AUD/USD Price Forecast: Bears have the upper hand while below 200-day SMA, US data in focus

- AUD/USD weakens in reaction to mixed Australian Q3 CPI report, albeit lacks follow-through.

- Hawkish RBA expectations offer some support to the Aussie amid Subdued USD price action.

- Traders now look forward to Thursday’s US macro releases for some meaningful opportunities.

The AUD/USD pair dropped to its lowest level since August 8, around the 0.6535 area following the release of mixed consumer inflation figures from Australia earlier this Wednesday. The Australian Bureau of Statistics reported that the headline Consumer Price Index (CPI) rose 0.2% during Q3 2024, marking a notable slowdown from the 1.0% increase seen in the second quarter and missing consensus estimates for a 0.3% growth. Adding to this, the annual inflation rate decelerated from 3.8% to 2.8%, or the lowest level since the March 2021 quarter. This, in turn, fueled speculations about a possible interest rate cut by the Reserve Bank of Australia (RBA) and weighed on the Australian Dollar (AUD).

That said, the core inflation, as measured by trimmed mean CPI, showed resilience and remained above the RBA's target range and rose 3.5% YoY during the reported period, dashing hopes for a rate cut before the year-end. This, along with subdued US Dollar (USD) price action, helps limit any further losses for the AUD/USD pair. Nevertheless, spot prices remain on track to record the worst monthly performance since September 2022 as traders now look to important US macro data for cues about the Federal Reserve's (Fed) interest rate outlook. This, in turn, will play a key role in driving the USD demand and determining the next leg of a directional move for the currency pair.

Wednesday's economic docket features the ADP report on private sector employment and the Advance GDP, which is expected to show that the world's largest economy grew by a 3% annualized pace in Q3. Any positive surprise will further point to a still resilient economy and reaffirm bets that the Fed will proceed with smaller rate cuts. Apart from this, deficit-spending concerns after the US election should keep the US bond yields elevated, which should inspire the USD bulls and continue to exert pressure on the AUD/USD pair. The focus will then shift to the US Personal Consumption Expenditure (PCE) Price Index on Thursday and the Nonfarm Payrolls (NFP) on Friday.

In the meantime, a muted market reaction to China's stimulus plans suggests that the path of least resistance for the AUD/USD pair remains to the downside and supports prospects for an extension of the recent downtrend witnessed over the past month or so. Hence, any attempted recovery led by softer US economic data might be seen as a selling opportunity and run the risk of fizzling out rather quickly.

Technical Outlook

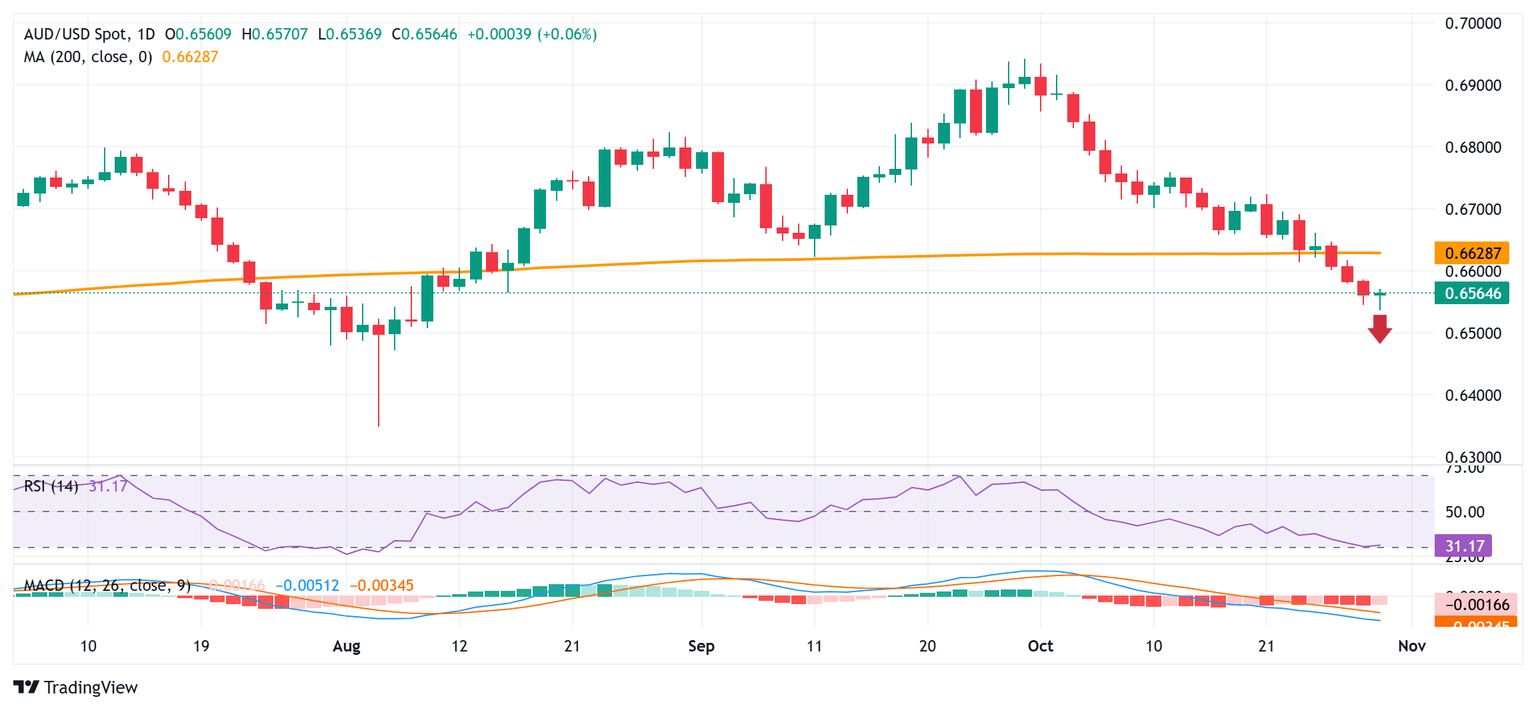

From a technical perspective, the recent breakdown below the very important 200-day Simple Moving Average (SMA) was seen as a fresh trigger for bearish traders. That said, the Relative Strength Index (RSI) on the daily chart has moved on the verge of breaking into the oversold territory. This, in turn, makes it prudent to wait for some near-term consolidation or a modest bounce before positioning for any further depreciating move.

Any attempted recovery, however, is more likely to confront stiff resistance near the 0.6600 round figure. This is followed by the 200-day SMA breakpoint, around the 0.6630 region, which should now act as a key pivotal point. A sustained strength beyond could trigger a short-covering rally and lift the AUD/USD pair to the 0.6675 intermediate hurdle en route to the 0.6700 mark.

On the flip side, the daily swing low, around the 0.6535 area could offer some support ahead of the 0.6500 psychological mark. Some follow-through selling should pave the way for a further depreciating move towards the 0.6440-0.6435 support zone. The AUD/USD pair could eventually drop to the 0.6400 round figure and the next relevant support near the 0.6370 region.

AUD/USD daily chart

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the Australian Bureau of Statistics on a quarterly basis, measures the changes in the price of a fixed basket of goods and services acquired by household consumers. The CPI is a key indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference quarter to the same quarter a year earlier. A high reading is seen as bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Last release: Wed Oct 30, 2024 00:30

Frequency: Quarterly

Actual: 2.8%

Consensus: 2.9%

Previous: 3.8%

Source: Australian Bureau of Statistics

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.