AUD/USD

AUDUSD remains constructive and consolidating Tuesday’s 0.80% advance, as this morning’s RBNZ rate cut by 25 basis points negatively impacted Aussie dollar, but dips were limited, due to strong near-term bullish sentiment on revived risk appetite.

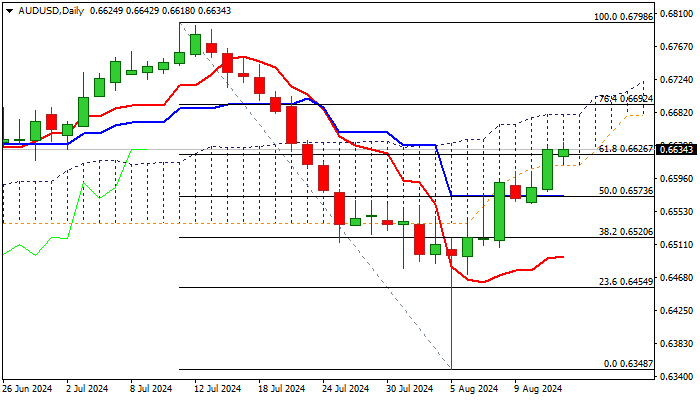

Technical studies are bullish on daily chart (rising positive momentum / MA’s turning to bullish setup) with strong bullish signals generated on close above converged 100/200DMA and penetration and close within rising daily cloud.

On the other hand, overbought conditions may further weigh on bulls, as markets await release of key US inflation data.

AUDUSD would benefit if CPI numbers fall below expectations, with extension towards targets at 0.6680 (daily cloud top) and 0.6692 (Fibo 76.4% of 0.6798/0.6348) in bullish scenario.

Conversely, above expectations July CPI would deflate AUD and risk extension through initial supports at 0.6613/0.6596 zone (daily cloud base / converged 100/200DMA’s).

Res: 0.6642; 0.6680; 0.6692; 0.6714.

Sup: 0.6613; 0.6596; 0.6573; 0.6555.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD keeps the trade above 1.1000 post-US CPI

The Greenback trims part of its earlier losses, while EUR/USD manages to maintain the trade north of the 1.1000 milestone in the wake of the release of US inflation data in July.

GBP/USD remains on the defensive on US CPI data

GBP/USD keeps its offered stance unchanged around 1.2830 on the back of slight gains in the US Dollar following the lower-than-expecyted prints from US inflation gauged by the CPI.

Gold cuts gains around $2,470 following US inflation

Gold prices remain bid in response to July’s US inflation data, which came in below estimates according to the CPI, while US yields trade in a mixed so far on Wednesday.

Maker price poised for rally following Grayscale's launch of MakerDAO Trust

Maker (MKR) saw a 6.3% price rally on Tuesday and remains up 0.3% at $2,147 on Wednesday. A negative spike in MKR's Exchange Flow Balance and rising open interest signal a bullish trend.

Federal Reserve scenarios: More twists and turns to come

Having priced a high chance of an inter-meeting Fed rate cut last week, interest rate expectations have moderated in the wake of better data and calming words from Fed officials.