AUD/USD Price Forecast: Door open to further losses

- AUD/USD dropped further and reached new two-week lows near 0.6250.

- The US Dollar added to Wednesday’s gains on the back of tariffs.

- Australia’s Private Capital Expenditure contracted 0.2% QoQ in Q4.

On Thursday, the US Dollar (USD) regained extra traction and reached multi-day highs, motivating the US Dollar Index (DXY) to reclaim the 107.00 barrier and beyond, helped by the intense tariff narrative as well as the acceptable rebound in US yields across the spectrum.

Meanwhile, the Australian Dollar (AUD) is on its fifth consecutive daily decline, with AUD/USD convincingly breaking below the key 0.6300 support and hitting new two-week lows in the mid-0.6200s. Furthermore, the pair is expected to remain under pressure amid the prospect of additional US tariffs in the near future.

Trade uncertainties under the spotlight

Trade tensions are still front and centre in the currency markets. Riskier assets like the Aussie often struggle when tariff threats resurface.

Earlier on Thursday, President Trump “confirmed” that the announced 25% tariff on goods from Canada and Mexico will kick in on March 4.

In the meantime, the White House maintains a 10% tariff on Chinese imports, while threatening to impose a 25% tariff on imports from the European Union (EU).

Since China is Australia’s main export market, any slowdown in Chinese demand would likely hit Australian commodities—and by extension, the AUD—particularly hard.

Central banks and inflation

Despite recent swings in the Greenback, investors are wary of further trade escalations that could fuel inflation and prompt the Federal Reserve (Fed) to keep policy on the tighter side.

In Australia, the Reserve Bank of Australia (RBA) cut its benchmark rate by 25 basis points to 4.10% in February, while insisting this wasn’t the start of a prolonged easing cycle. Officials project underlying inflation to hover around 2.7%.

Meanwhile, better-than-expected job data led the RBA to lower its unemployment forecast to 4.2%.

Governor Michele Bullock noted that more rate cuts remain possible if inflation continues to drift downward, although she stressed that the RBA will base its decisions on incoming data. Deputy Governor Andrew Hauser added that market pricing—which currently factors in fewer than 50 basis points of cuts over the next year—may be too optimistic.

On the inflation front, the RBA’s latest Monthly CPI Indicator (Weighted Mean CPI) stayed at 2.5% in January, slightly below analysts’ predictions.

Commodities on shaky ground

Australia’s economy is closely tied to commodity exports, so it’s vulnerable to any dips in Chinese demand. Prices for copper and iron ore extended their retracement on Thursday, underscoring concerns about softer global growth and adding to the sour mood surrounding the Australian currency.

Key technical levels for AUD/USD

Resistance comes first at the 2025 peak at 0.6408 (February 21), which is reinforced by the 100-day Simple Moving Average (SMA). A break above there opens the door to the November 25 high near 0.6549, close to the 200-day SMA.

On the downside, the weekly low of 0.6249 (February 27) provides initial support. Further below lies the 2025 trough at 0.6087, ahead of the psychological 0.6000 handle.

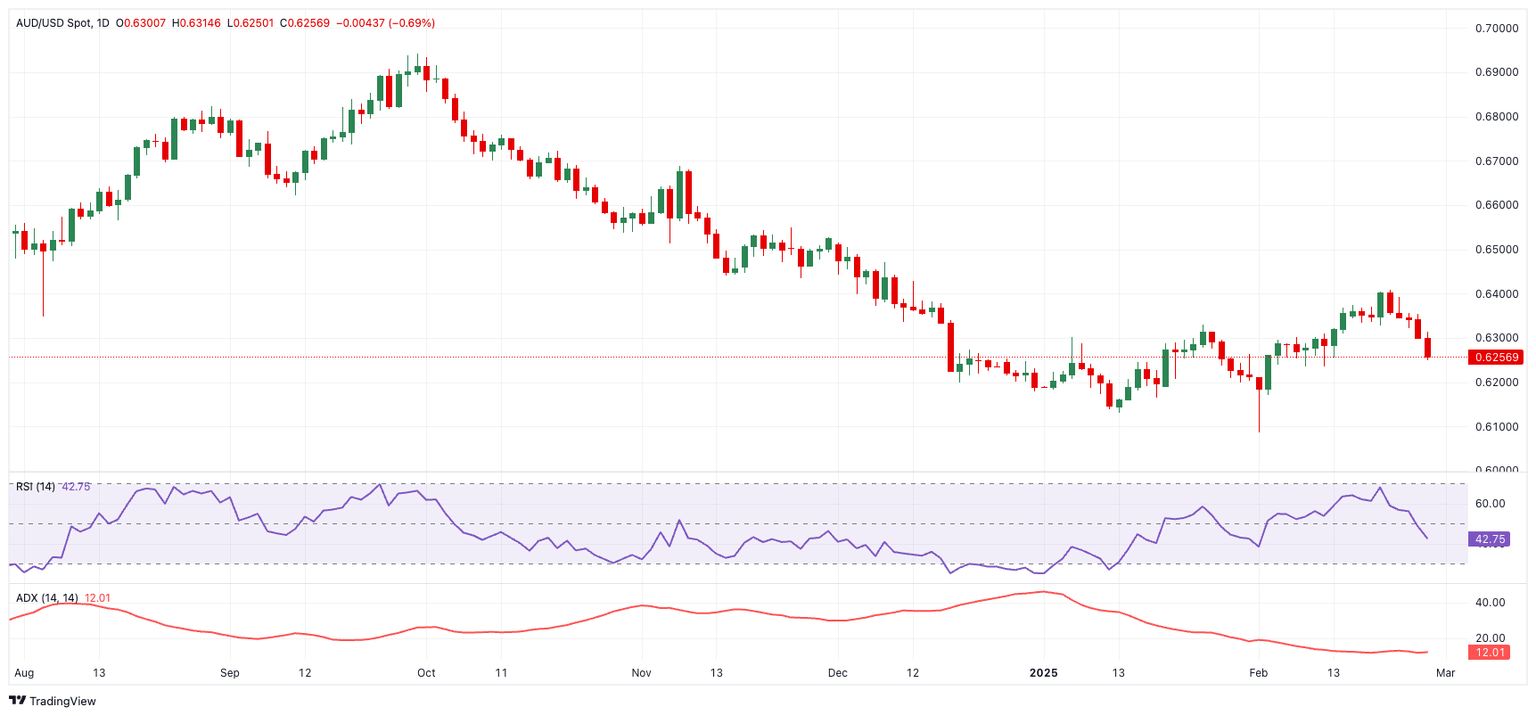

Momentum indicators show the Relative Strength Index (RSI) dipping to around 42, pointing to a rapid loss of upside momentum, while the Average Directional Index (ADX) near 13 signals a generally weak trend.

AUD/USD daily chart

What’s next

Closing the weekly docket, Housing Credit and Private Sector Credit data are due.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.