AUD/USD outlook: Hawkish RBA lifts Aussie Dollar towards key resistance zone

AUD/USD

AUDUSD rose to one week high on Tuesday morning, after the RBA kept interest rates steady at 12-year high and kept hawkish stance on persisting upside inflation risk, although remains ready to act if economy weakens more.

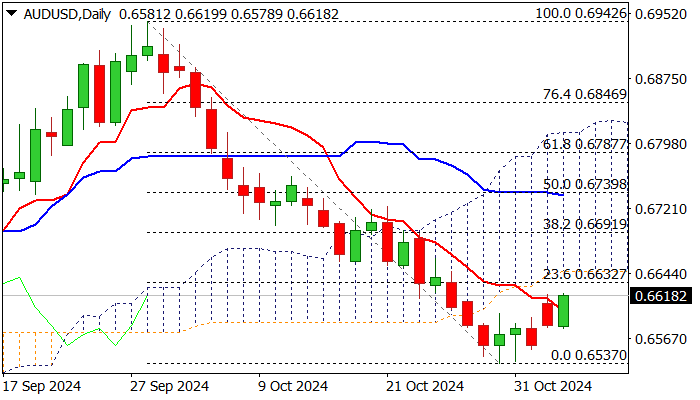

Near-term action is holding within a recovery leg from 0.6587 (Oct 30 low) and was boosted by Monday’s gap-higher opening.

Slight improvement of technical picture on daily chart (the price rose above 10DMA and potential formation of daily bullish engulfing) generates initial bullish signal, although daily studies are still predominantly bearish (14-d momentum is still in negative territory, the action weighed by thick daily Ichimoku cloud) and more work at the upside required to spark stronger recovery.

Recovery faces very strong barriers at 0.6627/45 (200DMA / Fibo 23.6% of 0.6942/0.6537 downtrend / base of thick daily Ichimoku cloud) violation of which to likely spark stronger recovery, while recovery may stall if fails to clear these barriers.

Markets will be looking for the situation surrounding today’s US election, as well as coming FOMC policy meeting

Res: 0.6627; 0.6645; 0.6691; 0.6723.

Sup: 0.6599; 0.6578; 0.6553; 0.6537.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.