AUD/USD

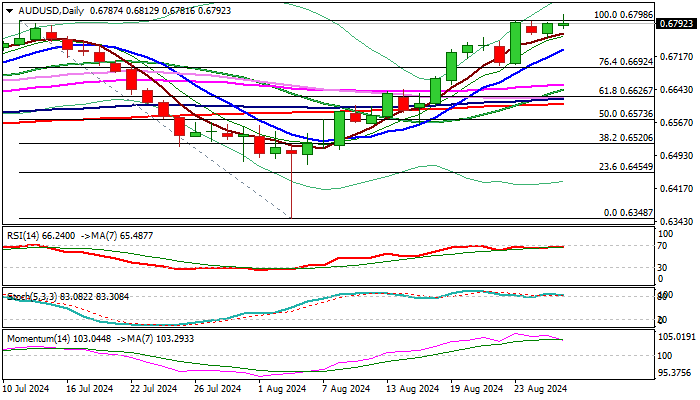

AUDUSD hit new 8-month high in Asian session on Wednesday, lifted by higher than expected Australian July CPI, but was so far unable to hold gains above 0.6800 mark.

Although subsequent dip was shallow, it sends initial warning that larger rally from 0.6348 (Aug 5 spike low) might be running out of steam.

Triple consecutive failure to clear previous top at 0.6798 (July 11) and today’s (so far) false break, contribute to such scenario in addition to initial negative signals from fading positive momentum and Stochastics’ bearish divergence on daily chart, as well as Thursday’s twist of daily cloud.

Immediate bias is expected to remain firmly bullish as long as the price stays above 0.6761 (Aug 21 former top/Aug 27 low/upper 20-d Bollinger band), while break here to generate initial bearish signal and risk dip towards 0.6734/00 (rising 10DMA / Aug 22/23 higher base) which guards more significant supports (a cluster of daily MA’s at 0.6655/10 zone / Fibo 38.2% of 0.6348/0.6812 rally).

Res: 0.6812; 0.6839; 0.6871; 0.6904.

Sup: 0.6761; 0.6734; 0.6700; 0.6655.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays pressured near 1.1150 on US Dollar resurgence

EUR/USD remains under moderate selling pressure near 1.1150 in European trading on Wednesday. The pair holds the correction from yearly highs, in the face of resurgent US Dollar demand, as risk sentiment sours ahead of Fedspeak and Nvidia earnings report.

GBP/USD keeps losses below 1.3250 amid US Dollar recovery

GBP/USD is keeping the red below 1.3250 in the European session on Wednesday, undermined by a broad US Dollar rebound. Markets turn anxious ahead of speeches from the BoE and the Fed policymakers later in the day.

Gold pulls back to $2,500 as USD recovers

Gold exchanges hands just above $2,500 on Wednesday after sliding lower due to a rebound in the US Dollar (USD). Given Gold is mainly priced in USD, any strength in the Greenback tends to weigh on its price.

FLOKI price is poised for a rally after breaking above the descending trendline

FLOKI price broke above the descending trendline and rallied 10%. At the time of writing on Wednesday, it continued its ongoing rally and trades 4.4% at $0.00015. Additionally, the suggestion of on-chain data supports the bullish trend, as evidenced by active, dormant wallets.

Three fundamentals for the week: Focus on the fragility of the US economy Premium

US Consumer confidence data will provide a gauge of how consumers are feeling. Jobless claims are in focus after Fed Chair Powell's dovish speech. Investors will look to the core PCE index to confirm that inflation is falling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.