AUD/USD Price Forecast: Bulls remain on the sidelines, US NFP eyed for fresh impetus

- AUD/USD benefits from a modest USD downtick, though bulls lack conviction.

- Geopolitical risks act as a headwind for the risk-sensitive Aussie and cap the pair.

- Traders also seem reluctant and prefer to wait for the crucial US NFP report.

The AUD/USD pair struggles to gain any meaningful traction on Friday and hangs near a one-week trough touched the previous day amid mixed fundamental cues. The Reserve Bank of Australia's (RBA) hawkish stance, reiterating that interest rate cuts were unlikely in the near term, turned out to be a key factor acting as a tailwind for the Aussie. Apart from this, a modest US Dollar (USD) downtick assists the currency pair in stalling its recent retracement slide from its highest level since February 2023 touched earlier this week.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, for now, seems to have snapped a four-day winning streak amid some repositioning trade ahead of the release of the closely-watched US monthly employment details. The popularly known Nonfarm Payrolls (NFP) might influence market expectations about the size of the Federal Reserve's (Fed) interest rate cut in November. This will play a key role in driving demand for the USD and determining the near-term trajectory for the AUD/USD pair.

In the meantime, investors continue to pare their bets for a more aggressive policy easing by the US central bank amid signs of a still resilient labor market. Furthermore, the Institute for Supply Management (ISM) said that its Non-Manufacturing PMI rose to 54.9 in September, or the highest level since February 2023. This, in turn, suggested that the economy remained on a solid footing in the third quarter. Apart from this, escalating tensions in the Middle East should offer support to the safe-haven buck and cap the AUD/USD pair.

Hezbollah fired approximately 230 projectiles from Lebanon into Israeli territory on Thursday and Israel launched strikes early on Friday targeting Hezbollah's intelligence headquarters in the southern suburbs of Lebanese capital Beirut. Adding to this, Israel will reportedly carry out a very significant retaliation within days in retaliation to Iran's onslaught of nearly 200 ballistic missiles on Tuesday, fueling fears of a full-blown war in the region. This should contribute to keeping a lid on the perceived riskier Australian Dollar (AUD).

Technical Outlook

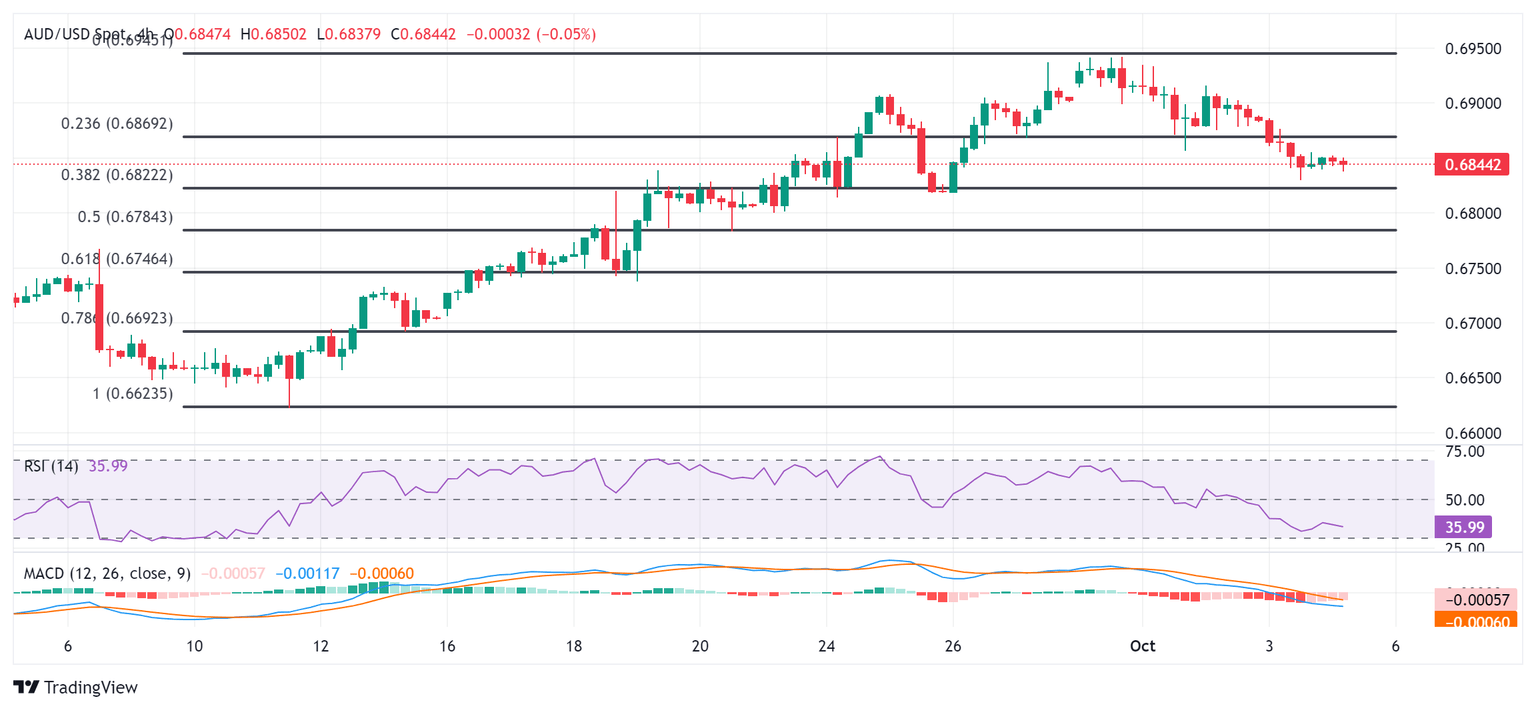

From a technical perspective, the previous day's breakdown momentum below the 23.6% Fibonacci retracement level of the September rally stalls ahead of the 38.2% Fibo. level. The said support is pegged near the 0.6820 region, which should now act as a key pivotal point for short-term traders. Some follow-through selling has the potential to drag the AUD/USD pair below the 0.6800 mark, towards the 50% Fibo. level, around the 0.6780 region. The subsequent slide could extend further towards the 61.8% Fibo. level, around the 0.6745 area, en route to sub-0.6700 levels, or the 100-day Simple Moving Average (SMA).

On the flip side, the 0.6860-0.6865 region, or the 23.6% Fibo. level, now seems to act as an immediate hurdle ahead of the 0.6900 mark. The next relevant hurdle is pegged near the 0.6940-0.6945 region, or the highest level since February 2023 touched last month, which if cleared should allow the AUD/USD pair to reclaim the 0.7000 psychological mark. A sustained strength beyond the latter will set the stage for a move towards the 0.7055-0.7060 intermediate resistance en route to the 0.7100 mark and the 2023 swing high, around the 0.7155-0.7160 region.

AUD/USD 4-hour chart

(This story was corrected on October 4 at 08:10 GMT to say that geopolitical risks act as a headwind for the risk-sensitive Aussie, not tailwind)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.