AUD/USD Price Forecast: At the mercy of Trump and the US Dollar

- AUD/USD resumed its downtrend and breached 0.6500.

- The Aussie Dollar faces initial hurdle at 0.6550 in the near term.

- Investors’ focus shifts to the speech by the RBA’s Bullock on Thursday.

The US Dollar (USD) had a very positive day on Wednesday, regaining upside traction in a strong fashion against the backdrop of alleviating geopolitical concerns and mixed US yields across the curve.

Against this unfavourable atmosphere, the Australian Dollar (AUD) performed poorly, receding to the sub-0.6500 region after three consecutive days of advances lifted spot to as high as the 0.6550 zone.

That said, the Aussie Dollar gave away part of its recent gains, which were in response to the knee-jerk in the Greenback and the Reserve Bank of Australia’s (RBA) hawkish leanings revealed in its recent meeting Minutes.

The Aussie’s pullback also rode the wave of rising copper and iron ore prices. These key exports injected some much-needed optimism into the market, even as traders remained wary of China’s recent stimulus measures.

In Oz, the RBA held its policy rate steady at 4.35% during its November 5 meeting, as widely expected. While the central bank acknowledged progress in curbing inflation, it struck a cautious note on economic growth. Governor Michele Bullock reaffirmed the need for tight monetary policy until inflation demonstrates a sustained downward trend.

Australia’s latest inflation data provided further evidence of cooling. The Consumer Price Index (CPI) eased to 2.1% for September, while the annual Q3 rate softened to 2.8%.

Looking ahead, a potential rate cut from the Federal Reserve (Fed) could offer a tailwind for AUD/USD. However, the possibility of a Trump presidency and the inflationary risks it might bring could keep the USD strong, limiting any substantial upside for the Australian currency.

Furthermore, China’s economic performance remains a persistent drag on AUD sentiment. Even so, Australia’s labour market continues to display strength. October’s unemployment rate held steady at 4.1%, with nearly 16K jobs added.

Still around the RBA, the Minutes highlighted the central bank’s cautious stance. While a quicker-than-expected drop in inflation could pave the way for rate cuts, policymakers emphasised the need for more than just one strong quarterly inflation result before making such a move.

For now, market expectations are aligning with a gradual quarter-point rate cut by May 2025, all while the RBA maintains its watchful, data-driven approach.

In trading circles, speculators remained net buyers of AUD for seven straight weeks. However, declining open interest signals a growing sense of caution among those traders.

Data wise, the Leading Index rose by 0.2% MoM in Ocotber, according to Westpac. Later on Thursday, all the attention will be on the speech by the RBA's Michele Bullock.

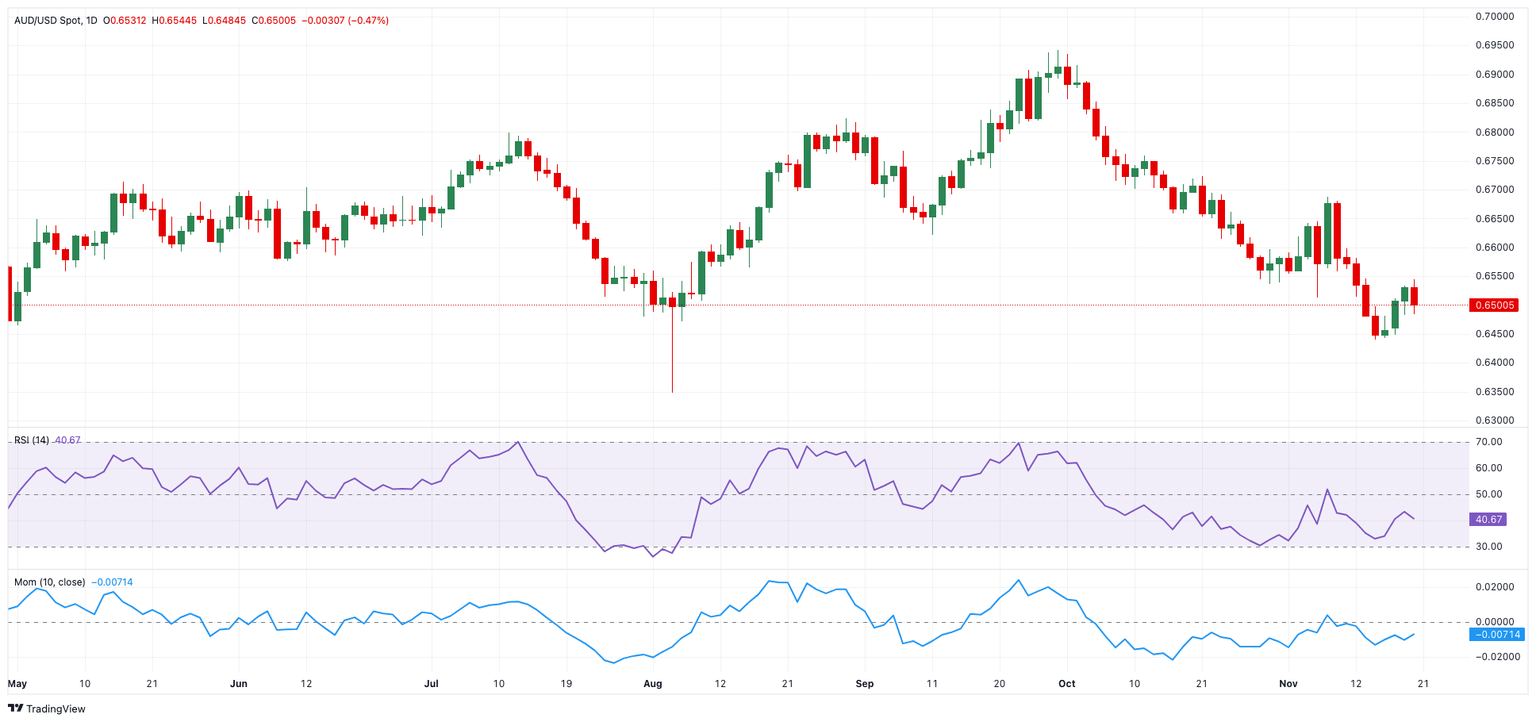

AUD/USD daily chart

Technical Outlook for AUD/USD

In the medium term, assuming bulls regain the upper hand, the next resistance level is the 200-day SMA at 0.6628, followed by the November high of 0.6687 (November 7), which is still supported by the interim 100-day SMA.

On the other hand, first support comes from the November low of 0.6440 (November 14), which precedes the 2024 bottom of 0.6347 (August 5).

The four-hour chart indicates some loss of impulse in the upward momentum. The initial support is at 0.6440, followed by 0.6347. However, resistance may build at 0.6544, prior to the 100-SMA at 0.6552 and the 200-SMA at 0.6624. The RSI dropped to around 48.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.