AUD/USD Price Forecast: A decent contention is seen around 0.6700

- AUD/USD reversed its multi-day leg lower following a drop to 0.6700.

- The US Dollar clinched marginal gains after US CPI surprised to the upside.

- Australia’s Inflation Expectations eased to 4.0% in October.

Finally, some respite for the intense sell-off in AUD/USD. That said, the pair regained some balance and printed decent gains on Thursday, reversing five consecutive days of loss despite the lacklustre advance in the US Dollar (USD) and lingering scepticism surrounding China’s latest stimulus initiatives.

In fact, spot initially challenged the key support at 0.6700, an area where both the 55-day and 100-day SMAs also coincide, regaining fresh upside traction soon afterwards.

Also bolstering the renewed upbeat impulse in the Australian Dollar emerged the recovery in copper prices and iron ore prices despite persistent uncertainty surrounding the recently announced Chinese stimulus package.

On the monetary policy front, the Reserve Bank of Australia (RBA) held its cash rate steady at 4.35% during its September meeting. While the RBA acknowledged inflationary risks, Governor Michele Bullock noted that a rate hike was not a serious consideration at this time.

Earlier in the week, the release of the RBA’s meeting minutes signaled a shift towards a more dovish stance. The central bank dropped its August guidance, which had suggested that interest rates would remain stable in the near term.

However, RBA Deputy Governor Andrew Hauser later clarified that the interpretation of a dovish turn might be premature, stressing that the central bank’s efforts to combat inflation are "far from over."

Market sentiment currently reflects a 55% chance of a 25-basis point rate cut by year-end, with the RBA expected to be one of the last central banks in the G10 to cut rates, likely in response to slowing economic growth and easing inflation pressures.

Despite Federal Reserve rate cuts already being factored into the outlook, AUD/USD could extend its rebound in the latter part of the year. Yet, uncertainties around China’s economic outlook and the effectiveness of its stimulus measures continue to cloud the picture.

On the domestic calendar, Consumer Inflation Expectations rose to 4.0% in October (from 4.4%), according to the Melbourne Institute.

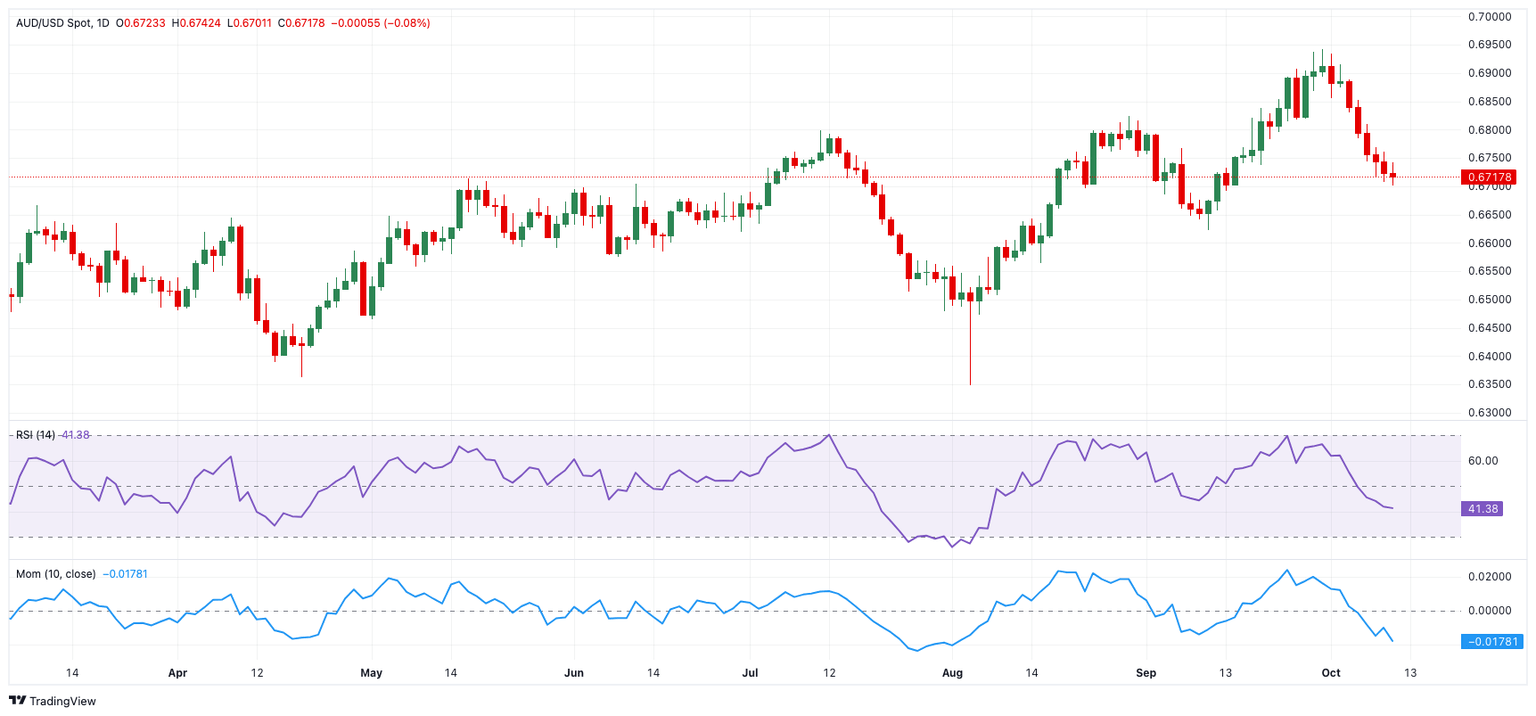

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses may drive the AUD/USD to retest its October bottom of 0.6699 (October 10), ahead of the September low of 0.6622 (September 11), which is still supported by the critical 200-day SMA (0.6626).

On the plus side, the first obstacle appears at the 2024 peak of 0.6942 (September 30), which comes before the key 0.7000 milestone.

The four-hour chart shows a resurgence of the consolidative mood. Having stated that, the initial support is 0.6699, followed by 0.6622. On the upside, the 200-SMA at 0.6780 ahead of 0.6809 and the 100-SMA at 0.6828. The RSI dropped to about 35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.