AUD/USD Outlook: solid China's data inflate Aussie but price action is still within the range

AUD/USD

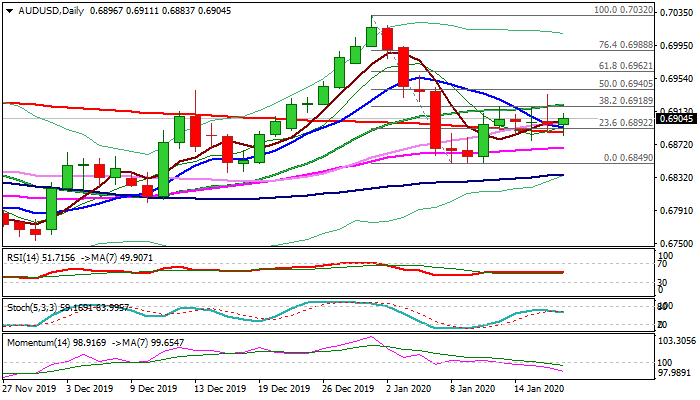

The Australian dollar regained traction and advanced towards multi-day range tops, following strong upside rejection on Thursday after the price spiked to 0.6933 but subsequently reversed and closed in the middle of the range.

Solid Chinese data, released overnight signal that the pressure on world’s second biggest economy start to fade that offered fresh support to Aussie.

However, near-term action continues to trade within extended range between 200DMA (0.6887) and 20DMA (0.6921), lacking stronger signal on mixed daily studies.

The pair looks for a catalyst that would generate fresh direction signal and drive the price out of the range.

Pivotal support is marked by 200DMA and firm break here would weaken near-term structure for further weakness. Strong bearish momentum on daily chart supports this scenario.

On the other side, sustained break above pivots at 0.699/21 (Fibo 38.2% of 0.7032/0.6849 / 20DMA) would generate initial bullish signal.

Res: 0.6921; 0.6940; 0.6962; 0.6988

Sup: 0.6887; 0.6877; 0.6849; 0.6835

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.