AUD/USD

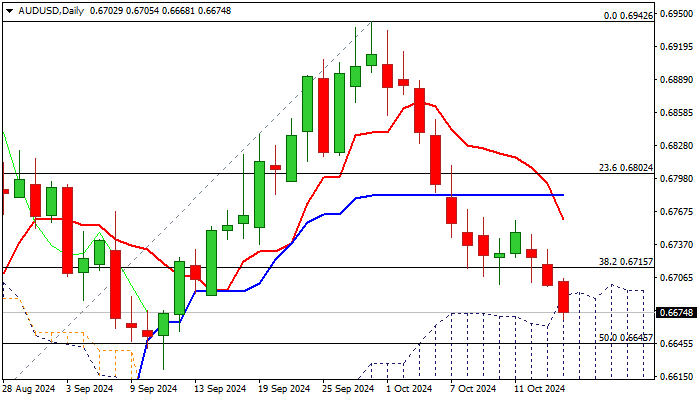

AUDUSD came under increased pressure in past few sessions with fresh acceleration lower on Wednesday, pushing the price to one month low (0.6668).

Break through 100DMA (0.6693) and penetration of rising thick daily Ichimoku cloud (spanned between 0.6690 and 0.6586) is bearish signal which needs close below these level to be confirmed and open way for test of next target at 0.6645 (50% retracement of 0.6348/0.6942 / weekly Kijun-sen) and 0.6926 (200DMA).

Bear-cross of daily Tenkan/Kijun-sen and strong bearish momentum contribute to negative near-term outlook.

Several barriers (0.6693; 0.6715; 0.6723 – 100DMA / broken Fibo 38.2% / 55DMA respectively) should cap upticks and guard upper pivot at 0.6760 (daily Tenkan-sen).

Markets await release of Australia’s September labor report (due in early hours of Asian session on Thursday) for fresh signals.

Res: 0.6693; 0.6715; 0.6726; 0.6760.

Sup: 0.6645; 0.6626; 0.6586; 0.6575.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Australian Dollar sees gains on hawkish RBA minutes

The AUD/USD climbed by 0.15% to 0.6520 in Tuesday's trading, driven by several factors. The hawkish Reserve Bank of Australia (RBA) Minutes provided support to the Australian Dollar, as did a weaker US Dollar and hopes for Chinese economic stimulus.

EUR/USD: The recovery needs a stronger catalyst

EUR/USD reversed two daily pullbacks in a row and came under some fresh downside pressure following renewed geopolitical jitters on the Russia-Ukraine front, all prior to key data releases on both sides of the ocean due later in the week.

Gold remains propped up by geopolitics

Gold retreats slightly from the daily high it touched near $2,640 but holds comfortably above $2,600. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help XAU/USD hold its ground.

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin (BTC) has outperformed Ethereum (ETH) in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.