AUD/USD Price Forecast: Bulls have the upper hand; 100-day SMA breakout in play

- AUD/USD attracts some sellers on Tuesday amid a modest USD bounce from a multi-month low.

- Fed rate cut bets and a positive risk tone cap the USD gains, lending some support to the Aussie.

- Traders also seem reluctant and opt to wait for the outcome of a two-day FOMC policy meeting.

The AUD/USD pair ticks lower on Tuesday and erodes a part of the previous day's strong move up to the 0.6400 neighborhood, or a three-week high amid a modest US Dollar (USD) bounce. The risk of a further escalation of tensions in the Middle East turns out to be a key factor that assists the USD Index (DXY), which tracks the Greenback against a basket of currencies, to recover slightly from its lowest level since October touched on Monday.

Talks to extend the Gaza ceasefire failed to reach an agreement at meetings in Qatar. Moreover, the Israel Defense Forces (IDF) said that it is carrying out extensive strikes in the Gaza Strip and targeting what it called terror targets belonging to Hamas. This comes on top of a warning by the US defense secretary on Sunday that the US will continue attacking Yemen's Houthis until they stop attacks on shipping in the Red Sea. Apart from this, a modest USD strength could be attributed to some repositioning trade ahead of the key central bank event risk.

The Federal Reserve (Fed) is scheduled to announce its policy decision at the end of a two-day meeting on Wednesday. Market consensus suggests that the US central bank will keep the federal funds rate unchanged. Traders, however, are pricing in the possibility of 25 basis points interest rate cuts each at the June, July, and October policy meetings amid concerns about a tariff-driven US economic slowdown, signs of a cooling labor market, and easing inflation. The bets were further reaffirmed by unimpressive consumer spending data released on Monday.

The US Census Bureau reported that US Retail Sales rose by 0.2% in February compared to the downwardly revised decline of 1.2% the prior month. The reading fell short of expectations for a 0.7% growth and signaled consumer caution, which, in turn, gives the Fed headroom to resume its rate-cutting cycle and might cap any meaningful USD appreciation. Meanwhile, the optimism over China's stimulus measures announced over the weekend and hopes for a Ukraine peace deal remain supportive of the risk-on mood. This further contributes to keeping a lid on the buck.

Apart from this, hawkish comments by Reserve Bank of Australia (RBA) Assistant Governor (Economic) Sarah Hunter, saying that the central bank will take a cautious approach to rate cuts, help limit losses for the AUD/USD pair. Hence, it will be prudent to wait for strong follow-through selling before confirming that the recent move-up witnessed over the past two weeks or so has run out of steam. Traders now look to Tuesday's US economic docket – featuring Building Permits, Housing Starts, and Industrial Production data ––for short-term opportunities.

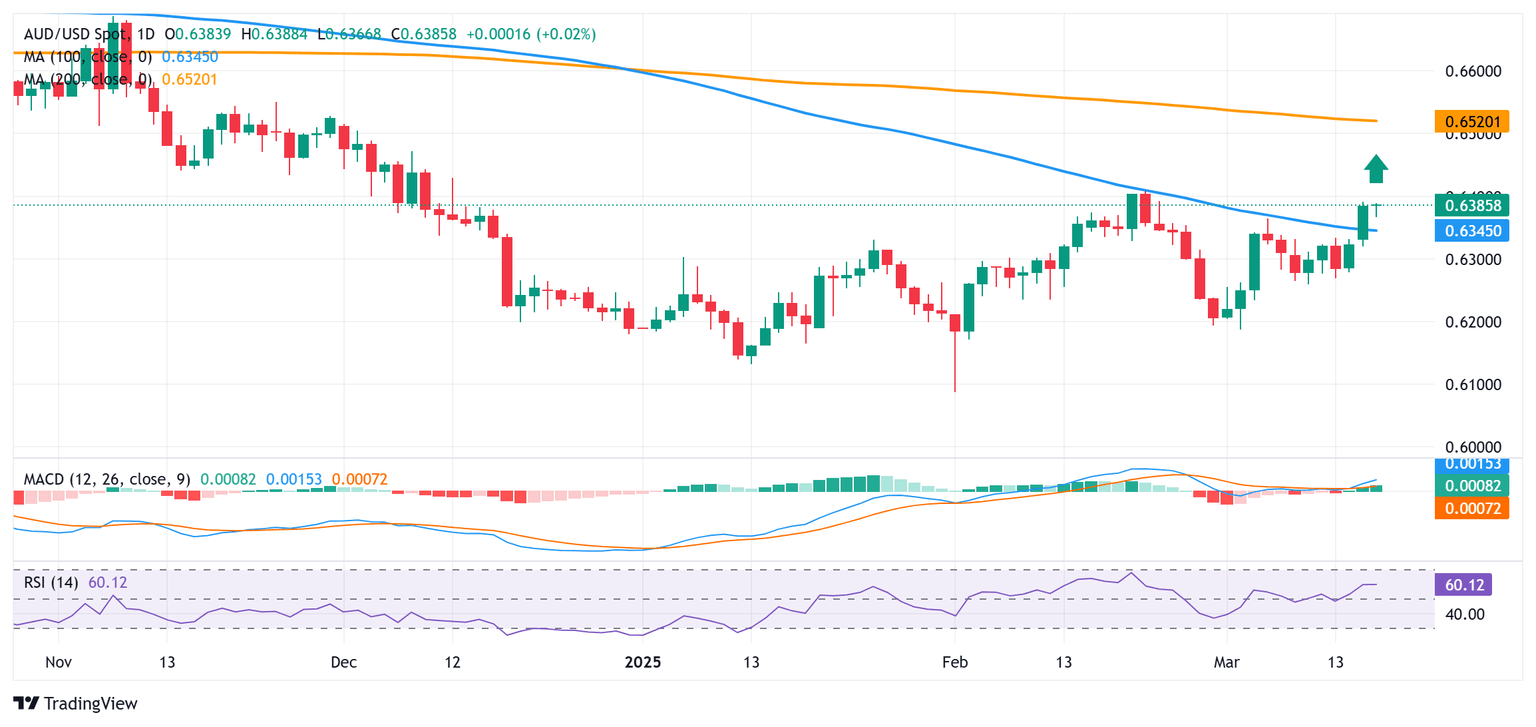

AUD/USD daily chart

Technical Outlook

From a technical perspective, the overnight breakout and close above the 100-day Simple Moving Average (SMA) for the first time since October 2024 was seen as a key trigger for bulls. Moreover, oscillators on the daily chart have just started gaining positive traction and are still away from being in the overbought zone. This further validates the near-term positive outlook for the AUD/USD pair and supports prospects for additional gains. Hence, a move towards testing the February monthly swing high, around the 0.6410 area, looks like a distinct possibility. The momentum could extend further towards the 0.6455-0.6460 intermediate hurdle en route to the 0.6500 psychological mark and the very important 200-day SMA, currently pegged near the 0.6525 region.

On the flip side, any corrective slide might now attract some dip-buyers near the 0.6355 area, or the 100-day SMA and remain limited near the 0.6330 horizontal support. Some follow-through selling, leading to a subsequent slide below the 0.6300 mark, could drag the AUD/USD pair towards last week’s swing low, around the 0.6260-0.6255 region, en route to the 0.6200 round figure. The latter should act as a key pivotal point, which if broken decisively would negate the positive outlook and shift the near-term bias in favor of bearish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.