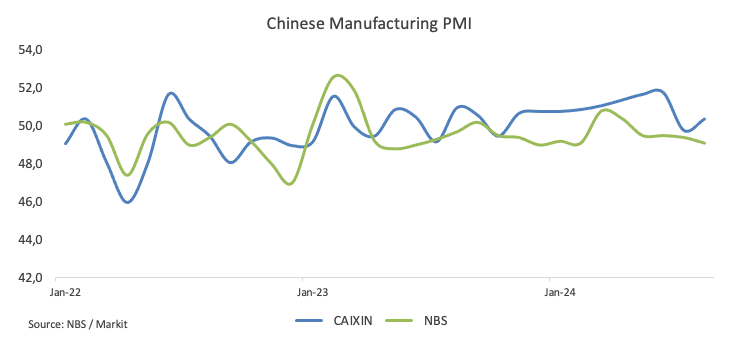

More upsetting data saw China's official composite PMI come in at 50.1 in August, indicating stagnant growth. The breakdown showed a deeper contraction in the manufacturing sector (49.1) and a slight increase in non-manufacturing activity (50.3). Notably, the private Caixin manufacturing PMI improved to 50.4 in August from 49.8 in July.

Recent developments in monetary policy have also supported the Australian dollar's multi-week rise. The Reserve Bank of Australia (RBA) recently decided to keep the Official Cash Rate (OCR) steady at 4.35%, taking a cautious approach amid ongoing domestic inflationary pressures and showing no clear intention of easing policy soon.

In a subsequent speech, Governor Michelle Bullock reiterated that the RBA is ready to raise rates further if necessary to control inflation, maintaining a hawkish stance due to high underlying inflation. She emphasized that the bank remains vigilant regarding inflation risks after deciding to keep rates unchanged.

Further optimism around the AUD was further boosted by the hawkish tone from the latest RBA Minutes, which revealed a debate among members on whether to raise the cash rate target. The minutes highlighted persistent inflationary pressures and market expectations of possible rate cuts in late 2024.

Also aligning behind a hawkish narrative, RBA Deputy Governor Andrew Hauser argued that they were not yet as confident that inflation in Australia was on a sustainable path back to target. As a result, he indicated that rates would need to be held steady for the time being.

However, a drop in the Melbourne Institute inflation gauge to a three-year low of 2.5% year-on-year in August suggests the possibility of a lower RBA cash rate by year end. Futures markets are currently pricing in around a 66% chance of a 25 bps cut by December.

Currently, the RBA is expected to be the last among the G10 central banks to begin cutting rates.

However, with potential rate cuts from the Fed in the near future and the RBA's likely extended period of restrictive policy, AUD/USD appears positioned for further strength in the coming months.

Despite this, gains for the Australian dollar may be limited due to the slow and gradual recovery of the Chinese economy. Deflation and insufficient stimulus are holding back China’s post-pandemic recovery. The last Politburo meeting failed to announce new substantial stimulus measures, despite voicing support, adding to concerns about demand from the world's second-largest economy.

Meanwhile, the latest CFTC report for the week ending August 27 showed that speculators remained net short on the AUD, albeit halving their contracts from the previous week. The AUD has been in net-short territory since Q2 2021, with just a brief two-week break earlier this year.

Data-wise, Down Under, the final Judo Bank Manufacturing PMI eased a tad from the preliminary print and came in at 48.5, although it was higher than July’s reading.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains are expected to propel the AUD/USD to its August high of 0.6823 (August 29), ahead of the December 2023 top of 0.6871 (December 28) and the 0.7000 level.

Occasional bearish attempts, on the other hand, may result in an initial decline to the temporary 55-day SMA of 0.6663, before the significant 200-day SMA of 0.6614 and the 2024 bottom of 0.6347 (August 5).

The four-hour chart depicts the continuance of the range-bound trade. However, the immediate resistance level is 0.6823, prior to 0.6871. On the other hand, the initial support comes at 0.6751 ahead of the 100-SMA at 0.6706, and 0.6697. The RSI climbed to around 54.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.